Introduction

Switzerland falls in the band of the richest countries globally, with a GDP of $705.14 billion in 2018. Besides, the country has one of the most skilled labor forces in the world. Switzerland lies in the Eurozone but does not belong to the European Union. As a result, the country enjoys the status of an oasis of stability in periods of turmoil in the EU.

Apart from Germany, Switzerland is among the few countries in Europe that run a favorable trade balance. Exports accounted for 66% of the country’s GDP in 2019, according to OECD figures. Moody’s Analytics’ data show that 14.4% of Switzerland’s exports go to Germany, 5.8% to France, and 4.9% to Italy within the Eurozone. For this reason, Europe and Switzerland are deeply integrated.

From the foregoing, the relationship between the Euro (EUR) and the Swiss franc (CHF) is an interesting one. The EUR/CHF currency pair is popular because of the safe-haven status of the CHF. Since 2011, the CHF formed against the EUR as the EU grappled with a debt crisis in the aftermath of the Great Recession. Switzerland’s strong institutions have mostly given the CHF a reputation of stability when the EUR is roiling.

Why is the CHF a safe haven?

In forex-speak, a safe haven currency retains its value within a comfortable range when the value of many other currencies is declining. Investors rush to convert their assets into safe-haven currencies to protect value. For a long time, forex traders have trusted the ability of the CHF to safe-keep value when the market turns turbulent. But why?

As noted above, Switzerland has Europe’s most stable institutions, both political and financial. Besides, the country is independent of the EU’s policies because it is not part of the Union. The economic condition has been strong even as the EU struggled with low inflation and high unemployment rates. Switzerland has successfully suppressed unemployment rates at around 3% for a long time. Contrarily, the Eurozone’s average plays in the region of 6%-8%.

The stable financial system in Switzerland has kept volatility levels in the market comfortably low. Another pillar of strength for the Swiss economy is that its institutions i.e., the Swiss Financial Market Supervisory Authority (FINMA), regulate large banks such as Credit Suisse and UBS. To cap it all, Switzerland has played a tax haven for the world’s rich for ages. As such, the market’s confidence in the CHF derives from the belief that more money will flow in the CHF’s way when a crisis falls into the global financial markets.

What moves EUR/CHF?

Market fears

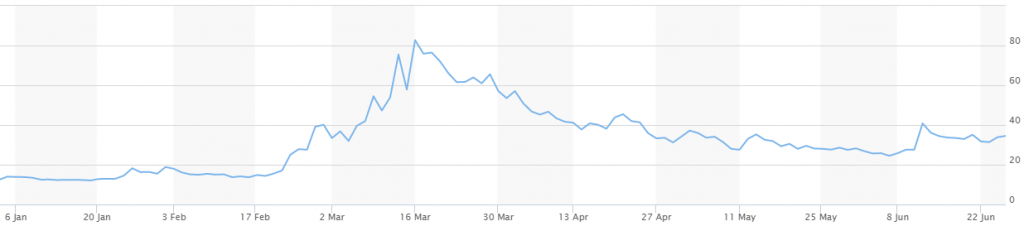

Market fears peak when the global financial market enters a recession. During the Great Recession, for instance, investors’ fears shot through the roof, leading to a massive sell-off of risky assets. The Volatility Index (VIX) created by the Chicago Board Options Exchange (CBOE) is the world’s best gauge of investor fears in the global financial markets. Although the index tracks the S&P 500, it provides the most accurate Fear Gauge in the global financial markets.

