Lux Algo is an advanced system that assists you in formulating your own strategies, getting trading signals, and identifying opportune trading moments. The tools provided by Lux Algo work alongside TradingView, a website for traders where you can find advanced trading ideas and live quotes. This system promises to extract the best signals regardless of the market noise, allowing you to enhance your profits.

The presentation on the company website is quite different from other services and it certainly makes us interested to find out how this system actually performs. But, in order to do that, we must look at each and every aspect carefully.

Detailed Forex Trading System Review

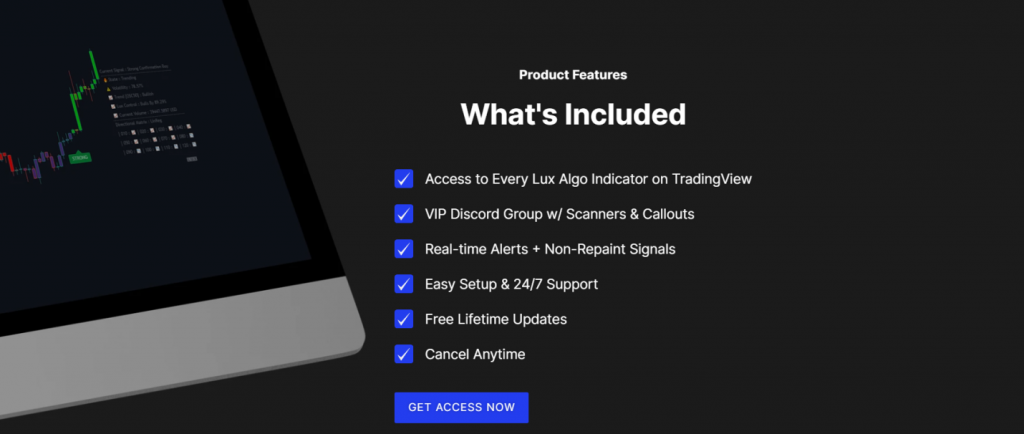

Lux Algo promises users access to all indicators on TradingView and maintains a VIP discord group where callouts and scanners are present. It provides real-time alerts and 24*7 support for its customers. The system is easy to set up and provides lifetime updates.

While many other Forex trading systems are lacking in vendor transparency, the same cannot be said for Lux Algo, which has provided ample information about the four main people heading the project. It was co-founded by Sean Mack and Alexander Friend, who are based in Boston, MA and London, England, respectively. The Lead Developer is Alex Pierrefeu, a known personality among the TradingView community who is known for creating innovative technical indicators.

Finally, the account manager is Matthew O’Hagan, who is an active trader with a medicinal background. While all of these people are young folks who don’t have too much experience in the Forex market, we appreciate them being transparent and it tells us this is a company that could make it big in the future.

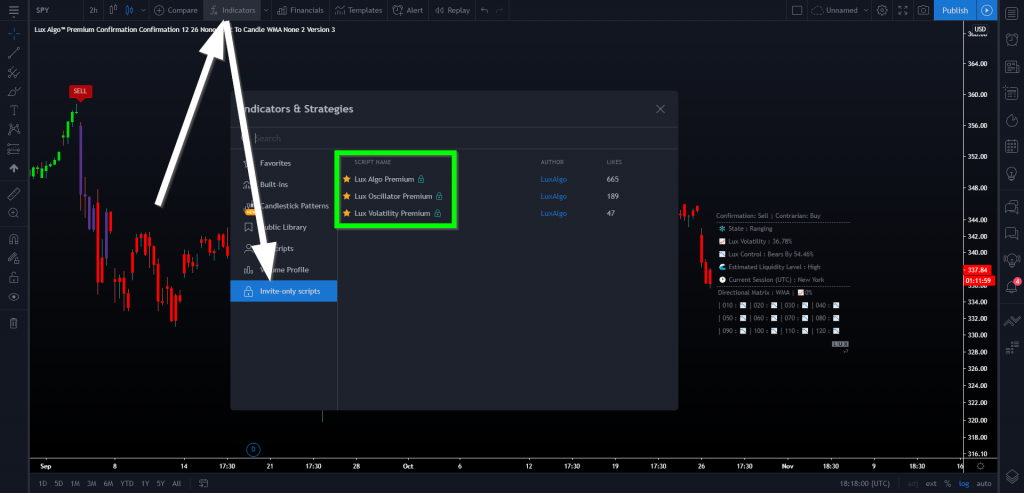

After signing up with this software, users have to add Lux Algo to their chart on TradingView.

Then, all the features can be accessed from the settings option and users can begin trading on any timeframe. The input settings are adjustable, so you can modify the sensitivity to change the volume of incoming signals and the agility factor in order to avoid ranging markets.

Lux Algo Strategy Tests

Although the website homepage doesn’t have any information related to the trading strategy, the resources page outlines the various strategies and indicators used by this platform. Through this system, users get confirmation and contrarian signals. Moreover, indicator overlay modes, support and resistance methods, volatility indicators, and oscillators are also used.

