USD/JPY is a widely traded currency pair in the trillion-dollar forex market, loved by veteran traders and beginners. The pair is made up of two different currencies representing some of the biggest economies in the world.

The first listed currency in the USD/JPY pair is USD or U.S. dollar, commonly referred to as the greenback and representing the U.S. economy. The second currency is the Japanese Yen representing Japan’s economy.

What You Need To Know About the Yen

The Yen is one of the seven currencies that account for 80% of trading activity in the forex market. It is backed by Japan, one of the world’s largest economies in terms of Gross Domestic Product and a key player in the export market. It came into being in 1871 after the Meiji government adopted it as legal tender.

Bank of Japan is Japan’s central bank tasked with the responsibility of passing policy measures that influence economic activity, thereby the Yen strength in the currency market. Like most central banks, the BOJ ratifies policies designed to encourage economic growth, conversely strengthening the Yen, and minimize inflation.

The Economy behind the Yen

Unlike most countries, deflation has been a big problem since Japan’s equity and real estate burst in the 1990s. Since then, Japan has struggled with slow economic growth, with the BOJ being forced to cut interest rates to zero or negative, all in stimulating the economy. Likewise, deflation characterized by a consistent decline in prices of goods and services has been a big thorn in the economy.

Despite being one of the world’s oldest economies, Japan’s economy, a key driver of Yen strength, boasts of one of the lowest fertility rates in the world. An aging workforce characterizes the economy. Higher deflation levels are, therefore, as a result, if less young population is highly needed for taxation and consumption.

The Yen’s major currency status is affirmed by the fact that Japan’s economy is one of the most advanced, boasting of a highly educated workforce. Industries and factories are at the heart of Japan’s economy. Japan is best known as a leading manufacturer of consumer electronics and autos and technological components.

What Moves USD/JPY Pair

The rate at which the USD/JPY exchange rate fluctuates depends on many things that influence the value of the U.S. Dollar as the base currency and the Yen as the quote currency.

- Monetary Policy

Monetary policies initiated by the Bank of Japan and the Federal Reserve in the U.S. act as a key driver of the USD/JPY exchange rate. Whenever the two central banks comment or take actions with regards to interest rates, quantitative easing, inflation, or economic growth forecast, the same ends up influencing traders’ sentiments, conversely causing the exchange rate to fluctuate.

- Economic Indicators

Economic indicators paint a clear picture of how the economy is doing. In the forex market, traders await the release of GDP, Consumer Price Index numbers, Interest decisions, and industrial production and unemployment rate to gauge how Japan and the U.S. economy are doing.

Wage growth and retail sales data also paint a clear picture of how U.S. and Japanese economies are doing conversely influencing traders’ sentiments on the Yen and the U.S. dollar.

Whenever Japan prints impressive economic data signaling the economy is doing well and growing at an impressive rate, the Yen tends to appreciate against the dollar, sending USD/JPY pairs lower in the forex market. In return, whenever the economy is not doing well affirmed by weak economic data, bearishness in the Yen kicks in, resulting in the exchange rate edging higher.

Yen for Market Risk Appetite or Safe Haven

In the forex market, the Yen is often referred to as a safe-haven that traders seek refuge in, in times of economic turmoil or geopolitical tensions. Conversely, the Yen tends to appreciate economic recession or geopolitical tensions in times, pitting some of the world’s biggest economies. Likewise, it is common to find the USD/JPY pair edging lower in times of market turmoil or geopolitical crisis due to the Yen appreciation.

Similarly, the Yen tends to weaken whenever there is tranquility in the market, and the global economy is doing well, and world powers are at peace with each other. The currency also tends to weaken when the stock markets are rallying, given the reduced risk sentiment in the market. In such times, the USD/JPY exchange value tends to increase in value due to a weaker Yen and a stronger dollar.

