They say the best things in life come in pairs. When we trade forex, we are continuously measuring the strength or weaknesses of one currency against another.

As expected, with virtually every country having its own currency, there are mathematically thousands of pairs you could trade. The average retail forex trader is usually exposed to between 28-40.

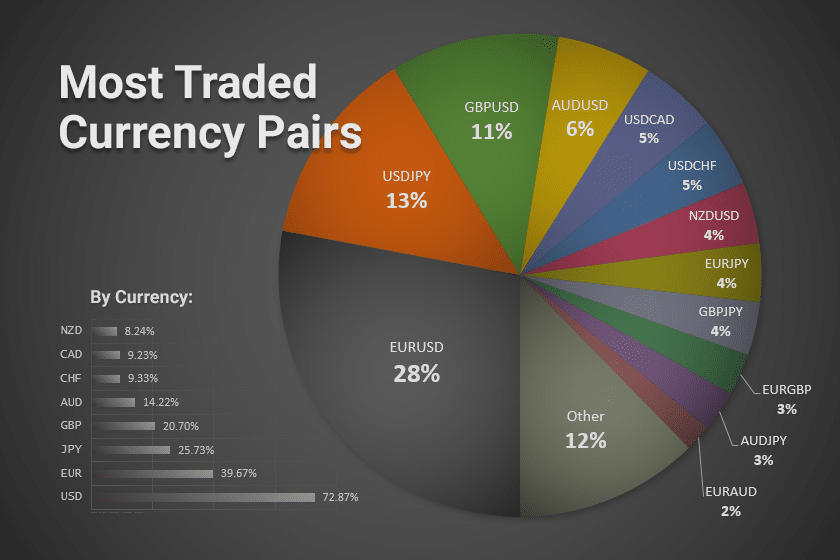

However, it’s usually better to become a specialist and focus only on a handful. This article will cover the top 10 most traded currency pairs you should focus on in 2022.

EURUSD (Euro/US dollar)

EURUSD or the euro is the most actively speculated currency pair in foreign exchange, accounting for close to 30% of all volume.

EURUSD represents the world’s reserve currencies in the US dollar and euro. This means nearly all forex transactions will be denominated in one or the other, which is one of the reasons this market is so prominent.

EURUSD is characterized by having the cheapest spreads in the industry, relatively constant volatility, and stable price movements.

This pair is a particular favorite for short-term traders for these qualities. Still, any trader would be doing themselves a disservice by not including this market in their watchlist or portfolio.

USDJPY (US dollar/Japanese yen)

USDJPY or the yen is another popular major pair regularly enjoying heavy trading volume and media coverage. The Japanese yen holds a status as a so-called safe-haven currency.

Investors seek refuge by owning Japanese yen in market turmoil because of Japan’s stable and prosperous economy. USDJPY is typically more volatile than EURUSD, meaning we can expect more big moves than its counterpart.

The yen is suitable to virtually all traders because of the volatility and having dirt-cheap spreads. As a USD-based pair, USDJPY often moves along with other major pairs like EURUSD, and USDCAD, depending on whether the dollar is strengthening or weakening.

GBPUSD (British pound/US dollar)

While ‘Cable’ is in the third position, it’s frequently the most volatile major pair in forex, meaning this instrument can move several hundreds of pips in one direction for extended periods.

Technically, the British pound is the strongest among mainstream currencies, which is one of the main reasons this market continually attracts intense speculation in forex.

Like USDJPY, GBPUSD shares correlations with all major pairs because of having the US dollar. If you prefer a pair that can move more in pips while having exposure to the US economy, Cable may just be your best bet.

AUDUSD (Australian dollar/US dollar)

The ‘Aussie’ is another favorable tradeable market and forms a considerable component of the major pairs and overall daily trading volume in forex. This market is distinct because it’s a ‘commodity pair’ since Australia’s economy relies heavily on commodity exports, particularly gold.

So, commodity prices considerably influence the direction of the Aussie. Thus, the volatility is above average compared to the likes of EURUSD.

When the values of commodities like gold and coal increase, AUD would likely become more valuable, thereby increasing AUDUSD’s price; of course, the opposite is true.

USDCAD (the United States dollar/Canadian dollar)

USDCAD or the ‘Loonie’ (in reference to the loon on the reverse side of the Canadian dollar coin) is another intriguing commodity pair. Canada is one of the world’s largest oil exporters.

Hence, USDCAD shares an inverse relationship with crude oil prices. When the latter increases, it typically makes the Loonie less valuable because there is more demand for the quote currency (CAD) and less for the base currency (USD).

Of course, the opposite is true. As a result, the Loonie is one of the more volatile major pairs but also provides low spreads and some level of predictable stability.

Aside from being a forex pair, it can be an excellent market to trade for anyone wanting exposure to the oil without having to trade large contract sizes.

USDCHF (United States dollar/Swiss franc)

USDCHF or the ‘Swissy’ is essentially a mirror image of EURUSD since both pairs often move in the opposite direction.

The Swissy is also immensely traded by all speculators worldwide and has maintained a reputation of being a ‘safe-haven pair’ much like the USDJPY.

This is because of how investors perceive Switzerland as being a dependable country with several favorable economic advantages.

NZDUSD (New Zealand dollar/United States dollar)

NZDUSD or the ‘Kiwi’ (in reference to the kiwi, New Zealand’s national symbol) is another keenly-traded commodity pair that moves in tandem with the Aussie because of the proximity between the two underlying countries.

Most of New Zealand’s economy relies on agricultural production, with the country being one of the globe’s largest dairy exporters. Hence, prices in the dairy markets have a significant influence on NZDUSD.

Moreover, the Kiwi will inevitably trade in the direction of other USD-based markets due to the greenback’s impact.

EURJPY (Euro/Japanese yen)

EURJPY makes it onto this list as the most traded minor or cross pairs, which are markets not directly influenced by the US dollar. Therefore, it’s worth having in any trader’s watchlist as it provides diverse, uncorrelated opportunities not found in the major pairs.

Cross pairs like EURJPY move farther than their counterparts because of the competitiveness between the Eurozone and Japanese economies. This market is driven by several fundamental drivers, which are all closely updated and followed.

GBPJPY (British pound/Japanese yen)

GBPJPY goes by several peculiar nicknames like ‘The Widow-Maker,’ ‘The Beast,’ ‘The Dragon,’ and ‘Gopher.’ This pair shares a positive correlation with GBPUSD, except that it’s far more volatile, perhaps why it has earned the previously mentioned labels.

Again, as a cross pair, it’s barely affected by the US dollar, meaning it provides traders with much-needed diversification from the US economies.

EURGBP (Euro/British pound)

The EURGBP also tends to produce significant directional moves, which is expected of a cross pair. However, it’s not as volatile as GBPUSD or GBPJPY, making it a little more stable.

This market shares an inverse correlation with GBPJPY since GBP is in different places within each pair. As expected, this market is primarily influenced by how well or poorly the Eurozone and British economies are performing daily.

Final word

Despite tens of currency pairs available at one’s disposal, most forex markets tend to be heavily correlated. This means you should understand these relationships to never unnecessarily double your risk by trading two different instruments moving in the same direction.

Usually, you can pick a maximum of two pairs within the top 7 of this article as your major pairs, mixed in with a few AUD, CAD, CHF, EUR, GBP, JPY, and NZD-based markets here and there.

With this selection, you should have a well-diversified mixture of the most traded currency pairs where you can find the best profiting opportunities.

Leave a Reply