Scalping is one of the most popular trading strategies among forex traders. They open their accounts every day and watch all timeframes available, from 1-month to 1-day charts, but they prefer the action of the tick-by-tick movements to try to make money.

Scalpers believe that catching small price movements are easier than large swings. Do you agree?

Today, we are going to talk about Forex scalping and how traders, who are scalpers define their investing life according to this market technique.

Who invented scalping and how it works? Keep reading, and all questions will be answered.

What is Forex scalping

Scalping is a Forex trading strategy that works in very short-term timeframes. It represents the shortest kind of trades.

Scalpers try to make money from small price changes in pairs, even from a pip move. The difference is that scalping trading uses big position sizes instead of small micro-lots to avoid risk.

Traders who do Forex scalping open positions and then quickly close it after the unit gains few pips. They could open hundreds of positions every day, but all should be closed promptly.

Scalpers don’t only pay attention to trends, but also pullbacks and price retracements. They can buy low and sell high, buy high and sell even higher, or sell high to cover the position low.

Any option is possible, but you should close the position with few pips, quickly. It is like a fisherman who catches a fish and doesn’t care about anything else. In scalping, you try to fish as many pieces as you can. The volume of trades is the difference.

Psychology is a crucial thing when scalping. It is a fast-paced trading strategy with traders being under pressure. You should have a clear mind and a specific trading plan. However, they need to be also adaptable as the market is very inconstant.

What a successful Forex scalper does is to master a trading strategy and then implement it with surgical precision.

How scalping works – Strategies

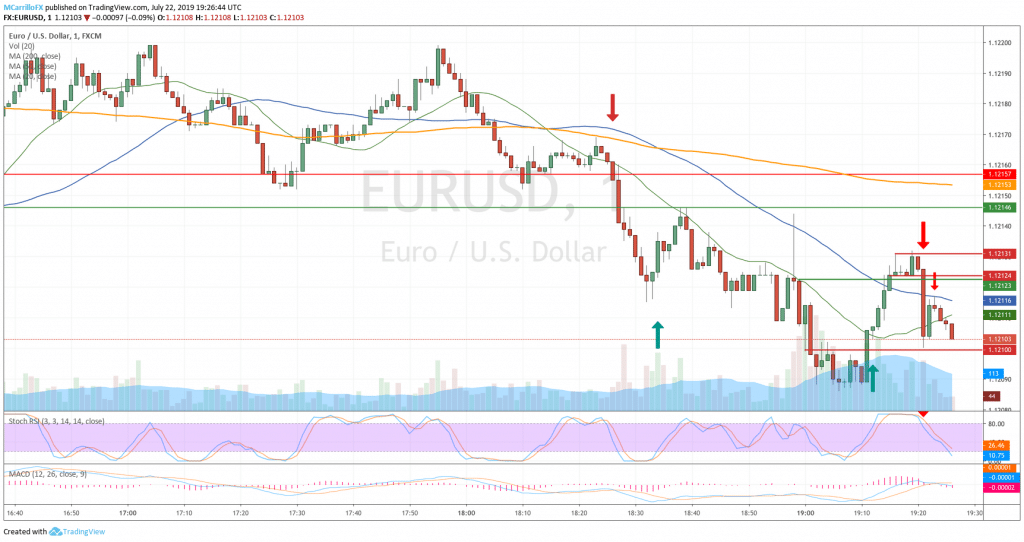

Scalping requires precision timing and execution. It works with smaller time frames such as one-minute and five-minute candlestick charts. The trading analysis behind the strategy is based on momentum indicators such as MACD. RSI, and Stochastics.

Besides, it would help if you took price chart indicators for reference, so you are going to identify possible entry points and profit targets. Scalpers use pivot points, supports and resistances, Bollinger bands, and moving averages as levels to focus.

Let’s say that a scalper trader is trading to make a profit from the EUR/USD in the one-minute chart. The speculator will use leverage to buy and sell the EUR/USD many times to farm small profits each time.

First, the trader identifies the pattern movement of the pair and possible supports and resistance. Then, he waits for a breaking event and enters in the direction of the break. Finally, he closes the position when a significant level is reached.

In a one-minute chart, EUR/USD was moving for five minutes between 1.1212 and 1.1214. Then, the pair broke below the support and when down to 1.1210 when it found support. Making a four pips move. Then, it tried to recovery, but the move was capped at the 50-minute moving average. Finally, the pair fell to 1.1208, for two more pips.

With the right size, it would be a decent profit for scalping trade.

Is scalping trading right for me?

Are you going to be a good scalping trader? The answer is inside you, and only you can solve that question.

If you are a trader who always thinks twice before taking a decision and hope to make big profits for every single trade, probably you will not be a good scalper.

However, if you are an impatient person who doesn’t want the trade to be open for a long time, but needs to close it right away after reaching few pips, you may be the best scalper in the planet.

In any case, no strategy suits everybody, and each trader should look for their own trading style. What it works for me doesn’t need to have to work for you, or vice-versa.

Is scalping trading good for you? To get the answer, go to a paper trading or demo account and test it. Try yourself and learn about the best scalping strategies, from 1-minute to even 1-hour timeframes.

It is all about you.

Leave a Reply