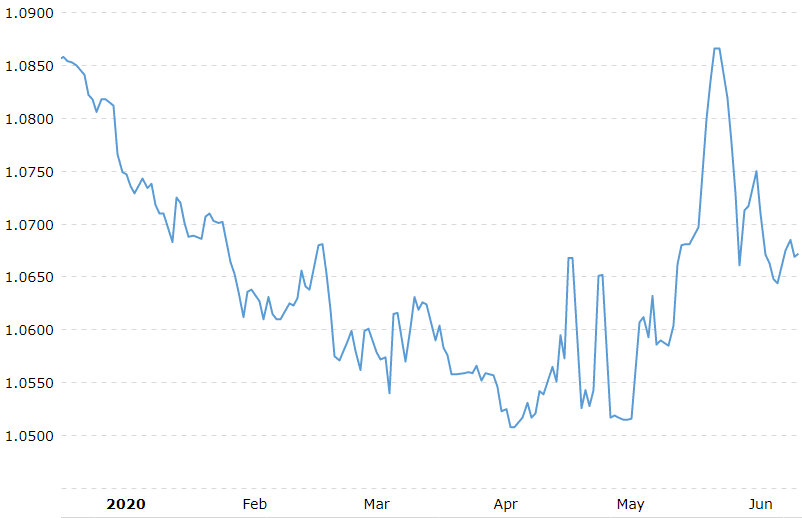

Higher VIX values show that market fear is elevated. Looking at the YTD charts of VIX and EUR/CHF, one can isolate an exciting relationship. Between January 2 and March 16, 2020, VIX gained 563%. In the same period, the value of the EUR/CHF pair fell by around 3%. The illustration shows that more investors buy CHF when market fears arise. EUR/CHF exchange rate began to rise in April as VIX leveled off at around 62% from the March peak.

SNB Monetary Policy

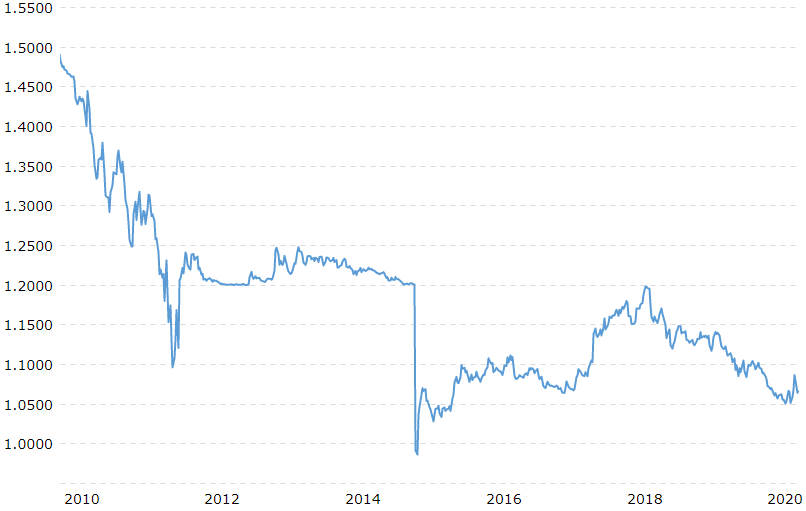

Swiss National Bank’s policy actions have an immense influence on the fluctuations of EUR/CHF. For starters, SNB is responsible for maintaining liquidity within the Swiss economy at certain predetermined levels. It means SNB’s actions influence the direction of inflation and unemployment. Consequently, the actions affect the stability of the Swiss economy, which either bolsters or undermines CHF’s strength.

