What is swing trading in forex, and is it the best trading style? After scalping and day trading, the third entrant on the list is swing trading, a system that requires a great deal of patience and long-term analysis but gears to offer less chart involvement and higher profits.

Swing trading has been one of the buzzwords in forex for a long time. Although day trading still receives its significant share of coverage, the drawbacks can be overwhelming for some.

For most traders, swing trading is not the first method they expose themselves to but is one they may eventually gravitate towards because of its time-saving capability. Despite this advantage, as with any method, swing trading can be difficult for others.

What is swing trading?

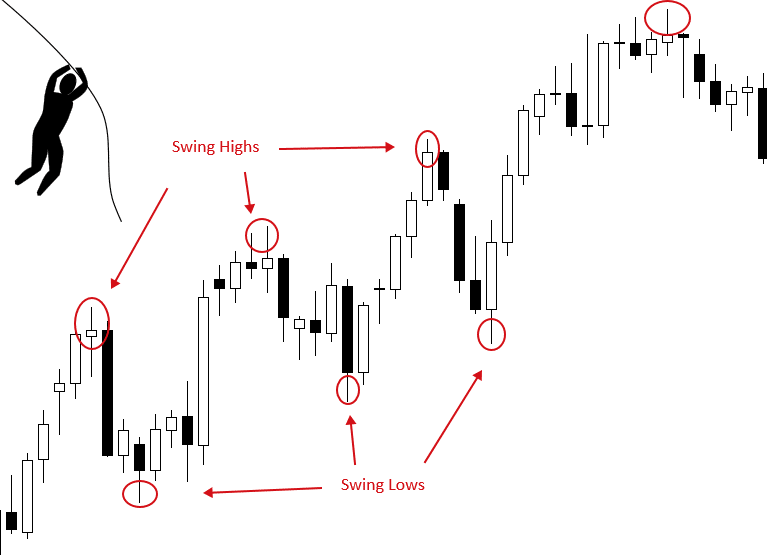

Swing trading is a popular trading approach where speculators seek to profit off considerable ‘swings’ from a market by holding positions for several days up to a few weeks. These traders capitalize on all types of market conditions, from trending, counter-trend, and even sideways on higher time-frames.

Swing trading is the perfect middle ground between day and position trading because it’s not too ‘choppy’ or short-term, but not too long-term either. However, it still does require a great deal of patience to be successful because the trade frequency is rare.

What do you need to be a swing trader?

As with any trading technique, there are some key prerequisites. Whether a trader has just introduced themselves to swing trading after dabbling in other approaches or whether this method is the first they know, the psychological and even physical shift can be equally challenging.

Higher time-frame technical and, in some cases, fundamental and sentiment analysis

The shift into swing trading involves consistent observation of higher time-frames, namely the 4-hour, daily, weekly, and monthly charts.

For those used to anything lower, this transition may be tricky and uncomfortable because these time-frames are slower and offer little ‘action.’ However, this requirement remains the same for swing trading in any financial market.

Capturing swings necessitates analyzing such time-frames as this is where they are more visible. Some would argue fundamental, or sentiment analysis is essential for this trading style because traders only care for the long-term.

Patience

Fundamentals and sentiment are both naturally geared towards forecasting where a market is likely to go next over an extended period through exploiting possible long-term changes or continuations. However, more often than not, you will find yourself tempted to diverge from your strategy driven by fear or greed.

Only being consistent will help you achieve certain positive results – and that will require an unbelievable amount of patience.

Pros and cons of swing trading

For all the benefits of swing trading, some glaring disadvantages deter many traders from considering this trading style.

Pros

- Swing trading is far less time-consuming and stressful: Perhaps one of the greatest benefits is the time factor. Because swing traders rely on ‘slower’ time-frames like the daily, they do not have to spend much time on the charts.

Such a type of person typically does not spend more than an hour (sometimes less) in total every day where they may split this time into two or three sessions. This type of style allows one to do other things when they are not physically involved in the markets.

- Swing traders expose themselves to less risk and trading fees: Although it’s not necessarily the amount of time that makes it risky more than what you are risking per position, by trading far less, swing traders are, for the most part, shielded away from volatile and illiquid market times which often lead to stress and losses.

By taking far fewer positions than the average trader and being away from the market for most occasions, they do not overexpose themselves. Furthermore, high-frequency trading can (not always) rack up fees in spreads and commissions over time, which is not a factor for swing trading.

- Higher risk to reward: A higher risk to reward is possible with swing trading due to the hold time and the target. Typically, these traders target anywhere from 1:8 risk to reward and above, which is almost unheard of with intraday trading.

By achieving a higher target, an account can quickly recover from losing streaks and gain massive profits from one trade.

- Swing traders tend to use wider stops, allowing them to stay in positions longer: By using wider stops, swing traders can stay in trades longer because the wider distance can ‘stomach’ larger price fluctuations.

Cons

- Swing trading requires an incredible amount of patience: Perhaps the patience aspect is the main hindrance, and understandably so since there are no guarantees of the trade outcome no matter the waiting time.

- Exposure to overnight, weekend risk, and the ‘risk of the unknown’: Overnight risk is not necessarily a big deal, even though during the rollover period (the period that starts a new trading day), spreads do often wide erratically for up to an hour before going back to normal.

Non-swing traders sometimes cite weekend risk as a disadvantage due to gaps. However, the forex market rarely produces noticeable gaps. The ‘risk of the unknown’ might be that because of the bigger targets, swing traders have to withstand periods of uncertainty through many fluctuations for days on end.

Big moves can take several days or even weeks to materialize, but the in-between waiting time can be stressful as no one knows with certainty how far a market can go. Swing traders have to be patient when they see an open profit if they have a specific target in mind which price may or may not reach.

- Exposure to negative swaps: This point is not a big drawback because most brokers debit very little when it comes to swaps. However, some pairs (especially exotics) may incur higher than standard swaps, though this may also depend on the trade length.

On the plus side, a positive swap for a swing trader holding a position for weeks would also work in their favor. Thus, this issue can be either good or bad.

- Some swing trading strategies may need to rely on the extra analysis (fundamental or sentiment): Although there are endless debates over the importance of fundamental and sentiment analysis, many trends are primarily driven by these factors. The long-term outlook is the bread-and-butter of any swing trader.

A ‘large swing’ needs one to forecast ahead of time through a deeper analysis of the dominant trend in a market. However, fundamental or sentiment analysis isn’t necessarily compulsory with swing trading, although it can be of incredible benefit.

Conclusion

The information above presents a thorough enough overview of what swing trading truly entails. To conclude, the main takeaways should be that swing trading is only for the patient and experienced chart analyst but does offer incredible time-saving and rare profiting opportunities.

Nonetheless, we should also not forget it is psychologically challenging and leaves a trader open to the ‘risk of the unknown.’

Leave a Reply