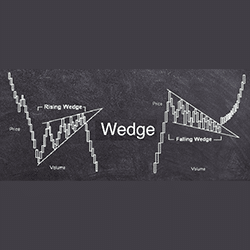

As a tool used in technical analysis, wedge helps to predict the change in the market tendency. Although similar in appearance to the ‘Triangle’ formation, the difference between the two is in the direction of the lines.

The wedge is a reversal formation due to the similar direction of the lines. Even if theoretically as per the typical reversal formations, a wedge should occur when a trend ends, it can occur mid-trend or as trend continuation formation too.

Interpretation

The wedge is in effect a merging zone that is bordered by two inclined lines, indicating support and resistance that meet sooner or later. The surge and decline in prices happen in one direction. But, the difference lies in the pace of the two excesses.

Three main properties characterize a wedge. They include the convergence or meeting of the trend lines, reduction in volume as the price moves via the pattern, and a breakout that occurs from either of the lines.

Wedge has two main categories, namely the rising and the falling wedge. Both are reversal formations dependent on trend changes and are capable of forming a trend continuation.

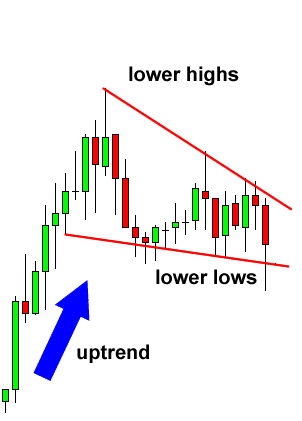

Rising Wedge

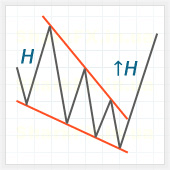

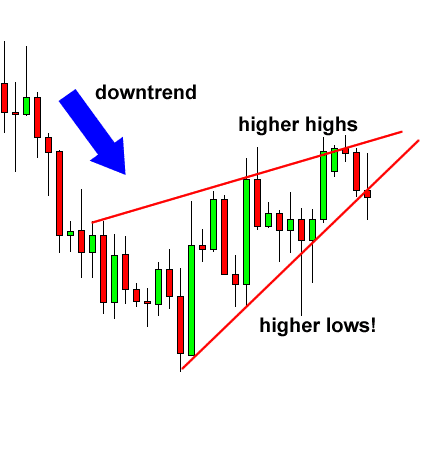

Falling Wedge

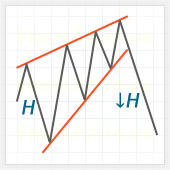

Rising wedge forms a zone of price action bordered by the resistance/upper and the support/lower lines. In the picture below is one such formation with the price surge and decline shown in blue and red lines.

Due to the rapid decline and slower surge, you get a steeper support line. When you find such a formation during an upward change in the market action, it can predict a reversal of rates. In general, the rising wedges indicate a bearish trend, while the falling wedges remain bullish in their downward and upward trend.

How Wedges Form

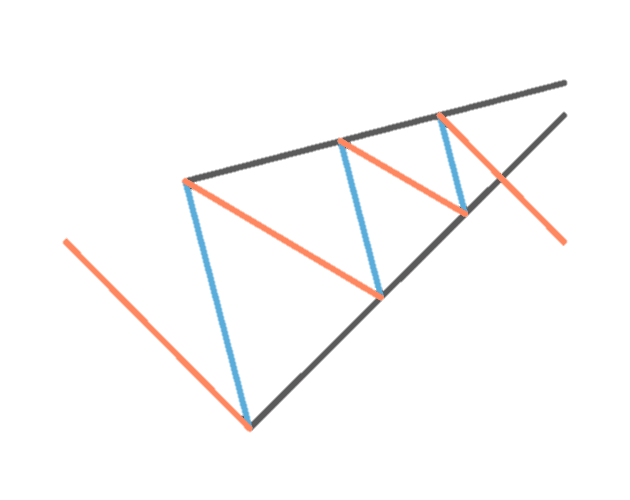

Formation of wedges takes a long time over many months and the trend movement can be contained inside the lines or form after there is a correction. For the resistance or upper line to form, the presence of two to three price surges is needed. For the lower/support line, three price declines have to form. For the rising wedge inside a downtrend, the lower line needs a minimum of two lows. And, in the two lines, each of the surges or lows needs to be more than the former one.

To establish the reversal of prices, the disruption in price via the support, along with a surge in the volume and a closed candle below, are required. For the guaranteed establishment of the reversal, the break should be under the current low.

Trading a Wedge

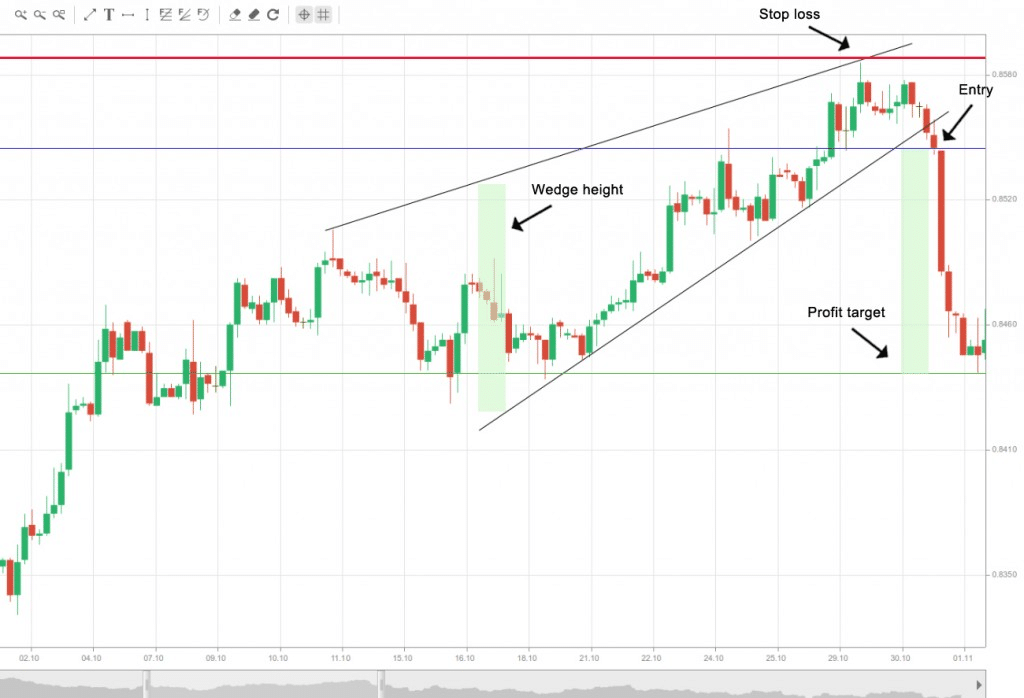

Two trading ways are possible with a wedge. One is to go short or long immediately following the establishment of a breakout. When a wedge forms, you should assume a reversal will occur.

To capitalize on this, you have to go short immediately after a price breakout via the lower/support line. It is important to confirm the condition as it minimizes the risk of trading with a breakout that is false.

The stop loss needs multiple pips over the maximum surge in the wedge formation. The profit point should be equivalent to the wedge height on the lower level. By assessing the pip distance, you can deduct it from the short position.

The other way is to delay for the retest of price after it shifts from support to resistance to the opposite and then retains a position. This is applied in a throwback or pullback scenario.

Final Thoughts

The wedge is frequently connected to a preceding reversal in the price movement. But, it can also form independent of the change as in the trend continuation formation. In this condition, it has a separate direction against which the reversal occurs.

Leave a Reply