What is momentum trading?

Momentum trading is the practice where one buys a currency pair whose price is trending upwards and sells a currency pair whose price is on a downward trend. The idea here is that an up-trending price is likely to continue in that trajectory for the near future. In like manner, a down trending price has the momentum to continue falling. One can summarize this trading thus, sell losers and buy winners.

To be sure, this is an interesting strategy bearing in mind that common wisdom in forex trading advices selling high and buying low. Nonetheless, momentum trading is one of the many money making hacks where you do not have to hold positions for long. Depending on the volatility in the market, markets change frequently. Therefore, one is better off holding positions for a short while.

Table of Contents

Key factors to consider in momentum trading

Before we go into the details of momentum trading, you should know that the strategy works based on three critical factors. Firstly, there is volatility. One of the best kept forex trading secrets is that volatility is the source of profits in the market. In a high volatility market, the price movement of a currency pair is fast changing. Price swings in such a market are frequent and big in magnitude.

Secondly, volume is an important factor for this forex strategy. Volume simply refers to the amount of a currency pair that market participants exchange within a given period. In momentum trading, the volume moved indicates the momentum behind a particular trend. A high volume tells you that the market is liquid and that demand is high, which implies huge momentum. On the contrary, a low volume is indicative of an illiquid market whose momentum is on the wane.

The other factor that is critical in momentum trading is time frame. As we saw earlier, this trading strategy is ideal for short-term positions. However, the duration of a single trade depends on how long the currency pair will maintain its momentum. If you find out that the momentum keeps changing in short time frames, then the strategy is ideal for scalping.

How momentum trading works

The rationale of momentum trading is to take small profits in many short trades. Compounded, you will find yourself with large profits in the long term. But from where do you begin? Well, momentum trading has three major steps.

Step 1: Identify the momentum

Technical analysis is the best process for spotting momentum. This analysis makes use of the best forex indicators in the market to identify a trend. Some of the indicators that you can use to identify momentum include moving averages, Ichimoku charts, and specific indicators that show momentum.

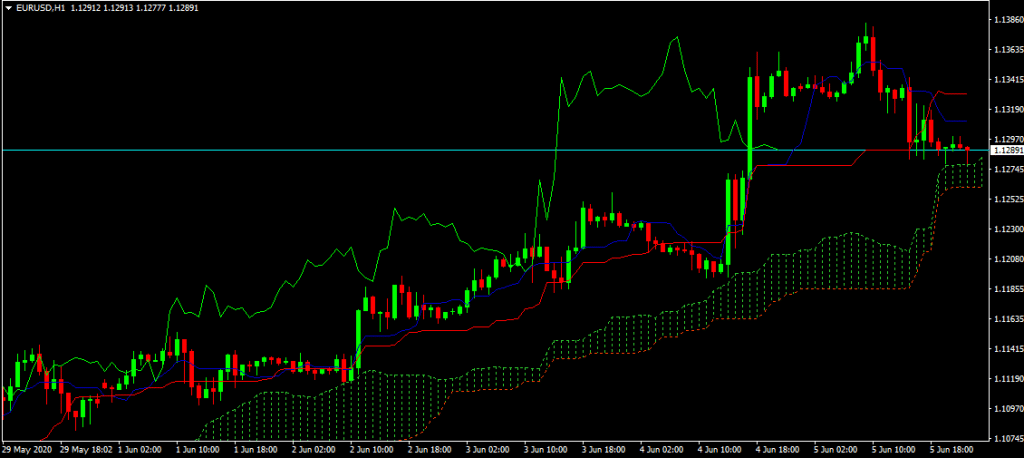

- Using Ichimoku charts

This equilibrium chart not only identifies but also confirms trends. Consider the EURUSD hourly chart below. The Ichimoku indicator shows that the market is in an uptrend. Usually, the price action is on a bullish trajectory when the color of the Ichimoku cloud is green.

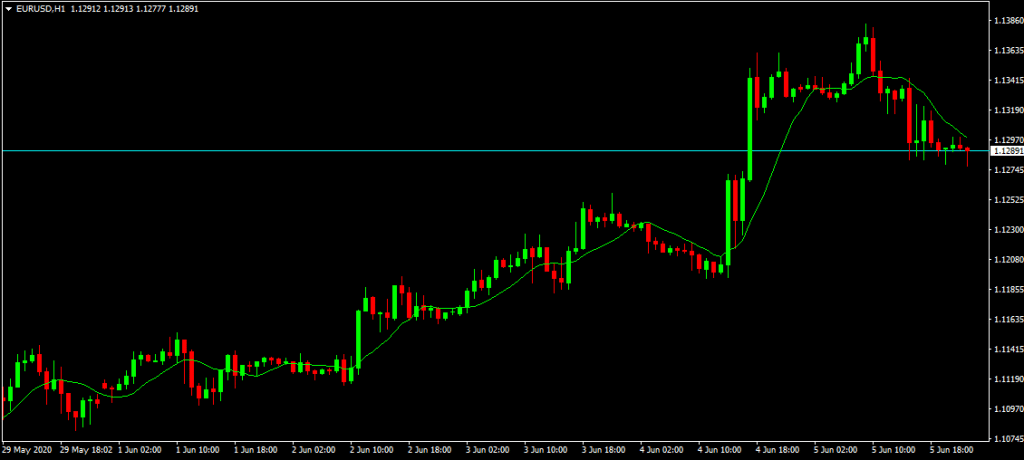

- Using moving average

Alternatively, forex charting tools such as moving average can help to identify trend. Consider the same EURUSD market above. If you drag and drop the 10-period moving average indicator onto the chart, it will appear as shown below.

However, you will notice that the 10-period moving average indicates a bearish trend while Ichimoku shows there is still some strength in the bullish trend. In such a case, you should find the input or “opinion” of a third indicator.

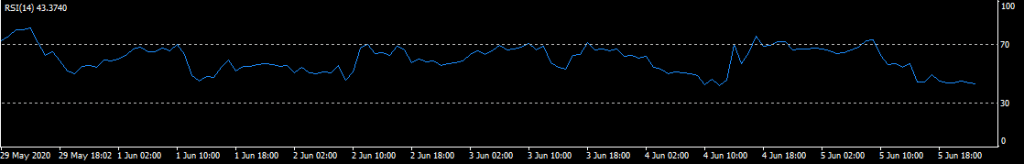

- Use an oscillator to confirm the trend

A good oscillator that can help to determine entry and exit points is the Relative Strength Index (RSI). Usually, RSI strategies show the strength in a trend by showing whether the market is overbought or oversold. Considering the EURUSD market in our examples above, the RSI indicators appears as shown below:

Looking at the RSI, it is not yet clear if the market is in a downtrend or an uptrend. However, there is a high likelihood that the market could tur bearish soon. In this case, you are better off going short.

Step 2: Take a market position

Developing strategies using different technical indicators often yield the best results especially if you intend to take a short-term position. Trend trading is profitable when you are certain of the strength in the price action. Although not always, strategies using fundamental analysis can help to confirm this strength.

Once you are certain of the strength in the trend, you can take a market position. In the case of the EURUSD market above, the trend does not have enough momentum to warrant entry. However, if the RSI breaks below 30, then this is a confirmation of the bearish trend and it is time to enter a market position.

Step 3: Exit the market when the trend weakens

The right time to exit the market is when the trend begins to weaken. Just like you did when confirming the trend, use the combination of indicators as above to confirm a weakening trend. The earlier you exit the market, the more the profits earned.

Done severally, you will end up earning large profits in the long term.

Leave a Reply