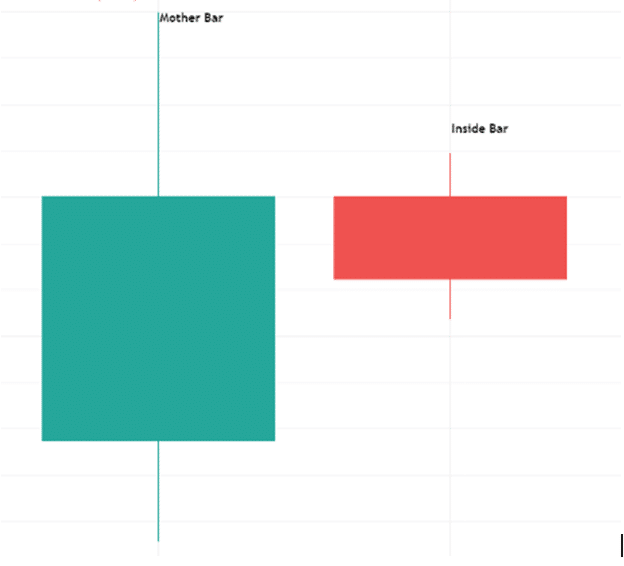

Inside bar trading is a two-bar setup in which the inner bar is smaller and within the preceding bar’s high-to-low range. This means that the new high is lower than the previous bar’s high. Depending on where it sits in relation to the previous bar, it can either be at the top, center, or bottom.

If the highs/lows of the inside candlestick and mother bar are equal, it may still qualify to be an inside bar. However, some traders do not consider this as a legitimate setup.

Inside bars indicate that a market is in a consolidation phase. For instance, an hourly or 30-minute chart will show a ‘triangle’. After a significant surge in the market, they often form while the market pauses to consolidate. As reversal signals, they can also occur at market inflection points.

How to inside bars work

It’s rare to see an inner bar pattern. This is mostly due to the fact that this formation needs a trend that is both strong and not yet exhausted.

Finding a nice inside bar setup in a trending market can be challenging because markets spend much of their time consolidating or ranging. Such a formation indicates a time for the market to head sideways following a significant move.

Inside bars come up when the previous bar’s high and low completely encompass the subsequent bar. The high and low are the only elements that matter when using this strategy. Traders should ignore the open and close.

You can use the inner bar pattern to your advantage if you know how to trade it correctly. While matching lows and highs are permissible, the range of the inside candlestick must not deviate too much from that of the mother candle.

The steps to using inside bar strategy

- Identify the key factors

A bullish or bearish trend’s endpoint is the best place for an inside bar to appear. When an inner bar forms, it indicates that traders could not drive the market to a new low or new high in this circumstance. Instead, the price fluctuated between the previous day’s high and low points. It’s a sign that the rally has run out of steam. Traders can tell if the trend is retracing based on how price behaves in the following few sessions.

- Look for an entry trigger

Whenever we spot an inside bar, it signifies an imminent breakout after some sideways action. However, to take advantage of this breakout, you must determine if it will likely lead to a price rise or fall.

There are many ways to do this, including looking at the previous trend. Before constructing an inner bar, the price movement is one of the most valuable elements of a profitable inside bar interpretation. Any price movement after an inside bar’s consolidation phase is likely to align with the trend that was already in place before the breakout.