For someone who’s new to the Forex market, all these pieces of information might be hard to grasp. Fortunately, this service has a discord server when customers can learn how to generate trading signals using the indicators. Unfortunately, no backtesting results for this system are available as of now.

Real Account Trading Results

No verified trading results are available for this system currently, at least none on the official website. We can assume that they share more details on the discord server, but verified trading results from third-party websites, like Myfxbook and FXBlue, is something that all traders look for. It helps them judge the efficacy of the system, and as it stands, there is no way for us to know how Lux Algo performs in the live trading market.

Considering the fact that there are four team members, Lux Algo should provide some trading results. This will give Forex traders more confidence as it would allow them to analyze the system’s performance thoroughly.

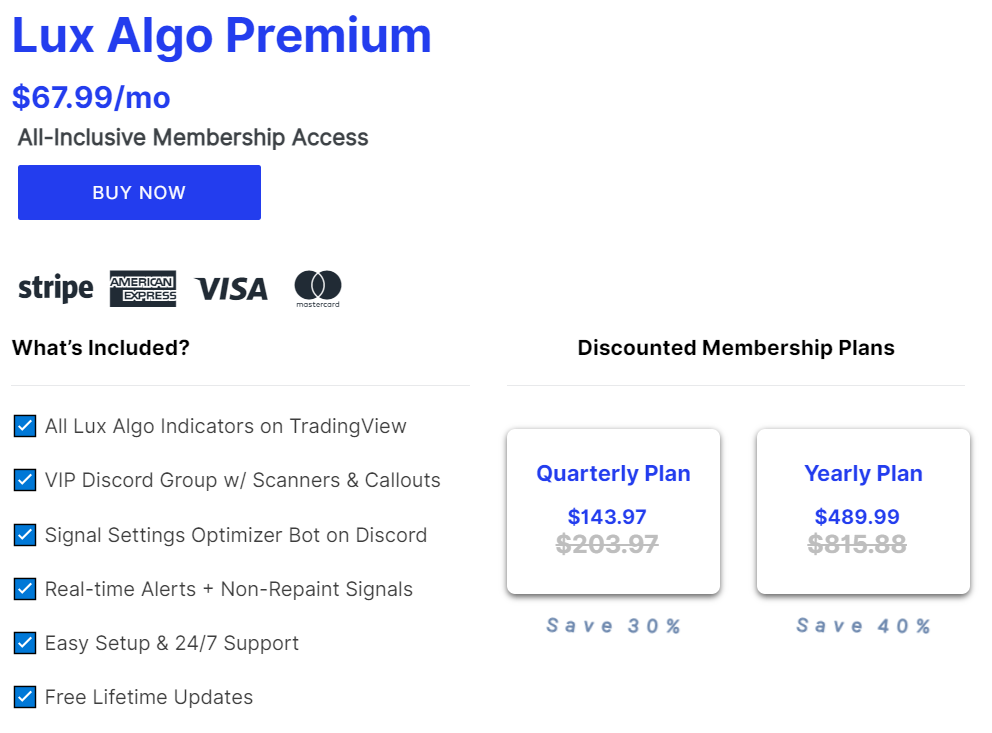

Pricing

Lux Algo offers three pricing plans for its members. The monthly, quarterly, and yearly plans cost $67.99, $143.97, and $489.99, respectively. Apparently, the last two plans let you save 30% and 40% respectively. All of them provide the indicators on TradingView, the VIP Discord Group access, signal settings optimizer bot, and more.

Compared to other Forex robots on the market, the pricing seems quite standard. In fact, there are unverified and illegitimate bots out there that ask for more.

Customer Reviews

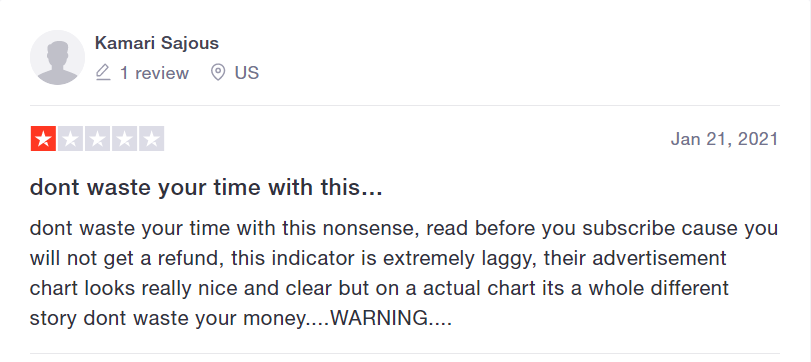

We managed to find some user reviews on the Trustpilot website and as you can see, customers have mixed feelings about this software. While some of them praise the quality of the signals, others say that the indicators are laggy. This tells us that while Lux Algo performs well in certain areas, it falls short in others.

In conclusion, we have to say that while this system doesn't seem like a total scam, there are certain areas where it could use some improvement.

It certainly provides us enough information about the vendors and outlines the strategies that are used, but some verified trading results would be most welcome.

Thus, we have neutral feelings about Lux Algo and believe that we need to keep an eye on it to see what it comes up with in the near future.

Leave a Reply