Stenvall Mark III is a trading solution that executes a Grid of orders strategy on clients’ accounts. The presentation could have been written better if the devs wanted.

Detailed Stenvall Mark III robot review

The presentation includes some details about how the system has to work for us. We have united all of this in the list.

- We can expect that the robot will work automatically on our terminal. No extra deeds are needed.

- It knows how to work on low risk accounts.

- The supported pit is EURUSD.

- We are allowed to trade on M5.

- “This is the 3rd generation of the EA Stenvall. The EA Stenvall MK III trading method is a hybrid of a trend strategy with a counter trend strategy.”

- The robot is good for high time frames.

- The release date was in 2016.

- We can work with 8% drawdown.

- “EA Stenvall MK-I MT4 was used as one of the EAs of a private hedge fund, with a total deposit of more than 2.7M USD (I can’t prove this information).”

- It sounds ridiculous.

- The system runs an account stable.

- The dev claims that the robot does not use “martingale or grid or other dangerous strategies”.

- It isn’t sensitive to spreads and requests.

- We can expect that the robot places SL levels for each order.

- There are 76 functions on the board.

- The average TP is 150 pips.

- We can get started within several minutes or so.

- We can use set files to customize the system properly.

- The balance can start from $100. It allows trading with 0.01-0.04 lot sizes.

Pipbreaker strategy tests

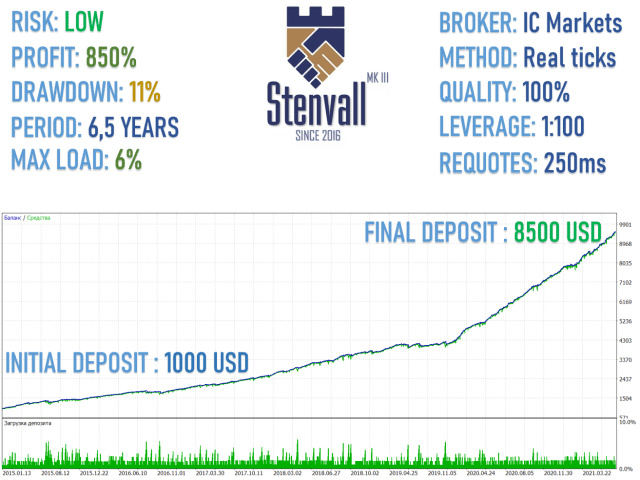

We have a backtest report based on the tick data from IC Markets. The leverage is 1:100. It worked with low risks. The profit was 850% with only 11% of drawdowns. The data period was 6.5 years.

