Eightcap is a broker company operating in the international market. Representative offices are open in England, Australia, China. The company was founded in 2009 but was officially registered in Melbourne since 2015. The forex broker provides tools for trading: oil, metal, indices, and currency. Traders can use scalping and hedging. You can try yourself at a demo account for thirty days. Customers are offered several accounts with the same conditions.

Customer trust for Eightcap

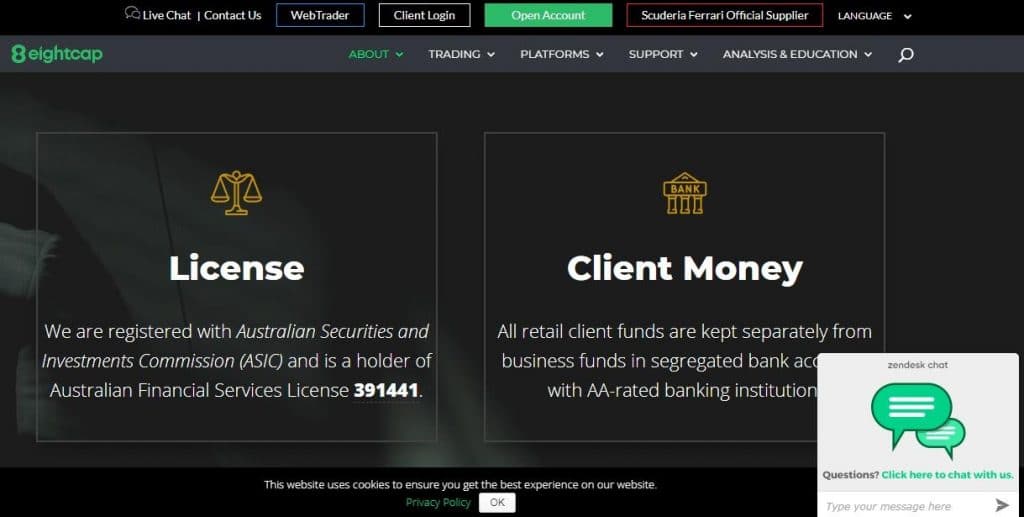

The broker has a high customer trust and has a license to carry out financial activities and trading on the exchange. The company’s activity is controlled by the Australian Securities and Investments Commission ASIC, which puts severe demands on the broker and sets the condition that he had from 1000000 US dollars budget and comply with laws and regulations of conducting the audit. The company also constantly reports to ASIC.

The regulator protects investors and, if the broker is declared insolvent, compensates them for losses. That is why Eightcap customers are protected and can invest without risk.

Trading Terms

The broker company Eightcap offers clients to work with different trading accounts, under the same conditions. The difference between them is in the spread, for the account Rawon is 0 points, and for Standard is 1 pip. On average, a pair of EUR / USD spread is 1.2 pips.

To open a trading account it is enough to deposit 100 US dollars. Broker’s investment portfolio includes forty products: CFD, Forex, silver, gold, oil and other instruments. In both accounts, the leverage is from 1: 1500. Traders can use scalping and hedging, as well as trading advisors. Using MAMM / PAMM, it is possible to register several accounts and place a transaction in each of them.

Fee and commission

Likely to other forex brokers Eightcap charges a spread fee, which is the difference between the sale and the value of the instrument. For example, if you purchased a lot of 100,000 units of EUR / USD at the rate of 1.17 and sold it at the same price on another day, then the commission will be 0%. If the lot was sold at the rate of two, the commission will be charged with a difference of 0.83.

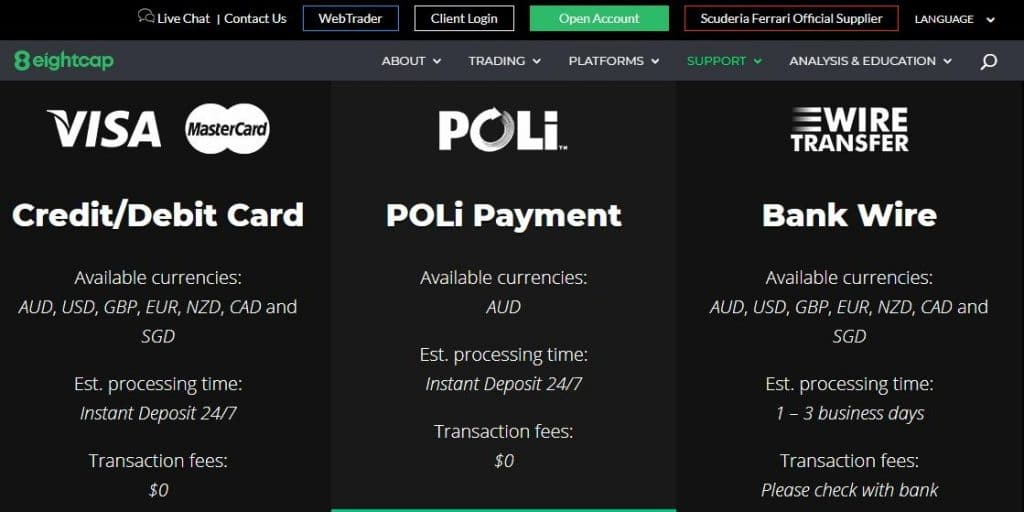

The broker does not charge a commission for the client’s inaction, but charges fees from the CFD. Also, the amount of commission varies based on the method of payment.

Withdrawal of funds

Customers of Eightcap can deposit trading accounts and withdraw money through bank cards, electronic payment systems: Moneybookers, Bpay, Poli and Skrill. After applying for withdrawal, funds are credited to the account from 3-20 days. Funds are withdrawn in US dollars, Euros, GBP and AUD.

The advantages of cooperation with Eightcap include:

• Availability of a regulator.

• Ability to make deals on MT4.

• Favorable spreads.

Among the disadvantages of the broker, there is a lack of news and market analysts.

Technical support

Eightcap customer support is available 24 hours per day. To do this, traders need to call one of the three offices located in London, Shanghai, and Melbourne. The company’s website is available in Chinese and English. The chat is conducted in 24/5 format, you can also get an answer to the question by sending a letter to the broker to its email.

Broker Eightcap is one of the few trading companies located in Austria and having good coverage in South and East Asia. And the updated website with a user-friendly interface is the pride of the broker.

Platform overview

Transactions are made on Metatrader 4. The platform is structured so that the client is allowed not only to conduct trades but also closely monitor live quotes. The platform is constantly updated and allows traders to follow the news of the financial market, conduct analytics and improve their skills.

Through Metatrader 4, Eightcap provides access to the Metaquotes market, providing investors with new perspectives and opportunities. Reviews of satisfied customers of the company testify about its successful activity and loyalty to all traders.

The broker is constantly developing and improving service, which makes it a successful leader in the financial market.

Leave a Reply