What are the benefits of the Commitment of Traders report in forex? In this piece of writing, you’ll discover the significance of the CoT in providing traders an idea of the positions of the most prominent market players.

One of the biggest challenges with forex is that no actual order book exists providing information on the positioning of the various participants. Some brokers like Axi, IG, and OANDA have their own useful tools to reflect some form of sentiment and positioning, though this is only limited to their clients.

Perhaps one of the under-utilized indicators in forex is the Commitment of Traders (CoT) report, a tool for showing traders what the largest investors are doing.

Due to their enormous size, we can trace back many trends or large movements in forex from an action they performed of reducing or adding a large number of orders at certain points. In many aspects, the CoT report is a leading indicator and particularly useful for long-term traders to gauge the beginning, continuation, and end of trends.

What is the Commitment of Traders report?

The Commitment of Traders report is a weekly publication by the Commodity Futures Trading Commission (CFTC), reflecting the positioning of institutional speculators and retail traders in the Chicago Mercantile Exchange futures markets.

The statement is available every Friday at 15h30 EST, but this does change temporarily on rare occasions. Results of the open interest for the traders established by the CFTC are from the positions they’ve taken on the previous Tuesday.

Some might wonder how the futures markets have any bearing on the spot forex. First, it’s crucial to note the broader currencies instrument consists of a few subsets. The market most people know is speculator-driven.

We have forex options, swaps, and futures. Each participant in these niches trades currencies for different reasons aside from profit. For instance, megacorporations trade forex to mitigate price volatility when receiving and sending foreign currencies.

Broadly speaking, currency futures have a positive correlation with spot forex. Moreover, the futures markets are centralized through an exchange, contrasting the decentralized nature of spot currencies. Thus, the CoT report is the closest thing retail traders have in understanding the positioning of the larger players.

Who and what makes up the Commitment of Traders report?

Technically, four sub-reports make up the entire CoT; legacy, supplemental, disaggregated, and traders in financial futures. Only the legacy section is pertinent to forex, further classified by commercial and non-commercial traders.

The commercial group comprises international corporations that use futures primarily to hedge against price swings since they hold and purchase large quantities of foreign currencies.

In contrast, the non-commercial group consists of speculative retail traders and financial institutions such as hedge funds, commercial banks, etc. Some traders look at both categories when using the CoT for making trading decisions.

However, this article will cover examples relating only to the non-commercial bracket. Because these guys trade mostly for profit, they are considered far more significant for retail traders.

One of the few drawbacks of the CoT report is data is not reported according to pairs but rather individual currencies. Below are the following currencies covered, including the major currencies:

- Australian dollar (AUD)

- British pound sterling (GBP)

- Euro (EUR)

- Japanese yen (JPY)

- Swiss franc (CHF)

- Mexican peso (MXN)

- South African rand (ZAR)

- New Zealand dollar (NZD)

Although the US dollar is not expressed as such, the US dollar index is one of the primary drivers for this market, making it a suitable instrument to analyze for USD in forex.

A quick tip: The original report from the CFTC is tricky to understand. Generally, accessing the CoT isn’t easy. However, a reliable and easy-to-use resource is Tradingster (tradingster.com), a site providing the latest CoT as it is released, along with historical reports.

How do traders use the Commitment of Traders report?

One of the main ways traders use the CoT is by looking at noticeable gaps between the net long and net short orders of the non-commercial group. At turning points, investors want to see a substantial difference between the two.

For instance, if a market has been moving upwards, this suggests a lot more net long positions than net short. For this trend to change, the non-commercial traders would gradually need to decrease their net longs and add more net shorts.

Therefore, the CoT is valuable both for confirming trends and the potential for trends to reverse. Like any indicator, analysts must combine the CoT with other confirmation factors. We’ll use supply and demand zones in the following example and see how we might have implemented the report.

A recent example of the Commitment of Traders report in action

In the image below, CHFJPY has been trending up for several months. The market consolidated from 27 May 2021, creating a potential supply zone (highlighted rectangle). To validate this as an area of potential selling interest, one would have consulted the CoT.

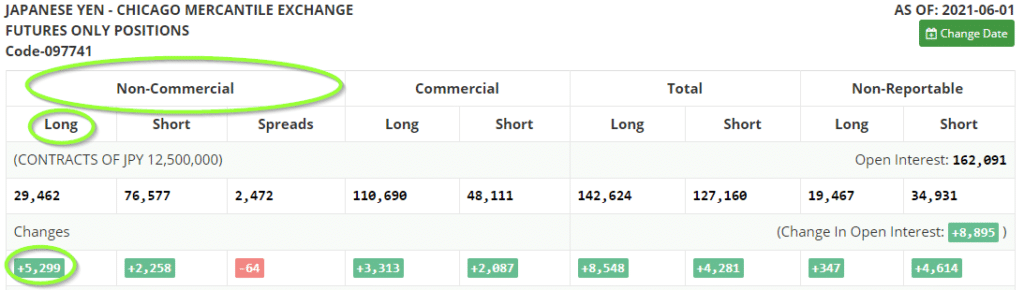

In the screenshots below, we see the positioning on the 1st and 8th of June, around the time of the consolidation. The non-commercial traders added 5299 contracts of buy orders on 1 June, more than double those for sell positions (2258).

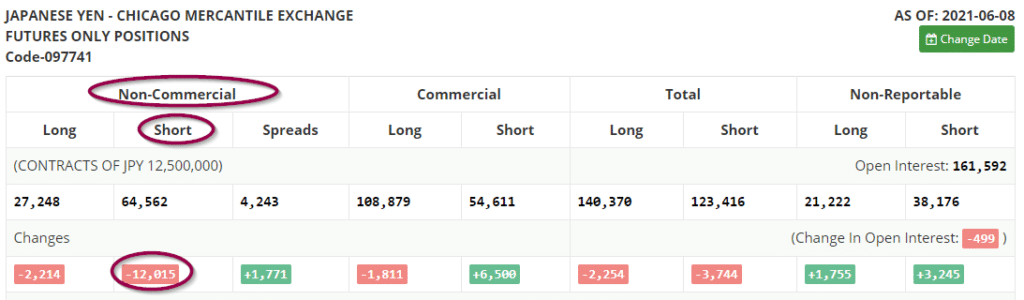

The following week, the group removed a staggering 12015 contracts of sell positions. Although they also reduced their longs (2214), this was a substantial discrepancy, signaling more buying pressure for the yen.

Since JPY is the quote of CHFJPY, any indication of bullishness on JPY would inevitably bring down this pair. When the price went into the high of the zone on 15 June, we eventually saw a significant drop.

Final word

Like any tool, the CoT report has its flaws. First, it’s unfortunate it only comes out once a week as many changes will often occur in the interim. Secondly, the report relates to standalone currencies rather than pairs.

Therefore, traders should also analyze the strength and weaknesses of the base or quote currency using correlations. Regardless, it does perform a decent job for anyone looking to trade in the direction of institutional traders.

This tool might also be better than studying fundamentals because one gauges the most formidable drivers of price judging by the ‘big boys’ orders,’ who are the most influential for dictating the movements we see on the charts.

Leave a Reply