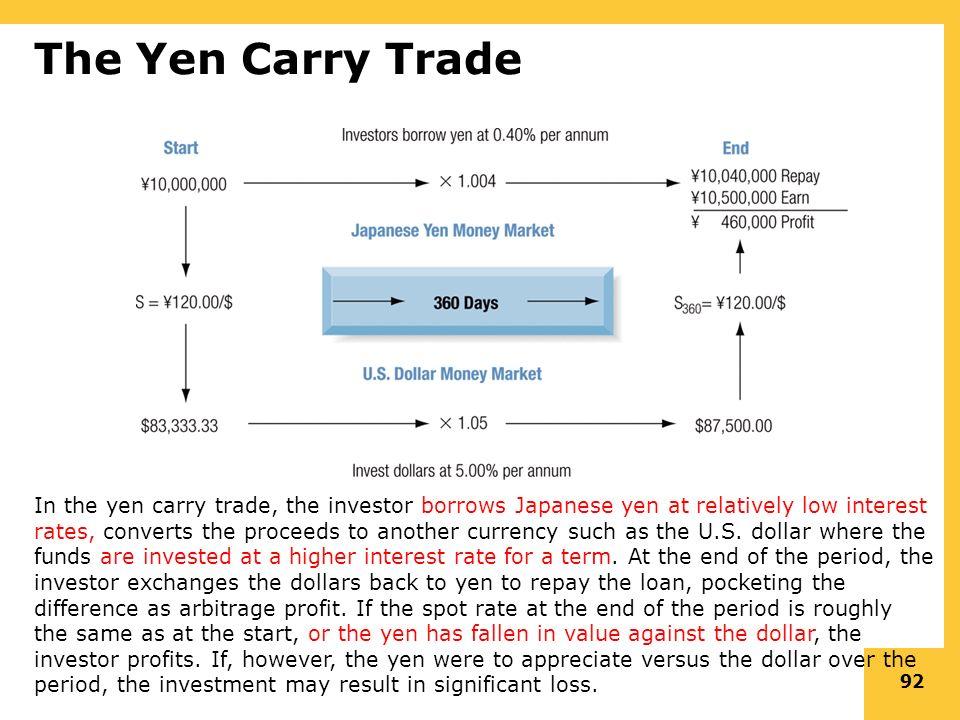

Yen Carry Trade

Currency carry trades occur whenever investors borrow money in one currency to invest in another country to take advantage of higher interest rates. For the longest time, the Bank of Japan has maintained interest rates at record lows of 0% cutting recently into negative territory at 0.1%

Traders have always opted to buy Yen by borrowing from Japanese banks, conversely taking advantage of the low-interest rates. The borrowed Yen ends up being exchanged for currencies with higher interest rates.

For instance, when U.S. Interest rates were at highs of 1.75%, investors often borrowed in Yen and exchanged them into dollars to benefit from interest rate differential. In the end, the traders ended up making a profit of 1.75% on the difference between Japanese and the U.S. interest rate.

Likewise, Japanese investors have been borrowing at low-interest rates in Japan and opting to invest overseas to profit from higher interest rates in other markets. Similarly, foreign investors have borrowed in yen and chose to invest in the global stock market.

Bank of Japan Monetary Policy

The Bank of Japan continues to influence the USD/JPY exchange rate given the monetary policies it passes from time to time. Over the years, the central bank has strived to maintain interest rates near the zero territories as part of its monetary policy.

Low-interest rates might as well explain the low inflation levels in the country. Likewise, Japan has always acted as a source of capital in the world as foreign investors flock local banks to borrow at low interest and invest in high-interest rates to carry trade strategies. Therefore talk of higher interest rates would often go a long way in sending shocks and ripples throughout the currency market given the value of carrying trades in play.

The BOJ has often carried out currency intervention selling the Yen all to weaken the currency and make exports cheap.

Economic data Impact on Yen: Tankan Survey

The Tankan Survey is a commonly watched economic release that influences traders’ sentiments on the Yen conversely USD/JPY price exchange rate. Released by Bank of Japan, the economic survey covers thousands of companies with a specified amount of minimum capital.

Given the number of companies covered in the survey, the Tankan Survey report provides an ideal picture of business confidence across Japan. Similarly, it paints a clear picture of the health of Japan’s economy, conversely influencing Yen sentiments in the forex market.

Therefore, the Tankan survey is a crucial financial measure that influences investor’s sentiments conversely stock prices and Yen exchange rate.

Bottom Line

The USD/JPY is a major currency pair and one of the most traded pairs in the currency market. The pair represents a significant amount of daily trading.

USD/JPY exchange rate is influenced by several things, key among them being the monetary policies passed by the Bank of Japan and the Federal Reserve. Economic data in the U.S. made up of GDP numbers, CPI number Retail sales as well as Industrial data influence trader’s sentiments on the USD and Yen conversely affecting USD/JPY exchange rate.

Leave a Reply