- Rising Covid-19 cases in Japan may hinder the yen’s gains.

- Speculative trading is likely to set in as the market awaits the next Fed decision.

- US jobs data is likely to guide traders’ decisions on USD.

The US dollar continued to show its recent weaknesses against major currencies as it slipped by 0.31% against the Japanese yen to trade at 109.379 at 1410 GMT on Monday. Following last week’s disappointing US GDP data, analysts will be waiting for this week’s US employment data to figure out the likely trajectory for the USD in the short term.

USD giving in to pressure as the Fed’s reluctance bites

The dollar index, DXY, which indicates the performance of the US dollar against six major global currencies, was marginally lower at 1014 GMT on Monday, shedding 0.22% in the previous 24 hours to stand at 91.975.

This was a small gain from Friday’s low of 91.779, according to data from TradingView. At the time of writing, the greenback stood at 1.3901 against the British pound after losing 0.02% and was 0.17% lower than the EUR to trade at 1.1887.

Following the Fed’s adamance that the current US inflation is transitory, analysts’ have to wait at least until September 21st at the earliest to know whether there will be a change in the US monetary policy.

With nothing much happening on the monetary policy front for almost two months, the market will be taking hints from comments made by FOMC committee members. Speculation trading could potentially lead to volatility in the USDJPY.

US jobs data likely to guide the market in the short-term

Nonetheless, in the intervening period, the labor market should provide useful data to traders to help them assess the performance of the US economy. Of immediate focus will be Friday’s release of Non-Farm Payroll Data, which is projected to indicate an additional 50,000 jobs from June’s 850,000.

A lower-than-expected figure could create investor sentiment about the US economy and dent USD’s standing against other major currencies. The jobs data will also be used to evaluate the possibility of a potential tapering by the Fed in its next meeting.

With the US dollar showing signs of weakness in recent days and US inflation rising amidst an underperforming GDP in Q2, many investors are increasingly looking forward to a Fed tapering from September. However, after recent Fed inaction that went against analysts’ expectations, there will still be much room for speculative trading involving USD in the next seven weeks. This is likely to herald a period of double-tops and double bottoms in the price chart.

The Japanese economy, the yen and Covid-19

For the yen, the Achilles heel is likely to remain the Covid-19 spike and the strong performance of the equities. Japan is currently hosting the Olympics, and the concerns around the pandemic have already meant that the country has missed out on the benefits of Olympics-driven visitor arrivals.

Instead, the host city, Tokyo, has been put under a state of emergency, which has surpassed 3,000 new infections for four consecutive days. The country’s containment measures seem to have achieved little, bearing in mind that the numbers keep rising despite Tokyo being on its fourth week of a state of emergency.

This has caused concerns about Japan’s economy and could potentially slow down gains by JPY. Investors who are bullish about the yen will, however, take solace in Prime Minister Yoshihide Suga’s stance against stricter lockdowns.

Technical analysis

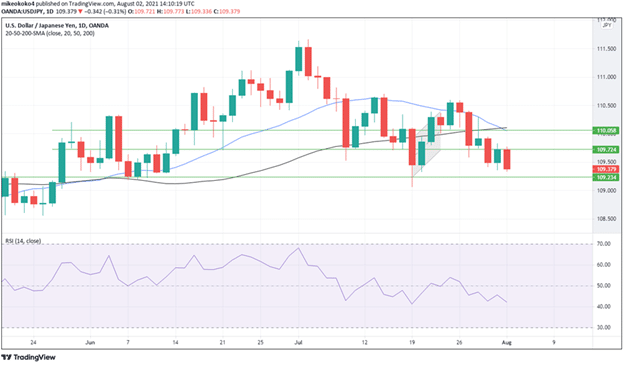

The USDJPY is showing a weakening momentum, with its RSI at 43 and the indicator pointing downwards. The 20-period SMA has crossed the 50-SMA, reaffirming the likelihood of the pair sliding further.

The pair is likely to find support at 109.234 if the bears hold on to their current control. The bulls’ fightback is likely to push the price to the first resistance at 109.724 and possibly to a second resistance at 110.058.

Leave a Reply