- USD dollar steadies ahead of the FED report.

- GBPUSD bounces back stalls.

- EURUSD is under pressure below 1.1300.

The US dollar steadied near two and a half week highs against the majors, Wednesday morning, as traders turned their attention to a pivotal policy report from the Federal Reserve later in the day. The dollar index is closing in on the 96.00 handle after pulling back on powering to highs of 96.25.

The pullback came as yields remained under pressure even on heightened expectations that the FED would tighten monetary policy and a hint of accelerated rate hikes. However, traders continue to shrug off the yield struggles, with the focus being on the potential armed conflict between Russia and Ukraine.

Conversely, the US dollar continues to attract bids as a safe haven as traders scamper for safety away from riskier bets.

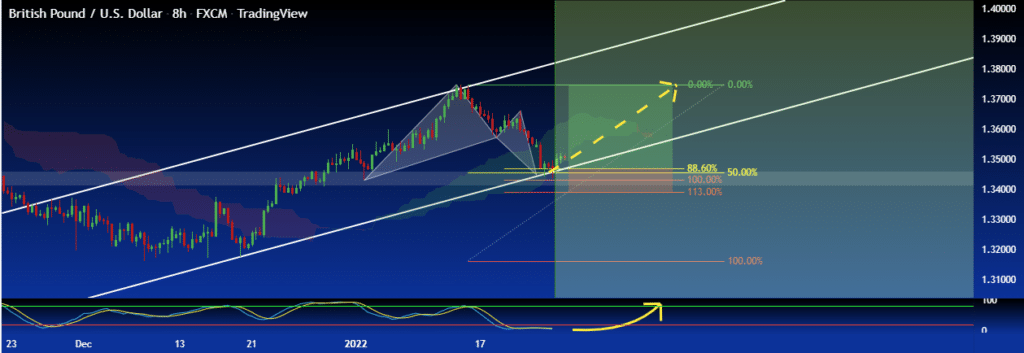

GBPUSD technical analysis

With the dollar struggling for direction ahead of the FED report, GBPUSD continues to attract bids going by the bounce back from three-week lows of 1.3434. However, the pair risks extra losses owing to traders shrugging riskier bets in favor of safe-havens in response to the Russia and Ukraine standoff.

Conversely, GBPUSD has struggled to power through the 1.3520 level, which has emerged as a short-term resistance level. A pullback followed by a close below 1.3500 could pave the way for short sellers to come back into the fold and steer a drop back to the 1.3434 area, which happens to be the next substantial support level.

The pair needs to find support above the 1.3500 to avert the risk of extra losses following the recent bounce back.

GBPUSD price action drivers

While the focus is on the FED report, downbeat concerns over Brexit and turmoil in the UK political scene continue to weigh heavily on the GBP sentiments against the dollar. Prime Minister Boris Johnson is under immense pressure to step down as police continue to investigate claims of lockdown parties at number 10.

Meanwhile, the downside action on the GBPUSD could be limited amid chatter that the Bank of England could move to hike interest rates at its next meeting next week. An increase will mark the second time that the BOE has hiked in less than two months as it moves to reverse more of the COVID-19 stimulus. Aggressive monetary tightening is in response to UK’s inflation rising to the highest level in nearly 30 years.

Another positive on the GBP against the dollar is a reduction in COVID-19 linked entry barriers with other countries. Britain is also believed to be in line for good post-Brexit trade deals with the US and India.

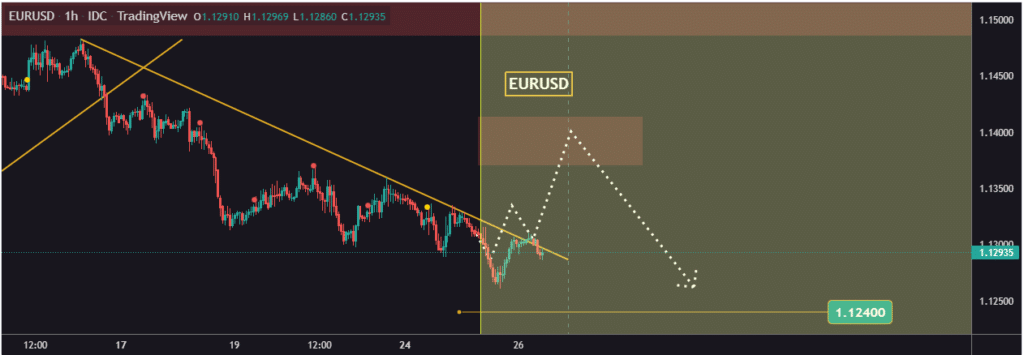

EURUSD under pressure

Meanwhile, the EURUSD remains under immense pressure after a recent drop to five-week lows below the 1.1300 level. A bounce-back above the psychological level has stalled, with the pair on the brink of extra losses as the greenback holds steady.

Below 1.1300, EURUSD looks set to make a run for the 1.1264 area, the next substantial support level. A sell-off followed by a close below the level could open the door for a drop to lows of 1.1219. The pair needs to bounce back and find support above the 1.1300 mark for the recent bounce back to hold.

The pair’s downside action has mostly been fuelled by the pre-FED fears at a time when the European Central Bank has failed to hint at aggressive monetary easing. ECB Chief Economist Philip Lanes reiterating that omicron-linked inflation will not influence activity levels that have only gone to fuel EUR weakness. So far, the downside action has been limited by solid economic data out of Germany and Eurozone IFO numbers that have offered support for the Euro.

Leave a Reply