Source: S&P Global

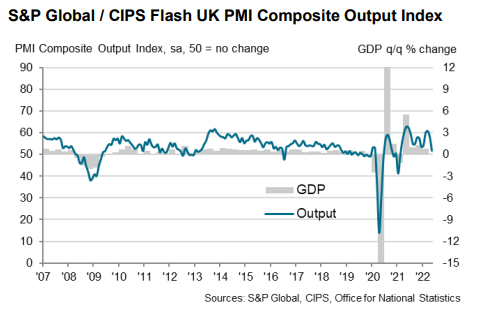

The UK private sector grew at the weakest pace in fifteen months in May, with the Composite Output Index at 51.8, down from 58.2 in April. FTSE 100 is down -0.027%, GBPUSD is down -0.70%.

- The services sector lost momentum in May, with the level of activity also sliding down to a 15-month low. The index reading of 51.8 was below 58.9 in April.

- The level of manufacturing output fell to a 2-month low, with the index at 51.8 in May, compared to April’s 54.3.

- The Manufacturing PMI hit a 16-month low after falling from a reading of 55.8 in April to 54.6 in May. Firms attributed the loss of momentum to supply disruptions, rising inflation, and the Ukrainian crisis.

- The decline in service and manufacturing activity in the UK in May was attributed to weak demand, with new order expansion slowing down for the third straight month. Export orders also fell the most since June 2020.

- Pressure on business capacity by UK private firms persisted, with the backlogs of work rising marginally, the fifteenth straight month of increases.

- Supplier performance remained weak, with the delivery times gauge hitting 34.0, the highest since October 2020. Employment rose rapidly in May as firms ramped up efforts to clear backlogs.

- Input prices rose at the fastest on record, while output charges eased slightly from the record highs of April.

- Business expectations fell to the lowest in two years, with firms less upbeat on the economic outlook amid expectations of lower consumer spending.

Leave a Reply