Automation is increasingly taking over trading activities in the forex market. The need to spend the least amount of time scanning for opportunities and trading has triggered strong demand for automated trading systems. Unlike in the past, it’s become much easier to come up with automated trading systems. MetaQuotes Language has made it possible for traders to automate their trading strategies and come up with customized trading indicators.

What is MetaQuotes Language?

It is an integrated programming language that is making it easy for people to automate trading strategies. It exists in two variations of MQL4 that runs on Meta Trader 4 and MQL5 that runs on Meta Trader 5.

MetaQuotes Language has also made it possible to develop technical indicators, strategies, and skills that can be used to enhance trading operations on the MetaTrader trading platform. In both variations, one can develop trading robots for analyzing the markets 24 hours a day and executing trades based on desired inputs.

In addition, both MQL4 and MQL5 make it possible to come up with unique trading indicators for executing trading strategies. Additionally, one can buy them from other programmers who have built and post them on the marketplace.

MetaQuotes Language goes a long way in encouraging rule-based trading. In this case, traders can execute trades based on set patterns or conditions. Therefore, emotions are kept in check while trading, preserving discipline and enhancing trading consistency.

Trading rules are implanted into the automated trading system, making it possible to backtest any strategies before engaging in live trading. Consequently, MQL makes it possible to fine-tune trading strategies before risking real capital.

How MetaQuotes Language works

As a programming language, it is based on the popular C++ language. Consequently, it allows people to develop complex programs capable of handling calculations while also accurately managing expert advisors and indicator parameters.

Ideally, MetaQuotes Language makes it possible to develop algorithmic trading software. Such programs can analyze the currency market based on the parameters deployed. The analysis is geared towards uncovering trading opportunities that meet a given risk-reward profile. Once all the parameters are met, the program executes a trade on behalf of the trader.

The programming language makes it possible to come up with trading strategies capable of analyzing current and previously received quotes. It also has built-in basic indicators and functions perfect for managing trading orders.

MQL, a powerful tool, makes it possible to perform various mathematical operations, i.e., calculating the position sizes of each trade. It is also used to determine ideal stop loss to take profit levels while enhancing the opening and closing of orders.

Understanding Expert Advisors in MQL

An expert advisor is simply a program built using the MQL programming language with the sole aim of analyzing and trading the markets. In this case, the EA analyzes and identifies opportunities on a given currency pair based on specific parameters.

Expert advisors are designed to limit the amount of time people use glued to the screen scanning for opportunities. The automated programs scan the markets as long as it is opened, even if one is not at a trading desk.

Whenever the expert advisor finds an opportunity that meets set out requirements, it opens a position automatically. In addition to opening, it sets profit take targets whereby gains would be locked in whenever a trade goes in favor. Additionally, it sets a stop-loss order as part of risk management strategy, averting the risk of accumulating too much loss on an open position.

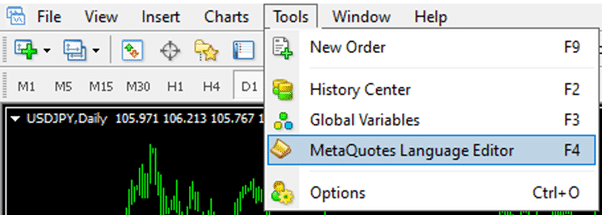

In MetaTrader 4, the MetaQuotes Language Editor for coming up with trading strategies and indicators can be accessed on the Tools menu.

It is commonly broken into five parts, with the top tool chats housing the traditional menu. The Navigator Window makes it possible to access file structure in the MQL4 directories, while the program writing editor is where one can write and edit active programs.

The toolbox portal showcases all the errors, search results, and program log while the status bar displays command promotes and the cursor position.

Why MQL in Forex trading

Gone are the days when people had to spend countless hours glued to the screen searching for trading opportunities. MQL has given rise to trading robots capable of performing operations 24 hours a day. Therefore, the programming language addresses the human limitation of not being able to watch the market every minute by enhancing the development of automated trading systems.

It has also made it possible to learn to program and leverage it in the financial markets. MQL has enabled traders to make use of various parameters and come up with rule-based trading systems that avert trading with emotions in the forex market.

MQL drawbacks

While MQL is an important tool in forex trading, it also comes with its fair share of shortfalls. For starters, the learning process can take time before one can develop an effective trading strategy or indicator. The programming language requires ample time to master.

Contrary to perception, it is not easy to run a profitable trading robot that generates the desired outcome all the time. A lot of backtesting and fine-tuning from time to time is needed to come up with a trading strategy with a high risk-reward potential.

Additionally, sporadic checks are needed from time to time to detect any errors that may occur in the MetaTrader platform.

Bottom line

MetaQuotes Language is an important tool for anyone looking to develop a trading system based on programmed scripts and capable of scanning the markets 24 hours for opportunities. By enhancing the development of trading robots, MQL has averted emotional trading and reduced anxiety as operations in the market are carried out based on predefined rules and parameters.

Leave a Reply