Strategies for trading inside bar

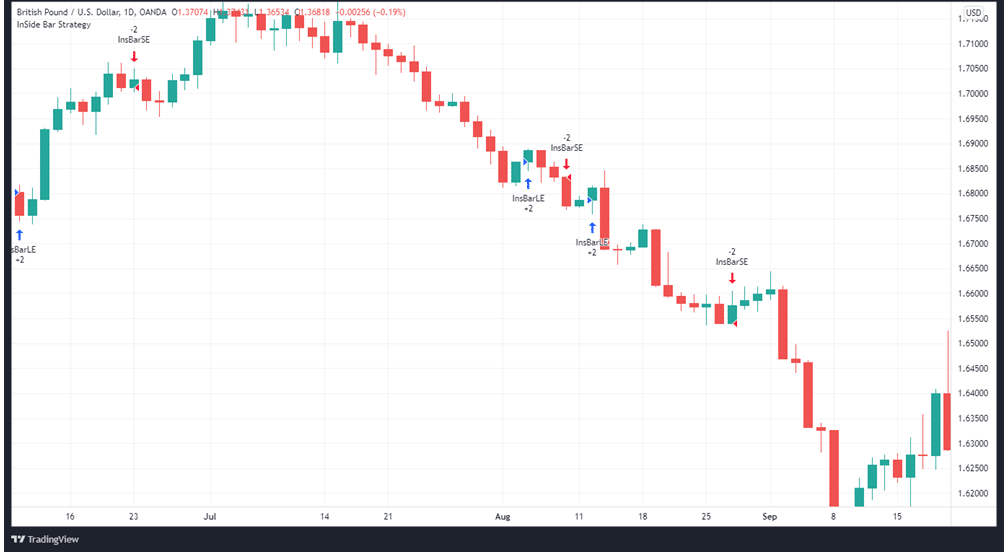

In a trending market

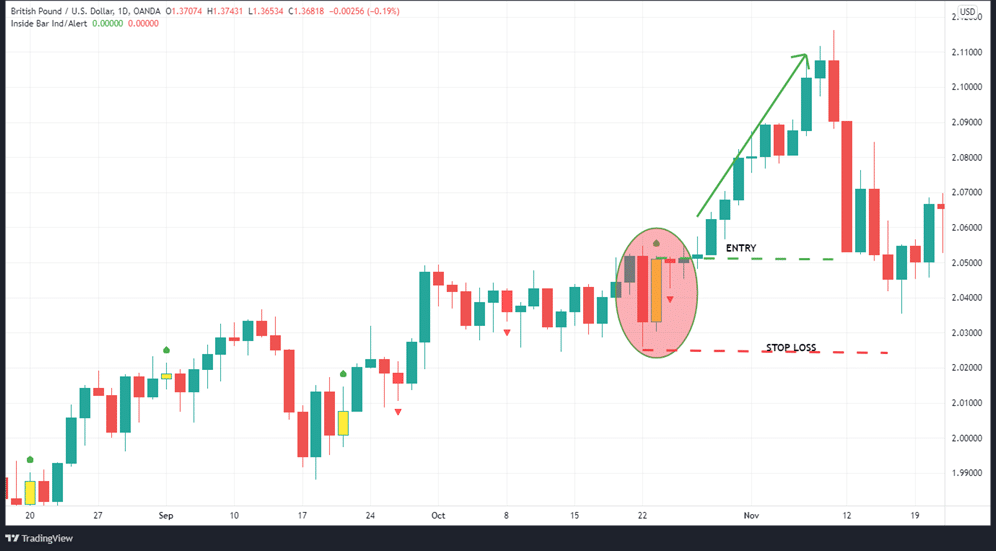

In the chart below, we can see how the setup works in a trending market. Given that the market was in a bearish trend, the inside bar signals an opportunity to sell.