Pipbreaker trading results

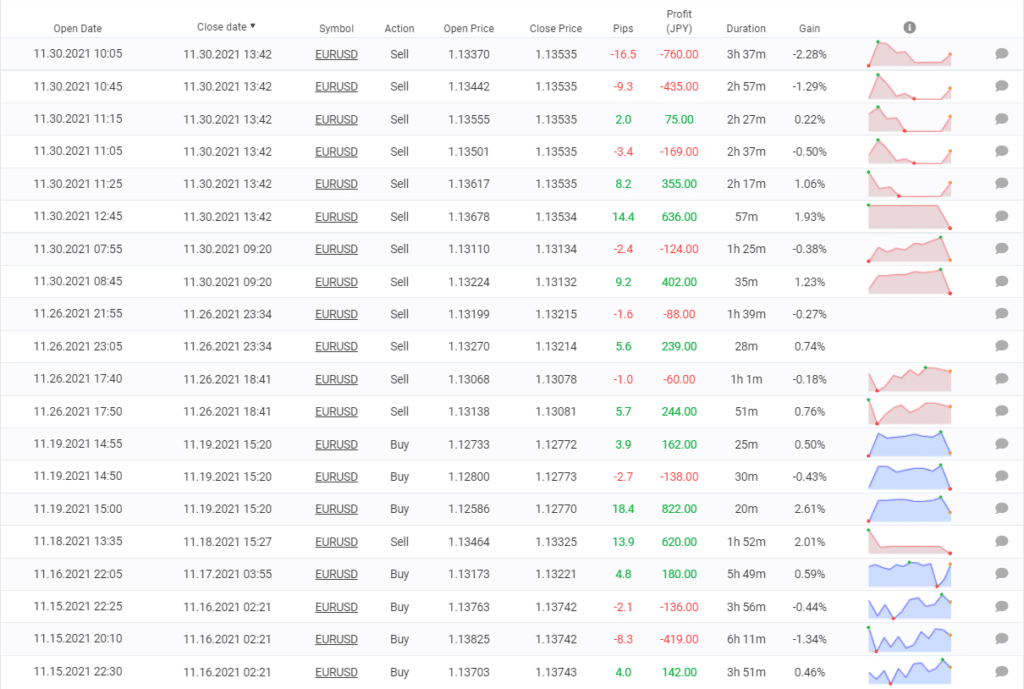

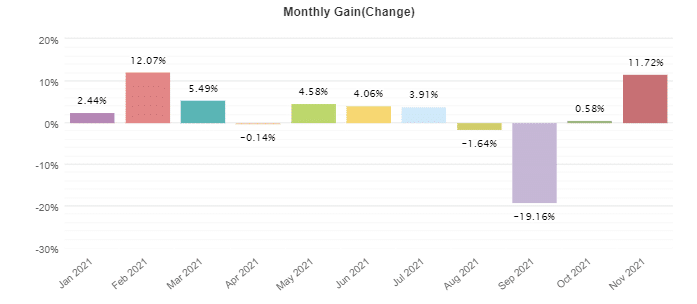

The system runs a real ForexChief account on MT4 with 1:400 leverage. The account has a verified track record. It was created on April 21, 2019, and deposited at ¥11,283. Since then, the absolute gain has amounted to 188.88%. An average monthly gain is 3.39%. The maximum drawdown is 23.80%. The account is tracked by 133 investors.

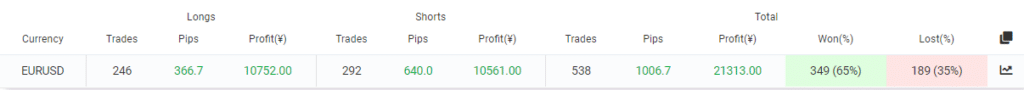

It has executed 538 deals with 1006.7 pips. An average win is 6.24 pips when an average loss is -6.20 pips. The win rate is 63% for longs and 66% for shorts. An average trade length is 5 hours 10 minutes. The profit factor is 1.62.

The short direction with 292 orders is traded a bit more frequently than the long one – 246 orders.

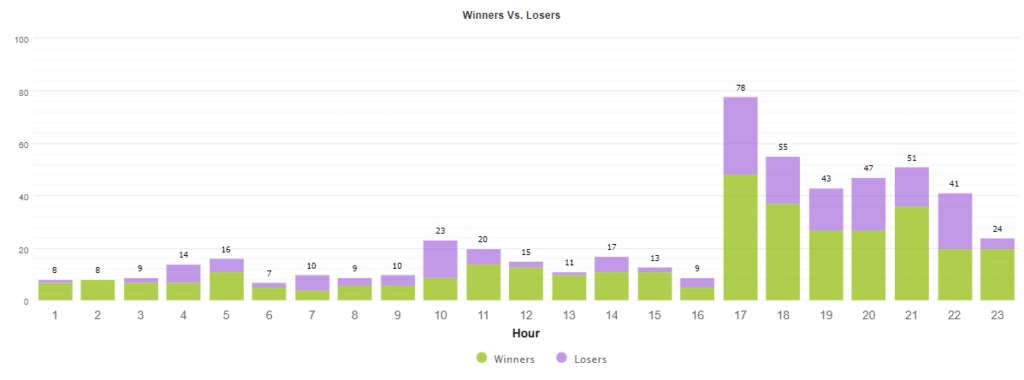

The system trades pull-backs during the American trading session.

