In Forex Trading, technical indicators are the main tool used by traders to forecast price changes in the foreign currency market. Traders usually can make important decisions using indicators, when it comes to market entry and exit. One such indicator is the Moving Average Convergence Divergence, a popularly used indicator by traders.

Moving Average Convergence Divergence is considered as a trend-following momentum indicator. It shows the relationship between two moving averages of a security’s price. It is one of the most popularly used indicators in forex trading. It was invented by Gerald Appel in 1979 and is appreciated by traders worldwide, for its flexibility and simplicity.

Table of Contents

Inside the MACD Indicator

The main function of the Moving Average Convergence Divergence indicator is discovering new trends and helping to identify the end of current trends. The signals generated by the MACD indicator can be gauged differently by traders, who often use their own unique settings and methods.

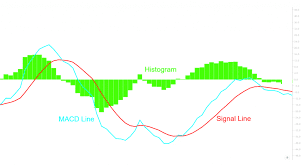

In a chart, the MACD is placed at the bottom, usually in a separate window beneath the price chart. It consists of three components, mainly a histogram and two lines.

These are explained in brief below.

- Moving Average Convergence Divergence Line: The MACD line is considered the faster line on the indicator and is more sensitive. It moves above and below the second line of the indicator, the MACD Signal line.

- Moving Average Convergence Divergence Signal Line: The second line of the indicator is the MACD Signal line. It is named so because of its ability to generate signals. This line is slower and gets breached frequently by the faster MACD line.

- Moving Average Convergence Divergence Histogram: The difference between the MACD line and the signal line is represented by the MACD Histogram. Here, the bars that the MACD histogram displays become higher with the increase in distance between the two above lines.

Moving Average Convergence Divergence Settings

The MACD indicator usually comes with default parameters, 9,12,26, on most trading platforms. It is important to understand the significance of these numbers.

The 12 and 26 are two numbers that concern the calculation of the faster MACD line and are mutually related. The MACD line is calculated as follows:

12 Period Exponential Moving Average on the price Action – 26 Period Exponential Moving Average = The faster MACD line.

The third figure, “9” comes from calculating the slower MACD signal line. The MACD signal line is generated by plotting a 9-period Exponential Moving Average on the faster MACD line. It is thus considered as the smoother version of the faster MACD line.

Moving Convergence Divergence Signals

The MACD indicator can provide a number of signals which traders can use. Some important signals of the MACD are explained in brief below.

- Bullish MACD Divergence: When the price action is moving downwards, with the MACD showing higher bottoms, a bullish MACD divergence occurs. The MACD indicator gives the trader a strong bullish signal. The price can often begin a strong upward move after the bullish divergence with the MACD.

- Bearish MACD Divergence: When the price action increases and MACD lines create lower tops, the bearish MACD divergence occurs. This hints that the price has a possibility of starting a rapid bearish move after the MACD divergence.

- Bullish MACD Crossover: When the MACD line crosses the slower MACD signal line, a bullish crossover is formed. It generates a bullish signal on the chart, indicating that the price has a strong possibility of increasing.

- Bearish MACD Crossover: Consequently, when the MACD line crosses the signal line in a bearish direction, a bearish crossover is formed. It hints that the price action has a possibility of entering a bearish move.

- Oversold MACD: An oversold MACD signal is formed when the MACD line gains a relatively significant bearish distance from the MACD signal line. The price is expected to stop decreasing and initiate a new bullish move.

- Overbought MACD: An overbought MACD signal occurs when the MACD line gains a relatively big distance from the MACD signal line. It indicates that the bullish move of the price will stop and a new bearish move will appear.

Based on the six technical indicators presented above, the trade entry rules of the MACD indicator can be classified into two types, bearish and bullish.

- Bearish MACD signals include Bearish MACD Crossover, Bearish MACD Divergence and Overbought MACD. Traders should consider opening short trades after each of the above signals.

- Bullish MACD signals include Bullish MACD Crossover, Oversold MACD, and Bullish MACD Divergence. Traders should consider opening short trades after these signals occur.

When conducting a MACD analysis, it is important for a trader to consider protecting their position with a stop-loss order. When opening a long trade, a stop loss can be placed below a previous bottom on the same chart. Likewise, while trading shorts the stop order can be placed above a previous top. The trader’s position will be closed automatically if the price action creates a higher high on a short trade or a lower low on a long trade.

Limitations of the MACD

Like almost all indicators, MACD does have some limitations. It can often signal a reversal when no actual reversal takes place, producing a “false positive”. False-positive divergence occurs with the sideways movement of the price of an asset, such as in a triangle or range pattern, following a trend. The MACD will pull away from its prior extremes if there is a slowdown in the momentum of the price movement, gravitating towards the zero lines, even when there is no true reversal occurring.

Conclusion

The utter complexity of the forex market makes it hard to find an optimum indicator to foresee the potential development of market trends. The MACD indicator comes the closest to revealing how the market may behave in the future. Since it represents the moving average of other moving averages, there is the possibility of lag in these indicators. In spite of its limitations, however, it still remains one of the most favoured tools for forex traders.

Leave a Reply