A simple moving average of SMA is the average price of a security over the past “N” number of periods. Older prices tend to fall out of the average as time passes, being replaced by newer ones. As a general rule, the shorter the period in the Moving Average, the more volatile it is, and the better it can track the price of the security. The length of your SMA will depend on your trading time horizon. As a trader, you can use Moving averages on intra-day or daily charts.

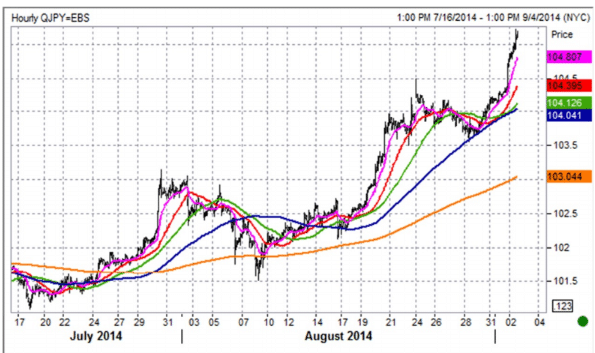

In the above chart, there are 5 simple moving averages: 20 Hour, 55 Hour, 100 Hour, 200 Hour, and 600 Hour. As you can observe from the chart, the faster SMA tracks the price of spot much closely compared to the slow SMA, which barely reacts. The challenge here is to find the SMA that helps users to define the trend without too much noise. In the chart above, it appears that the 200-hour SMA is the best moving average is a good approximation of the short-term trend.

Table of Contents

How to Use MA

Support and Resistance

You can use the moving average as resistance or support. Try going long when the spot is above the moving Average and short it when the spot is below. For instance, if you are bullish on EUR and searching for an entry point, you have to buy as the market nears any one of the fast-moving averages. You then place a stop below a slow MA. If the spot is above the MA with an upward sloping moving average line, it is an ideal bullish scenario.

For trades with a short-term strategy, the 20, 50, 100, and 200 periods MAs are ideal. Many traders tend to use back-testing to find optimal moving averages for each of the currencies. However, what has worked in the past is not necessarily going to work in the future.

Crossover Of Two Moving Averages

As a trader, you can use a crossover of 2 MA to define the trend and trigger buy or sell signals. When the 100-hour MA crosses up through the 200-hour MA, it is an indication that the price is starting an uptrend. Examples of specific moving average setups include the bearish Death Cross, where the 50-day MA crosses below the 200-day MA, and the bullish Golden Cross, where the 50-day MA crosses up through the 200-day MA.

As a trader, always focus on long positions in situations where the 20-day MA is above the 55-day MA. They should go for short positions when the 20 day is below the 55-day MA. This is the right type of thinking that can keep a trader on the right side of the trend, which also serves the purpose of using MAs in the first place.

The Slope

You can also use the slope of a single MA in combination with its location for entering newly forming trends. In this strategy, you have to wait for a specified Moving Average to go up or down and enter a new trade when the price returns to the same MA. As a way to align with short-term trends, you can use faster Moving Averages such as the 20-day MA. Thus, just lead a buy order at the 20 day MA when it turns up.

Additionally, there is another strategy where you can use closing prices with the MA. When the closing price is above the MA, traders should go long. If the closing price is below the MA, you should exit the longs and go short.

Never use Moving Averages in isolation. Instead, use them to enter and exit trades that you like for other reasons. For example, if you prefer the EUR/USD but you are flat, plot some moving averages onto a chart. This will give you an entry point and also give you a sense of what defines the current trend.

Advantages Of Using Moving Averages

Compared to a purely behavioral or fundamental approach, using a moving average for trade entry and risk management has a lot of advantages. The primary advantage it provides is that traders do not have to fight the market at all times. For instance, if you are bearish on EUR/USD but it is in an uptrend, wait for technical analysis to signal a turn in trend before entering. After properly identifying the trend and using the MAs to fine-tune your entry and exit, you can achieve better results.

In simple words, traders can get a direction of trends. They get guidance on how to enter a trade and how to exist one. So, why is the direction different? This is mainly because of the time period. With the help of MA, the trader can decide on trade. Decisions like the way of trading – if it should be above or right below can be easily decided.

Moving Averages produce good signals in trending markets but are of no use when it comes to range-bound markets. When the price is stagnant, each new trend signal will fail, and the price reverts back into the range. Moving Averages in this situation will get chopped up. Thus, if you are looking for a currency that is expected to trade in a range, avoid using Moving Average.

Conclusion

When using Moving Averages, always remember to keep it simple. It is not necessary for your indicators to be mathematically optimized at all times. Always try to find a setup where the major support and the Moving Average is around the same level, as it will make your levels much stronger. Try not to use the MA with other similar trend following indicators as it can clutter up your charts.

Leave a Reply