In Forex trading, a simple trading strategy can be created by using just some moving averages or MA’s along with some associated indicators. Moving Averages are generally used to identify support and resistance levels, as well as being used as a trend indicator. In this article, we will discuss how to formulate Forex trading strategies by using two of the most common Moving Averages; the Simple Moving Average (SMA) and the Exponential Moving Average( EMA).

1. Moving Average Trading Strategy

Traders need to follow the following steps to use the EMA in this trading strategy.

- First, on a 15-minute chart, traders should begin by plotting three EMAs, namely the 5 period EMA, the 20 period EMA and the 50 Period EMA.

- Traders should buy when the 5 period EMA crosses above the 20 period EMA resulting in the price, the 5 period EMA and 20 period EMA being above the 50 EMA.

- Traders should sell when the 5 period EMA crosses below the 20 period EMA, resulting in both the EMAs as well as the price being below the 50 EMA.

- Traders should place their initial stop-loss order about 10 pips from the entry price or below the 20 EMA for a buy trade.

- Traders also have the option to break even by moving the stop-loss when the trade become 10 pips more profitable.

- Traders should consider placing a profit target of 20 pips.

Traders often use a short term moving average crossover of a long term MA, as the basis of their trading strategy.

2. Moving Average Ribbon Trading Strategy

Traders can use the Moving Average Ribbon to create a trading strategy that can be utilized with a trend change in either up or down direction. It is based on the slow transition of the trend change.

The Moving Average Ribbon is formed when a series of 8 to 15 EMAs are plotted on the same chart, These EMAs can vary from very short term to long term averages. This results in a ribbon of averages which provide traders with an indication of both the strength of the trend, as well as the trend direction. A strong trend is indicated by the ribbon widening out, as the separation between the ribbons increase.

Traders can apply a strategy that would provide low-risk trade entries with high-profit potential. The aim here is to catch a decisive market breakout in any direction. This usually occurs when the market has been traded in a narrow and tight range for a considerable period of time.

Traders should follow the following steps to apply this strategy.

- Traders should look out for the convergence of all the moving averages together, as the price flattens out into a sideways range. On the chart, this is usually indicated by one thick line, formed by the various moving averages converging closely with each other.

- Traders can proceed to bracket the narrow trading range with a buy order. This should be placed above the high of the range. Additionally, a sell order should be placed below the low of the trading range.

- Traders should place a stop above the high of the range, in case a sell order is triggered.

3. Moving Average Envelopes Trading Strategy

Moving average envelopes are a class of percentage-based envelopes which are set either below or above the moving average. Forex traders can use simple, weighted, or exponential moving averages in these envelopes.

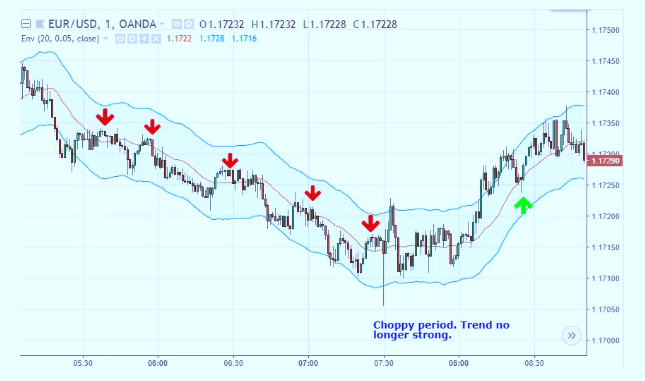

It’s very common to have envelopes formed over a 10 to 100-day period. They use “bands” that have a distance of 1 to 10% from the moving average for daily charts. During day trading, envelopes tend to be much less than 1%. We take the example of a one-minute chart for the EUR/USD pair.

Here, the envelopes are 0.05% and the Moving Average is 20. Traders may need to change certain settings like the percentage on a daily basis, depending on the level of volatility. They should use settings that align with this strategy, relative to the price action of the day.

Traders should only trade in the presence of a strong overall directional bias to the price. They should consider buying if the price is in an uptrend and approaches the middle-band MA and starts to rally off it. Consequently, they should consider shorting when in a strong downtrend.

Traders should place a stop-loss once a short trade is taken. It should be placed above the recently formed price swing. By that logic, they should place a stop-loss one pip below the recently formed swing low, once a long trade is taken. They should exit when the price reaches the upper band on a long trade and the lower band on a short trade. They can set a target that is two times the risk.

4. Moving Average Convergence Divergence Trading Strategy

The MACD contains a histogram that calculates the difference between the 26 period EMA and the 12 period EMA. On the chart, a nine period EMA is plotted on the histogram as an overlay. The MACD can be used as a tool to indicate both market direction and trend, in addition to being used as a momentum indicator.

There are several forex trading strategies that could be formulated using the MACD indicator.

Below we explain one such strategy and the steps traders should follow.

- Traders should trade the MACD and signal lines crossovers. In a downtrend, when the MACD is below the zero line, traders should short sell when the MACD crosses below the signal line. They should buy when the MACD is above the zero lines, crossing the signal line from below.

- When in a long trade, traders should exit when the MACD falls back below the signal line. They should exit when the MACD rallies back above the signal line when in a short trade.

- Traders should place a stop-loss just below the most recent swing low if trading long. Consequently, they should place a stop-loss just above the most recent swing high, when trading short.

The above four are just some of the strategies that use the Moving Average strategies are proven to be profitable.

Leave a Reply