Source: Office for National Statistics The UK economy rebounded in the second quarter, driven mainly by the growth in services and hospitality as quarantine restrictions were eased during the period. The gross domestic product expanded by 4.8% in the second quarter. This compares with -1.6% in the first quarter, and -19.5% in the same quarter last year.The latest reading … [Read more...] about UK Economy Rebounds 4.8% as Indoor Hospitality, Non-Essential Retail Reopen

Forex News

Lumber Futures Drops to 4.4%, The Lowest Level Since October 2020

Source: Bloomberg Lumber futures dropped to the lowest level in over nine months after sawmills increased production and demand from builders stabilized. LBS down -2.42%, DXY down -0.14% September futures in Chicago dropped 4.4% to $482.90 per thousand board feet, the lowest for a most active futures contract.The decline signals a drop of over 70% from the record … [Read more...] about Lumber Futures Drops to 4.4%, The Lowest Level Since October 2020

American Hourly Earnings Down for Seventh Straight Month

Source: Bureau of Labor Statistics Average hourly earnings for American employees fell in July, marking the seventh straight month of declines. Real average hourly earnings for all employees decreased by 0.1% from June to July.The reading compares with the 0.5% decline in June and the 0.4% drop in July 2020. Earnings have declined in all the months of 2021 so far.Hourly … [Read more...] about American Hourly Earnings Down for Seventh Straight Month

US Inflation Still Highest in Over a Decade

Source: Bureau of Labor Statistics US inflation stood steady at a 13-year high in July, as supply issues and heightened demand impacted prices of goods during the period. Annual inflation remained at 5.4% in July, unchanged from June. This is the highest since 2008.Core inflation, which excludes food and energy, rose stood at 4.3%. The food index climbed 3.4%, higher … [Read more...] about US Inflation Still Highest in Over a Decade

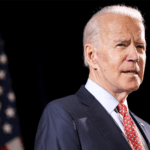

Biden’s Economic Agenda Gains Ground as Senate Democrats Support $3.5T Blueprint

Source: Bloomberg Senate Democrats have passed a $3.5-trillion budget blueprint that would pave the way for the economic agenda pushed by President Joe Biden. The measure recorded a 50-49 vote, with Democrats controlling the Senate.The proposal includes provisions for universal pre-K for children aged three and four, paid family leave, and two years of tuition-free … [Read more...] about Biden’s Economic Agenda Gains Ground as Senate Democrats Support $3.5T Blueprint