What to expect in 2021 from the Forex market

The exchange rates in 2021 will be decided by the degree of confidence traders have in the global economy recovering after the pandemic. It is estimated that the USD will depreciate sharply in 2021, by as much as 5%-10% against other major currencies. The effect of the pandemic on Europe and the USA will reduce the confidence traders have in the USD. Here we analysed in retrospective what happened to major currencies this year, so we can estimate how the forex market will perform in 2021.

The Forex market is vast, and the volatility is quite high because there are so many currency pairs you can choose from. Considering that we are going through a pandemic in 2020, the Forex market has not been negatively affected compared to other industries. The 1st quarter of this year saw a trading volume rise of 200% compared to 2019. Let us now look at the best-performing currency pairs in 2020.

#1. British Pound / US Dollar (GBP/USD)

Several Forex traders tend to favor this pair as news related to it is readily available. Both countries release financial data on a regular basis, and traders can easily make entry and exit decisions due to this. With the holiday season coming up, liquidity is likely to get dampened, while the news of the vaccine releasing and December PMIs could charge the relative volatility.

The GBP fell against the US Dollar by more than 1.6, with the currency pair displaying a huge weekly reversal after a yearly high.

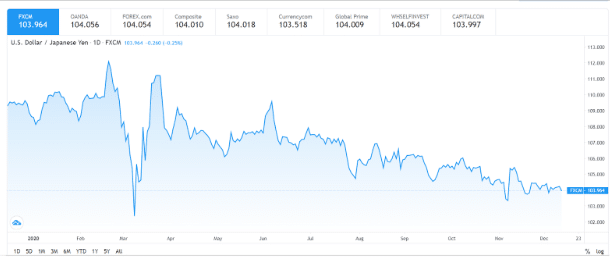

#2. US Dollar / Japanese Yen (USD/JPY)

This is the second most-traded currency pair after EUR/USD, and it is a faithful indicator of the Asian as well as the global economy. The Japanese Yen has a bullish forecast, with the Tokyo stock exchange outlook being threatened by the COVID-19 lockdowns. The pair has a greater chance of moving upward, with the chances of the Yen depreciating being increased by the rise of the stock index.

Coming to the client sentiment, there have been 67% long trades and 33% short trades this year.

#3. US Dollar/ Swiss Franc (USD/CHF)

This currency pair is considered by most Forex traders to be a safe investment. It keeps moving within the downtrend and fall channel with moving averages signaling a downward trending market. The rise of the currency pair will be confirmed by the resistance area breaking down and the quotation closing beyond 0.9065.

The SNB’s decision on the interest rate and a recent press conference may affect the rate of CHF against the USD. Provided the Euro keeps rising, the CHF will also rise, and this particular currency pair will maintain the downtrend.

#4. US Dollar/ Canadian Dollar (USD/CAD)

This particular currency pair is down-trending because of the rise in oil prices, causing CAD appreciation. With news about the vaccine coming in, oil prices are likely to keep rising, thus making the CAD continue its upward trend. The COVID-19 count in the US continues to rise; however, making traders avoid the USD.

#5. Euro / US Dollar (EUR/USD)

Since March 2020, the futures markets have been dominated by the long positions of the EUR/USD pair, with the total volume getting reduced since the middle of September. The prediction for the pair is still bullish, with the major influencing factors being the second wave of the Coronavirus in Europe and the failure of the European economy in comparison to the US, which has the potential to harm the currency pair rate.

#6. Australian Dollar / US Dollar (AUD/USD)

The Australian dollar is predicted to fall against the USD, and traders are thus looking for buying opportunities. The Australian economy has suffered a lot since the majority of its exports are to China, and there is an ongoing trade war between the two countries. In November, the pair slipped from 0.71 to 0.70 due to uncertainty regarding the outcome of the US election.

Nevertheless, with COVID cases falling in Australia, the government is relaxing the restrictions, and this is a good sign for the AUD.

#7. Euro / British Pound Sterling (EUR/GBP)

Since the past six months, this particular currency pair has been displaying a sideways trend, and there is very little chance of the range breaking with the Brexit story not reaching its conclusion. The mainland European countries have been less affected by COVID, thus prompting traders to go short with the pound.

#8. New Zealand Dollar / US Dollar (NZD/USD)

The NZD/USD pair seemed to be following a bearish pattern, causing traders to look for short setups. But recently, it made a strong surge upwards, mainly due to the changing risk sentiment towards New Zealand as the developed countries start introducing COVID vaccines. The momentum is bullish for now, with people being more optimistic about post-COVID economic growth.

#9. Euro / Japanese Yen (EUR/JPY)

Traders usually borrow JPY at cheap rates and then buy currencies like EUR that provide higher returns. Currently, it remains in a stable position inside the bullish channel, although the bullish rally is getting blocked by stochastic. Several traders are expecting the beginning of an uptrend soon.

#10. Euro / Australian Dollar (EUR/AUD)

The Australian Dollar is predicted to make gains due to improving COVID situations, despite the fact that they are engaged in an ongoing trade war with China. The EUR/USD may see a consolidation period with the ECB enhancing the financing policy of the Eurozone and EU leaders meeting to discuss Brexit.

Traders will probably be careful while making the EUR/USD go up, which further strengthens the suggestion of a consolidation period for this particular currency pair.

Leave a Reply