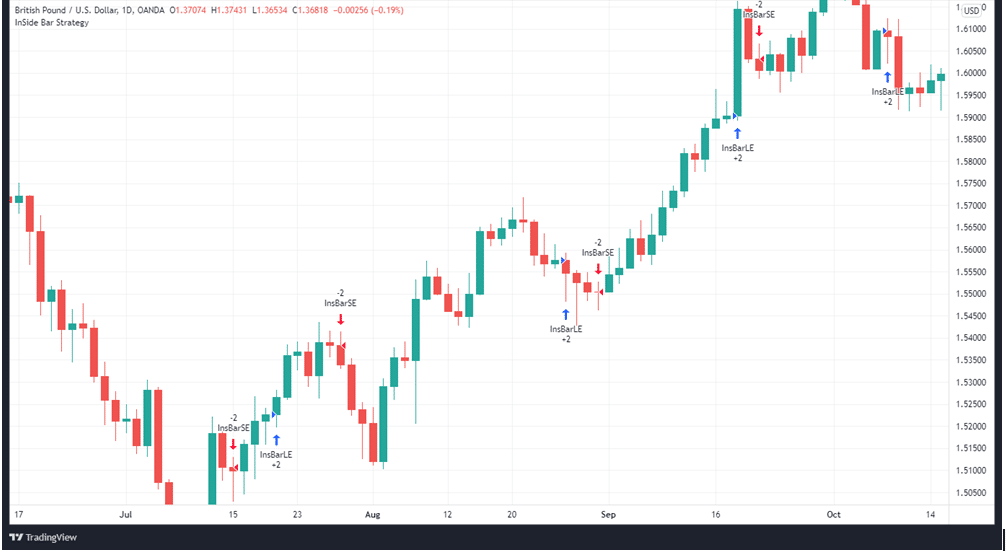

We can also see the strategy in a different trending market on the chart below. There were buy signals in this situation because the market was heading upward.

You’ll often see several inside bars, forming powerful trends like the one depicted in this example, which provides multiple opportunities to enter the market.

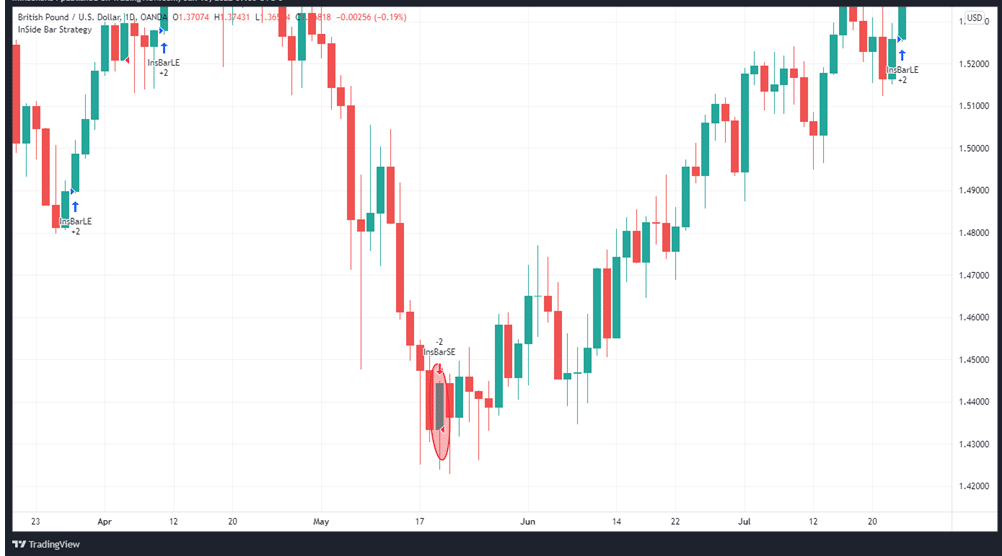

Trading against the trend

In the next example, we trade against the trend on a daily timeframe. During this instance, the price had returned to test a critical support level, forming the inside bar (see the circled area) and creating a reversal at that point. It then tested the same level again in June.

Take note of the substantial upward movement that occurred as a result of this configuration.

Entry, exit and stop loss

Entry: To enter a price action chart pattern, you should first identify the low and high points of the ranging zone. The two levels serve as a trigger for a possible transaction.

Recall that the inner candle indicates the final breakout. Additionally, it can tell us the probability of a breakout from a range. Nonetheless, it does not tell us the direction towards which the price will break out from the range before the actual break happens.

To put it simply, you should go long when the price movement breaks out of the downward range. To trade the short side, wait for a downward breakout from the range.

Exit: It is not easy to identify the optimal point of exit. Trailing stop losses are an effective approach once the price has moved in your favor following inside bar entry. This is because it can lead to an extended impulse move after the breakout.

Stop loss: Regardless of whether you’re long or short, your stop loss should be below the range’s low point, as seen in the image above.

In summary

Inside bar is a powerful tool for traders looking for signs of impending volatility in a particular asset. Always search for a strong market trend when using this approach to trade. In a choppy or sideways market, this method will not work and could lead to massive losses.

Leave a Reply