Forex traders are the most current in terms of the goings-on in the global economy. Their attention to detail is impeccable because their money counts on it. To be sure, good forex traders conduct thorough market research to ensure that whatever decisions they make rely on facts. Thorough market research ensures that trading decisions are devoid of the influence of human emotions.

Particularly, market research consists of technical analysis and fundamental analysis. While technical analysis tells you the direction of price action, fundamental analysis shows you the reason behind the changing direction of price action. In technical analysis, traders use forex charting tools to determine the price direction of forex products. Usually, short-term traders focus on price action because it predicts short-term movements more accurately. On the other hand, fundamental analysis is crucial for long positions. This is because it entails analysis of economic events like news releases, key economic data like GDP data, and more.

Explaining the economic calendar

Normally, a list of the economic events within a certain period are what makes up the economic calendar. The economic calendar is among the most valuable items in the forex traders’ toolkit. However, the tool would be useless if you do not understand its significance as well as how to read it properly.

Simply, the economic calendar lists all current and upcoming events whose information has a material effect on all forex products. Particularly, the economic calendar focuses on information on countries, which has a profound effect on the value of its currency. A useful rule of thumb among forex traders is that currency represents the political, social, and economic stability of its country. Therefore, material information about any of the three aspects of the country helps a trader to predict the potential volatility of a currency pair.

The currency in each currency pair carries a certain weight on its shoulder. Further, the value of a currency pair is representative of the status of sentiments of the market towards each of the countries represented in the currency pair. Nevertheless, some news items do not necessarily affect the country’s currency. For example, information from economic events in China affects the Australian dollar because over 30% of Australia’s exports go to China. This is because the Chinese Yuan (CNY) is not common currency in the forex market as the AUD.

Crucial information contained in the economic calendar

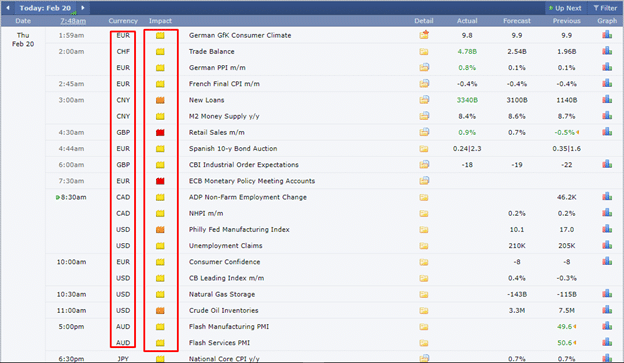

The economic calendar contains six sets of information that affect each currency. Firstly, there is the jobs data. This set of data includes information on the unemployment rate of the country over a certain period (usually one month). Also, job data shows a change in unemployment and a change in employment. Other information in the job data includes data on job openings and non-farm payrolls (NFP).

Secondly, there is the purchasing managers index (PMI). The PMI reveals the prevailing trend of the performance of private sector. It captures the economic trend in the service sector, the construction sector, and the manufacturing sector. Thirdly, there is information on inflation. Here, the economic event will reveal data on retail sales, consumer confidence, core retail sales, consumer price index (CPI), and other inflation reports.

Forth, there is GDP data. Particularly, this captures the gross output of the economy (considered quarterly) and the growth in GDP. Fifth, there is the trade data. This entails data on exports and imports, and subsequently, the trade balance. Lastly, there is information on monetary policy. This is critical information that has an enormous weight on the value of the currency. It details the official interest rate and speeches of key officials of the country’s central bank.

How to use the economic calendar in forex trading

To be sure, the economic calendar is critical for any successful trade, but few understand this. In the following paragraphs, we take you through the process of reading and analyzing the economic calendar.

The first thing you need to do is to check the economic calendar every day early in the morning. Specifically, this will help you to stay ahead of material market events. Further, perusing through the calendar early will enable you to perfect the algorithmic FX trading system during setup. If you are using a forex robot, then an early peek at the calendar will enable you to select the best parameters.

Secondly, customize the calendar. The forex market is global, and news from all around the world may affect your portfolio. However, the time zone difference may affect your consumption of the news. Therefore, it is advisable to adjust the economic calendar to your time zone for better preparation. Also, you should customize the calendar to show only the events that are relevant to you. As such, you will avoid being swamped in a deluge of news headlines, which may be overwhelming.

Thirdly, and most importantly, focus on the most critical news. Usually, the economic calendar uses color codes to identify the urgency of the news. For example, news whose currency impact is in red implies that it is the most important. However, the yellow coded news is least important and can be ignored without any consequence.

Leave a Reply