All forex traders are interested in as many methods of making profits with the lowest risk possible. Discussions of new and relatively unknown strategies are constantly hot topics. One strategy that may not be popular in forex with the masses is the carry trade.

The carry trade is a long-term type of speculating in forex involving some decent knowledge of the interest and swap rates between currencies. Also, good opportunities for this strategy are rare; hence why it’s often favored by position traders who hold positions for several months or even years.

When done properly, the strategy can produce a sizable profit over time provided one has a long-term mindset and performs the necessary risk management. Let’s go over what the carry trade is in forex and how it works.

What is carry trade?

Carry trade is the practice of buying or selling one currency with a high-yielding interest rate against another with a low-yielding interest rate to profit from the swaps or rollover between the two markets.

In short, traders look to gain from the daily accumulating positive interest and hopefully the natural currency pair’s appreciation or depreciation over months or longer. To recognize the effectiveness of this strategy, one needs to understand the idea of swaps.

The swap in forex is the interest traders incur or earn for keeping their positions overnight or ‘rolling’ them over. We have to remember that because trading currencies is leveraged, traders are effectively taking a loan. This is why much of the literature suggests leverage is the act of borrowing money from a broker to open bigger positions.

However, unlike a traditional loan, traders can also earn depending on the interest rate differentials in the currencies they are trading. There are no restrictions on how long someone can hold a position, provided they maintain the required margin.

How does the carry trade work?

Traders will need to consider the interest rates of the respective countries within the currency pair in question, whether they are going long or short (buying or selling), and the potential exchange rate fluctuations.

- Interest rates are set or modified by central banks about eight or ten times a year based on their monetary policies. In recent history, the trend for these organizations has been to maintain the same interest rate for years. Therefore, it is quite rare to see noticeable changes in the figures.

Nonetheless, the swaps will change should there be alterations.

- For going long or short, traders will determine the extent of the differential between the currencies and buy the currency with the higher interest rate while selling the currency with the lowest one.

For instance, in USD/JPY, if the US interest rate is 3% while that of Japan is 2%, the difference is 1%. This means that by buying and holding this pair, they would profit from the positive differential since the target currency (USD) has a higher interest rate than the funding currency (JPY).

Perhaps the most important aspect of a carry trade is the general currency fluctuation. In this example above, a trader would want the pair to increase in value to gain the best of both worlds; the natural appreciation of the market itself and the collected daily interest.

This factor is the hardest to determine, as with any strategy, since no one knows how long the market can go against them. Experts argue there are two risks with carry trading, the interest and exchange rate. However, interest rates have often stayed unchanged for years. Thus, the latter is the bigger risk as it can change more frequently.

One of the must-do things with carry trading is using a large stop loss as traders intend to stay in the position for a very long time in the hopes of the swaps and currency appreciation or depreciation making up for the risk.

Other things to consider about the carry trade

Here are two other things to consider about the carry trade:

- Exotic markets: One trick used by carry traders is observing exotic pairs. Swaps within the major and minor currencies are small. Consequently, the risks are a lot higher for a much lower reward. However, exotic pairs do have noticeably larger swaps.

These pairs are derived from so-called developing or lesser-known currencies like South Africa, Russia, and Turkey, whose central banks have historically maintained higher interest rates than their more established counterparts.

For instance, Turkey’s current interest rate is 19%, while that of the United States is 0.25%. Therefore, position traders may consider the USD/TRY for a potential carry trade if they spotted a good selling opportunity.

Not many exotic pairs have such a disparity between the rates, though they are much higher than other more popular markets.

- Finding the best swap rate from a broker: The swap rates amongst brokers aren’t uniform and vary widely. So, traders will need to shop around for the best deal. Unfortunately, the formula for calculating the swaps is not entirely universal, and brokers will also add their commission on top.

In most cases, the calculation is usually along the lines of: the number of lots X swap rate X number of nights divided by 10. The example in the next section will break down this formula in more detail.

Forex carry trade example

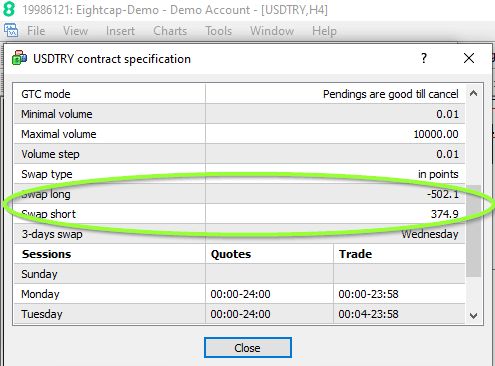

We are going to use the swap rate from Eightcap for USD/TRY. The broker offers -502.1 for a long position and 374.9 for a short position.

Let’s imagine someone opened a 1 lot sell order on this pair and held the position for 10 nights. Using the calculation mentioned in the previous section, this is the result:

1 X 374.9 X 10 nights / 10 = $374.9

Therefore, the trader would receive $374.9 in swaps assuming they were still in the position. It’s crucial to note that USD/TRY’s exchange may naturally favor or go against the investor. Thus, this is only a rough example showing how the swaps can accumulate to a sizeable sum over time.

Final word

The carry trade is an interesting forex strategy used by position traders to collect interest. One of the main advantages is an investor only needs to open their order once and hold for as long as possible.

Furthermore, the trader can also profit from the natural appreciation or depreciation if the position went in their favor over time. The biggest risk is managing the exchange rate fluctuations, which may go for or against them.

Leave a Reply