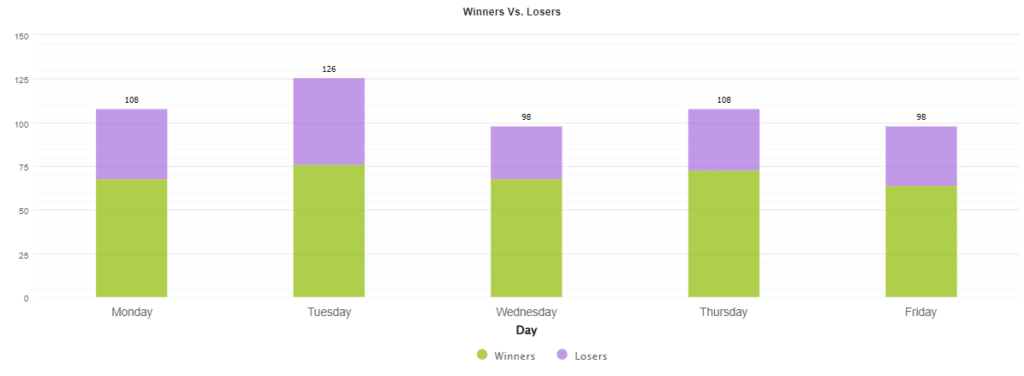

Wednesday is the less traded day with 98 deals.

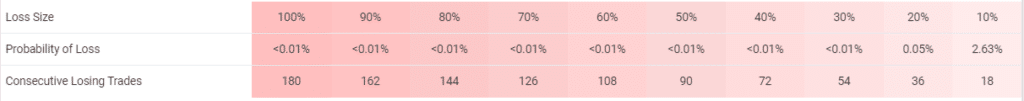

The risks aren’t healthy. There’s a 2.63% chance to lose 10% of the account.

The advisor has lost so many orders in the last two weeks.

We may note that the system looks unstable in this year’s trading.

Pricing

We can purchase a system for $980. This robot doesn’t cost this money. We can rent it out for $399 annually. We can download a demo copy of the system for free.

Customer reviews

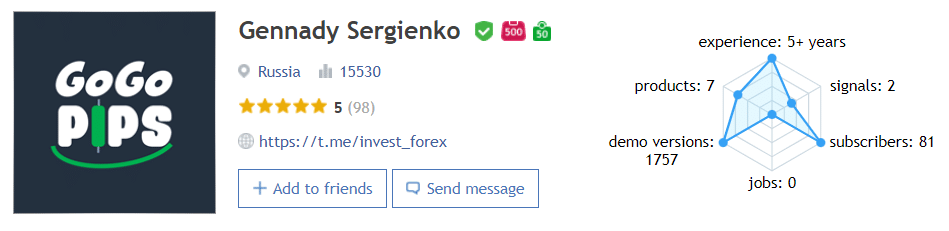

Gennady Sergienko is a robot developer from Russia who has a 15,530 rate. There are seven products in his portfolio: North Star, Alexis Stenvall, Ruxzo, Franc Pacific, Counter Trend Indicator, and Stenwall Mark III.

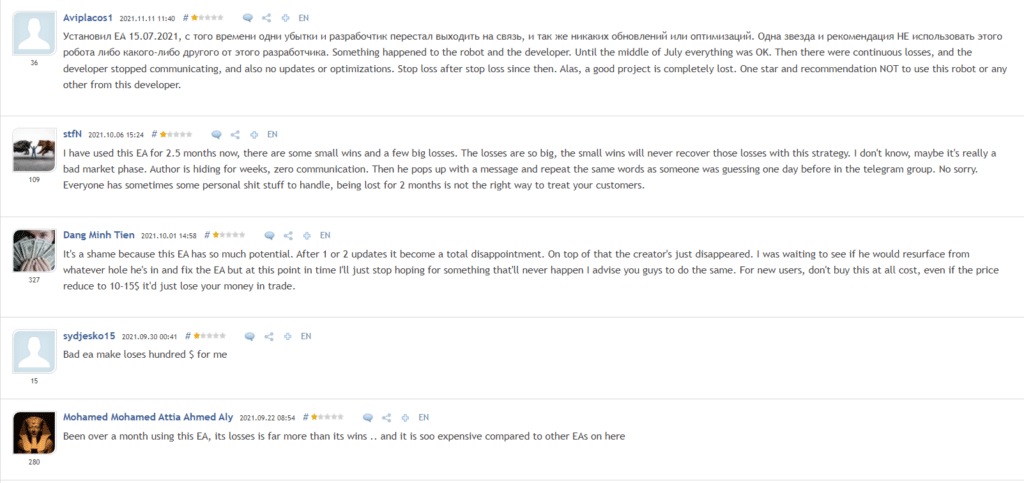

The last comments were only negative. We aren’t surprised at all.

Stenvall Mark III is a system that doesn’t look like a sure bet. The robot is wasting an account. The clients are angry because the dev disappeared.

Leave a Reply