The foreign exchange market, called forex, is one of the most extensive and liquid globally. Millions of traders put their capital in the market, hoping to earn a profit. However, the depth of the market and complexities require that the trader becomes familiar with specific items like charts. Notably, the significance of charts is inestimable because of the extent they go to help in profitable trading.

Interestingly, charts are not just useful to human traders. Even forex expert advisors rely on the charts to follow the market. The charts help traders to identify trading opportunities. In particular, a trader can use indicators on the chart to anticipate increased price actions. Numerous charting software makes it possible to utilize the charts. This article aims to introduce and to explain forex charting software. Also, the article will take you through a systematic process of how to choose the best forex charting software.

Understanding forex charting software

A forex charting software is a platform that collects prices of different currencies and then displays them on a chart. There are many forex brokers where each has their prices. Here, a forex charting software collects the price feed from these brokers. However, different charting software operates differently.

On the one hand, there is software that picks prices at random from different brokers. Others may focus on all prices in the market and then come up with the average. Therefore, this average value is the one that appears on the chart.

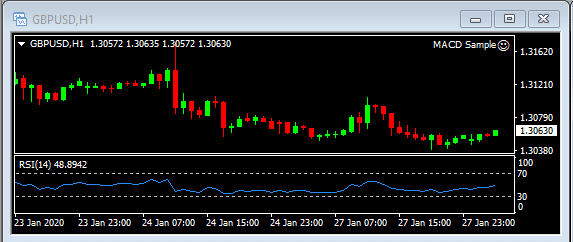

Admittedly, charts are invaluable in automated forex trading. It does not matter whether a trading robot is entirely in charge of the trades or the automation is hybrid. The fact is that the charting software enables traders to follow the fluctuations in prices of currencies in real-time. Also, the majority, if not all, of the software have forex charting tools that help traders to come up with winning trading strategies. A chart that shows real-time price data looks like the one in the image below.

Why the charting software is useful

Usually, trading platforms like MetaTrader 4 come with charting functionalities. However, sometimes the functionalities fail to provide the level of effectiveness and convenience a trader needs. Often, some automated trading strategies very complex that more advanced charting capabilities are necessary. In such a case, the forex charting software is indispensable.

Specifically, the charting software comes with advanced analytical tools that are useful in technical analysis. This way, traders (both human and FX expert advisors) can overcome the shortcoming of the trading platform supplied by the broker. Another reason why forex charting tools are useful in that they work on multiple devices. Therefore, if your trading platform is unavailable on a mobile device, a charting software can facilitate access to charting tools on the device.

A systematic guide to choosing the best forex charting software

There are tons of information on multiple media platforms about forex, and some of the information could be misleading. It is because many people want to trade due to the opportunities for huge profits that are available. In the process, many people end up with the wrong information. Ultimately, their forex experience becomes one that they would rather forget.

To be sure, there is much charting software that is useful, but only a few work well for each trader or the forex EA. Fortuitously, a few simple steps will help you to avoid making the mistake of choosing the wrong charting software.

Step 1: Outline your requirements

A good trader knows what he/she wants at the end of the day. It does not matter whether you are a newbie or a professional, but having a set of requirements is key to earning from forex. In like manner, algorithmic FX trading functions best when you outline the requirements that you expect the system to live up to.

For example, do you plan to be a day trader or a quasi-active trader? If you plan to be a day trader, then you have no option but to rely on the charts on your trading platform. Mainly, you can use the trading platform, like the MT4, to leverage some of the best forex indicators like relative strength indicator (RSI) to identify trading opportunities.

Step 2: Experiment with different platforms

Of course, if you are not a day trader, you can make use of other charting software, most of them web-based. Web-based charting software like TradingView offers an extensive range of analytical tools for free. Interestingly, there is a desktop application version of the software, also free to use. The full-featured chart comes with many tools, including a news feed, charting tools, and a watch list. It means that even when you are using a forex robot, you will be able to follow everything that is happening quickly.

Step 3: Leverage resources from experts

Fortunately, the internet is flush with information shard freely by expert traders. For example, some traders host free and premium webinars that teach newbies how to choose the best forex charting software. You will not regret getting tips from some of the traders. Even some forex brokers like CMC Markets offer charting analysis tutorials in free webinars.

Leave a Reply