- US dollar firms ahead of FED report.

- USDJPY turns bullish after BOJ purchases.

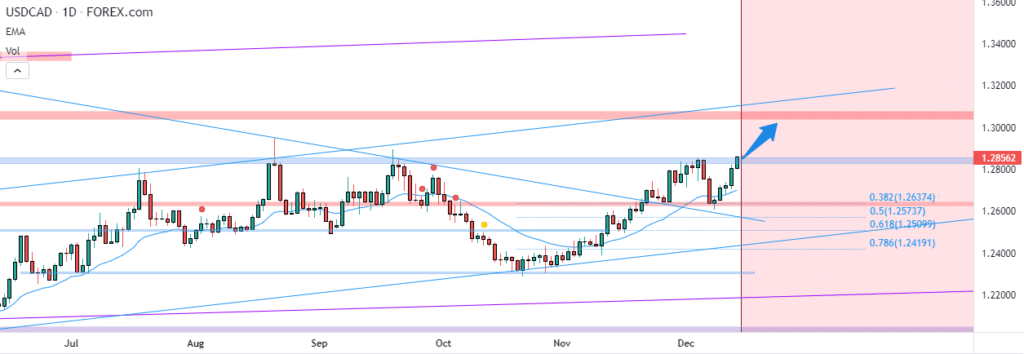

- USDCAD rallies amid CAD weakness.

The US dollar is holding steady against the majors as investors await the much-awaited Federal Reserve policy meeting report. At stake is whether the central bank will accelerate asset purchases to tame runaway inflation and provide hints of rate hikes next year. The market is betting that the FED will complete asset tapering of between $25 billion and $30 billion from the current 15 billion by March of next year.

The dollar index, which measures the greenback strength against the majors, has gained 0.5% this week, powering to highs of 96.55. In addition to the Federal Reserve, around 20 central banks are poised to issue their policy decisions expected to fuel wild swings in the currency market. The markets have taken a tiny break from the Omicron variant despite triggering significant concerns.

USDJPY technical analysis

Amid the increased attention on central bank decisions, USDJPY threatens to break out of a tight trading range. USDJPY powered to the upper band of 113.79. The rally comes on the Bank of Japan flooding the market with yen in a bid to curtail a spike in interest rates.

USDJPY powering and finding support above 113.80 should pave the way for bulls to steer a rally to highs above the 114.00 level. On the flip side, the 113.50 is the short-term support level above which the pair remains bullish.

BOJ cash injection

The bullish momentum in the pair comes from the Bank of Japan injecting cash into the markets for the third day running. On Tuesday, the central bank offered $17.6 billion via bond buys, adding to a 2 trillion yen purchase. The central bank insists it will maintain the ultra-loose monetary policy until the economy recovers from the shocks triggered by the pandemic.

The Japanese yen also remains under pressure against the dollar on easing concerns about the Omicron variant. The currency had strengthened as investors scampered for safety on concerns that the variant would trigger new restriction measures, all but slowing global economic recovery.

Nonetheless, USDJPY price action is highly dependent on the outcome of the FED policy decision. The hawkish report could trigger dollar strength, resulting in the USDJPY powering through the 113.80 level.

Similarly, a dovish report could trigger dollar weakness, which could see the pair edging lower below the 113.50 support level. The dollar has strengthened against the yen on expectations that the FED will accelerate asset purchases and hint of accelerated rate hikes next year.

USDCAD rally

Meanwhile, the Canadian dollar remains under pressure against the dollar ahead of the FED report later. The USDCAD pair has powered through the 1.2800 level to two-month highs of 1.2858.

The pair is currently trading near a strong resistance level at 1.2860 levels above, which it could power to highs of 1.2900. Acting as strong support strengthening the case for further upside action is the 1.2727 level.

The bullish biases on the USDCAD pair stem from growing worries about the Omicron variant that continue to weigh heavily on the Loonie. Oil prices edging lower below the $70 a barrel level has also fuelled CAD weakness causing USDCAD to re-rate higher.

The uncertainty around the Omicron variant has seen traders shun riskier currencies such as the CAD in favor of the US dollar, all but sending the USDCAD pair higher. Hotter than expected US producer Price Index has also affirmed dollar strength, strengthening the case for further upswing on USDCAD.

Leave a Reply