XM.COM company has an ambiguous reputation among users. The group of financial companies was established in 2009 in Belize. For a relatively short time, the financial infrastructure was built, allowing each user to open an account and trade in international markets.

According to the company itself, the number of their clients has already exceeded 2.5 million. A legal entity providing financial services is referred to as Trading Point Holdings Ltd.

General information about XM

• Availability of a regulator – yes, ASIC, CySEC, FSP;

• Trading terminal – MetaTrader4, XM Webtrader;

• Language – multilingual site;

• Minimum deposit is $5;

• Financial instruments – stocks of companies, currency pairs, indices, precious metals, raw materials, cryptocurrency.

At the time, the forex broker actively attracted new customers with big bonuses, lack of commission, easy registration.

Types of accounts

XM Forex broker offers to open one of four types of accounts:

• Micro;

• Standard;

• Ultra;

• Shares.

The peculiarity of different types of accounts with a fx broker is a large leverage (up to 1: 888). In addition, each account is protected from a negative balance. The smallest lot is traditionally determined at a rate of 0.01 points.

Other features of the trading conditions:

• Unlimited access to automated trading systems, trading signals and advisors (via Metatrader);

• Support service works in many languages of the world;

• Market execution of orders.

When opening an account like Ultra, users are granted access to a personal manager. Since XM is an international company, managers from different countries work in the team.

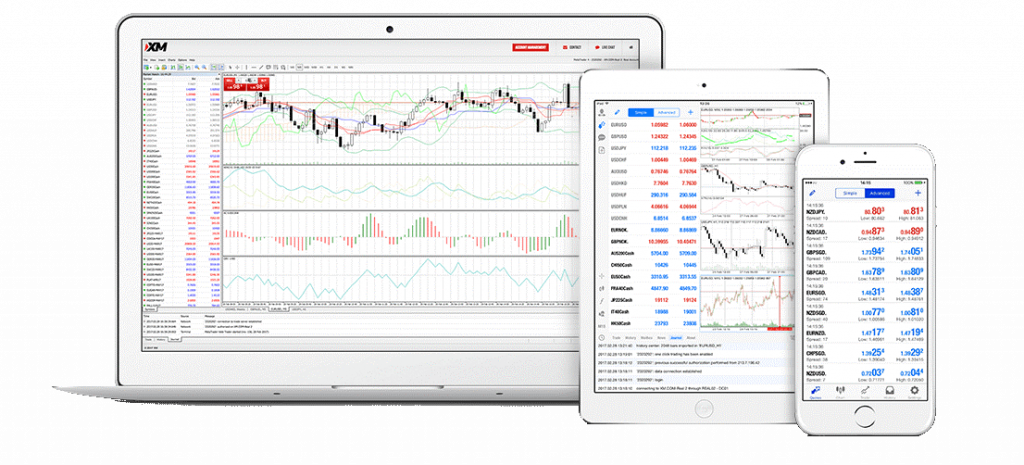

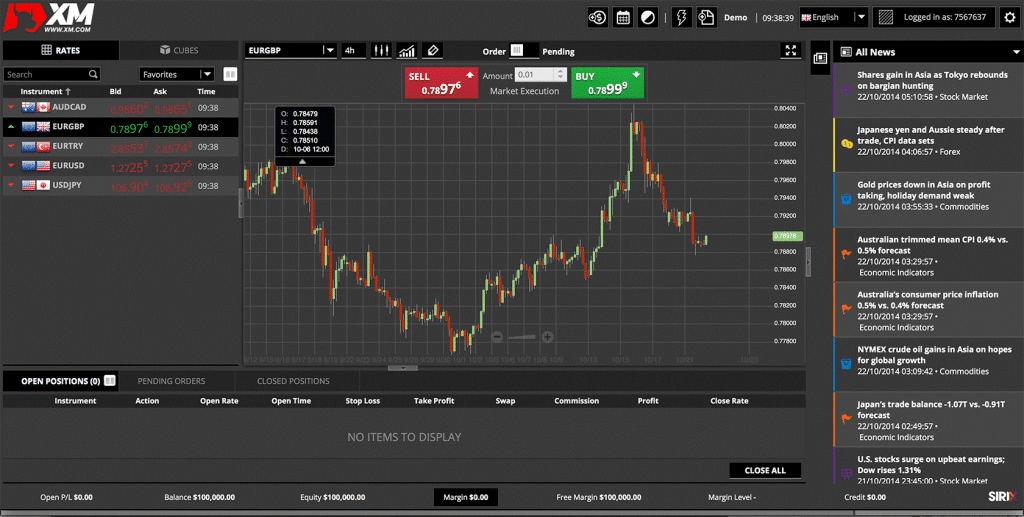

XM Forex Trading Platforms

In addition to the standard Metatrader platforms for a computer, smartphone or tablet, users can access the web version of the trading terminal. It has built-in analytical tools, the ability to connect to trading signals, use fundamental analysis.

Analytics and Training

An important section on the site of each broker is analytics and training. The company XM.COM this unit is presented in an extended version. The so-called distance learning center conducts periodic webinars, compiles video instructions for working with the trading terminal and broker’s investment tools. Also available is an entry to trading seminars held in different parts of the world.

In addition to the training material, tools are available for users to automate Forex trading. For example, connection to trading signals through the MQL5 system. Automatic execution of orders eliminates manual trading and reduces the time for forecasting. If necessary, you can always use the economic calendar or calculator for the trader on the XM.COM website.

Bonuses and Promotions

At the beginning of the review article, we already mentioned that the company actively attracted new users through the activation of the bonus program. The first type of bonus credited to all users who open any account, except XM Ultra Low and XM Shares for up to $ 5000. The amount of bonuses is equivalent to 100% of the amount entered. But it’s not possible to bring them out right away. Money is credited to the bonus account. To withdraw them, you have to convert to profit through daily trading. But keep in mind that after a certain period, promotional charges are burned. Therefore, it is necessary to trade in large volumes so that bonuses become real money in the main account.

In addition to the welcome bonus, broker representatives conduct a loyalty program. It consists in carrying out random draws among active clients every month, semester and year.

The bonuses and promotions section also states that the company excludes all fees for processing payments in the amount of $ 200. No commission is charged for replenishment, or for withdrawing funds through bank details and electronic payment systems.

Despite the wonderful wrapper and beautifully designed website, the company has a number of problems. This allows you to find hundreds of feedback from customers on thematic forums and portals. For example, slippage in quotes is often mentioned. The company does not indicate liquidity providers, so it will be difficult to refute such allegations. Someone points to the obsessive work of managers who literally persuade to open an account for a large amount.

Therefore, it is rational to initially test the terms of cooperation with a broker on a small deposit or on a demo account.

The company actively sponsors sports clubs and non-profit organizations. It is worth paying attention to it if the broker proves its stability and the ability to guarantee the safety of the deposit under the terms of the user agreement.

Leave a Reply