A bull trap is a pseudo breakout scenario. What happens here is that a buyer goes into a trade with the belief of an upside. Sometimes such stocks do not give an upward trajectory and hit the support levels of the trader’s stop loss. What exactly makes the bull trap important? Let’s find out!

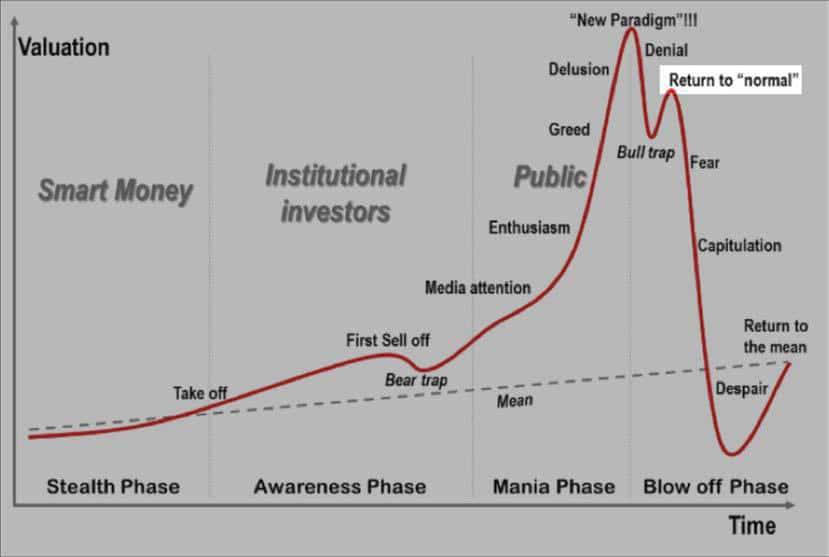

In a bull trap, long-term traders get forced to leave their positions as a result of rising incurred losses.It happens because of a reversal against a hitherto bullish trend. They are traps because they often come to traders without notice.

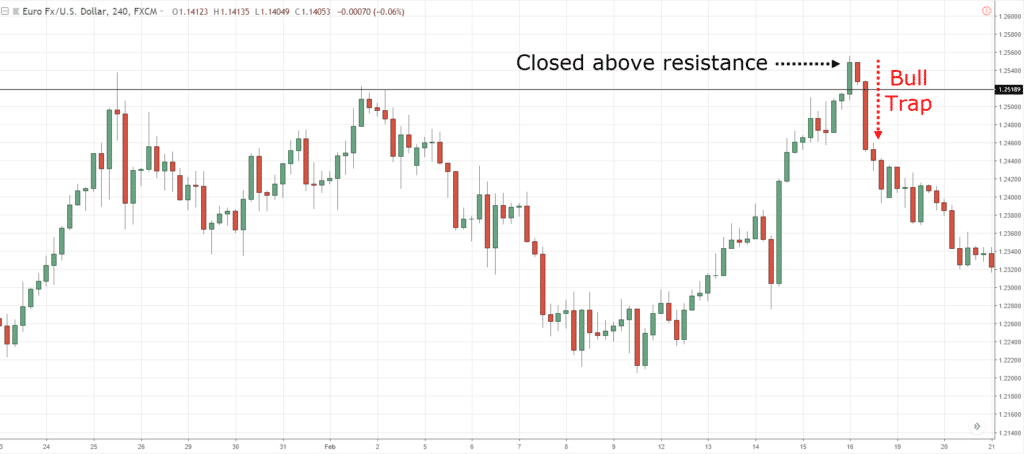

A bull trap features investors or traders purchasing an asset when it exceeds hitherto high resistance levels. Usually, breakouts beyond resistance levels often transition to greater peaks. Bull traps feature a sudden reverse after the breakout happens.

Pointing out a bull trap

Identifying a bull trap is difficult. It is because when a breakout occurs, an asset most likely increases in value and not the other way. You may carry out fundamental and technical analysis of the stock or currency you seek to trade.

Find out if the asset has been overbought. Doing this may serve as a pointer to the possibility of a bearish reversal. You may also delay diving in for a bit to see if the trend gets sustained. There are a few key indicators for a bull trap. It often occurs during earning announcements, bear markets, and in news events when upward trajectories don’t last on the chart.

Avoiding a bull trap

The ideal strategy for avoiding the suckers’ rally is to create a stop-loss on your position. Doing this will ensure that you do not suffer huge losses even if you get caught in a bull trap. Traders have the option of some stop-losses, which include trailing, standard, and guaranteed.

A trailing stop is quite helpful when seeking to evade the suckers’ rally. This is because it trails behind the prevailing price using a set number of points. The trailing stop then closes your current position in a situation where the market value falls by that amount.

The main benefit of this is that it will help you get enough profit while avoiding unnecessary losses caused by the bull trap. Moreover, you must watch the signals for a bull trap in order to avoid it. A smart trader would be on the lookout for more signals to stand a better chance to avoid a bull trap.

Trading bull traps

The easiest way to trade bull traps is to open a short position when you see that there is a bear trap. You can deploy strategies such as spread bets. Using these financial derivatives will help you get leverage on an asset even without you owning it, thus making it ideal to short.

Final Word

A bull trap occurs when there appears to be an upward trajectory when a given asset exceeds certain resistance levels. Breakout resistances usually point out to the fact that the prevailing trend will proceed, which is not the case with the trap. Expert traders may lose out if the prices of the commodity or currency fall after it opened a positive outlook. Often, this is because of a breakout that exceeds the resistance, which may have confused the trader.

Leave a Reply