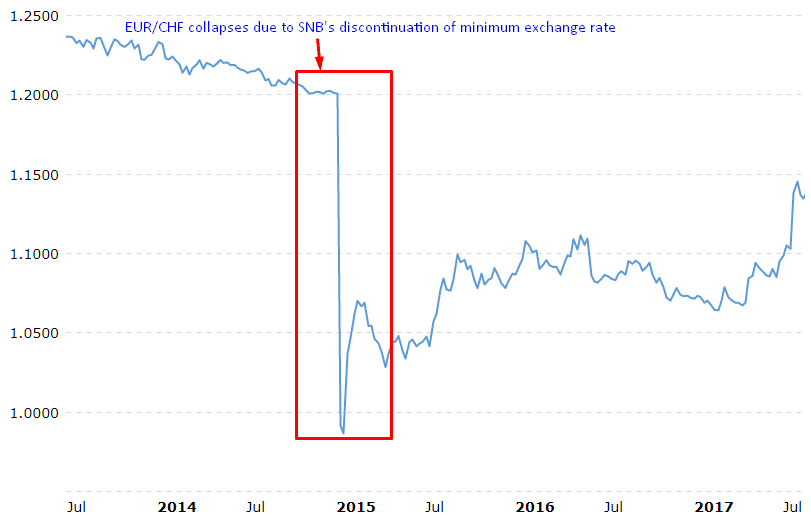

For example, in January 2015, SNB unpegged the exchange rate of CHF per Euro from the 1.20 level. Since 2011, SNB has set CHF 1.20 per EUR as the minimum exchange rate to prevent further strengthening of the Swiss franc. During that period, the Great Recession was at its peak, and investors were scrambling to convert their assets into CHF, a safe haven. Consequently, the CHF was strengthening against the EUR, making Switzerland’s exports unaffordable. After the discontinuation of the minimum exchange rate, EUR/CHF collapsed sharply.

SNB’s inflation targeting also affects the CHF’s strength significantly. To manage inflation, SNB adjusts policy rates to tighten or expand the economy’s flow of money. Over the past one year, SNB has maintained policy rates at -0.75. In the same period, the EUR/CHF exchange rate has continued to decline. It could be that the policy rate has kept the Swiss economy in a growth cycle hence lending strength to the Swiss franc.

Ties with the Eurozone

Switzerland is part of the Schengen area. Schengen countries eliminated international borders in 1985. It means a Schengen visa will allow holders to traverse across signatory countries without subjection to border control procedures. Consequently, these countries have a strong economic relationship. Interestingly, the Schengen area is Switzerland’s largest export market.

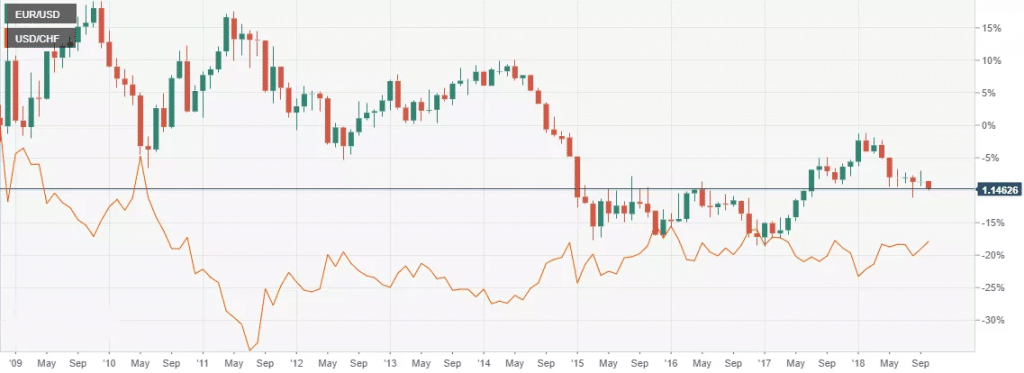

The ties put Switzerland’s economy at the mercy of turbulence in the Schengen Area and the broader Eurozone. Despite the close ties, the CHF has remained the currency of choice for investors when the Eurozone plunges into crisis mode. Interestingly, this phenomenon is responsible for the near mirror image relationship between EUR/USD and USD/CHF.

A crisis in the EU economy ripples through the whole region, including Switzerland, given Switzerland’s close ties with the Eurozone. In this case, both the CHF and the EUR decline against the USD. The result is a falling EUR/USD and a rising USD/CHF. Investors reason that a crisis in the Eurozone would lower the Swiss economy’s strength, leading to a weak CHF.

Conclusion

Switzerland might not be part of the European Union, but its membership in the Schengen area exposes its economy to the Union. Thus, the EUR and the CHF tend to decline together when the EU descends into a crisis. However, a crisis in the global financial markets brings investors to the CHF. It is because Switzerland has strong institutions that maintain stability. When market fears rise, CHF tends to strengthen because investors prefer to hold their wealth in the currency. Consequently, the EUR/CHF pair tends to fall in recessions and starts to pick up value as the markets return to normalcy.

Leave a Reply