The Forex industry is a lucrative one provided you know how to capitalize on the market conditions. While many people consider that this is possible only for skilled traders, it is not true. With the help of automated trading software, you will be able to trade accurately and with appreciable returns. FXCONSTANT is a product that features in the long list of Forex robots that claim to bestow huge returns with minimal risk. The FX EA assures real stats, rapid trading, and full protection of your capital.

Detailed Forex Robot Review

At the outset, the website of FXCONSTANT is designed with only the bare minimum information available on the robot and its functionality. We could not find details on the developer of the FX trading instrument or the team behind it.

There is mention of the EA being powered by the FX Store. While FX Store promotes several such FX EAs and other trading tools. But there is no vendor information on the FX Store site too. The absence of vendor transparency makes this ATS look suspicious.

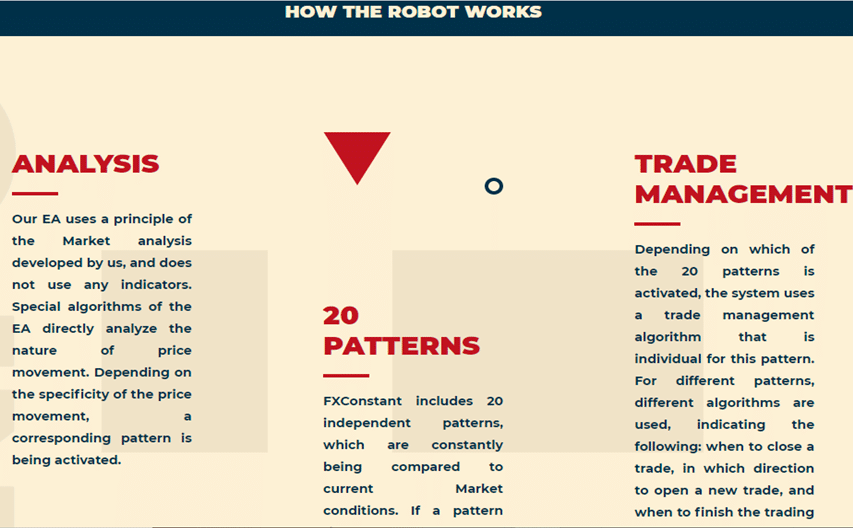

From the info given on the official site, the features include the use of market analysis principles and special algorithms, multiple patterns, and customized trade management.

Regarding the working principle, the vendor mentions that this FX robot uses different patterns that look for specific market behavior. On spotting the matching situation it gets activated and trades are executed.

While explaining the management of the trades, the vendor claims that this MT4 tool uses separate algorithms for each pattern with instructions on the exits and entries.

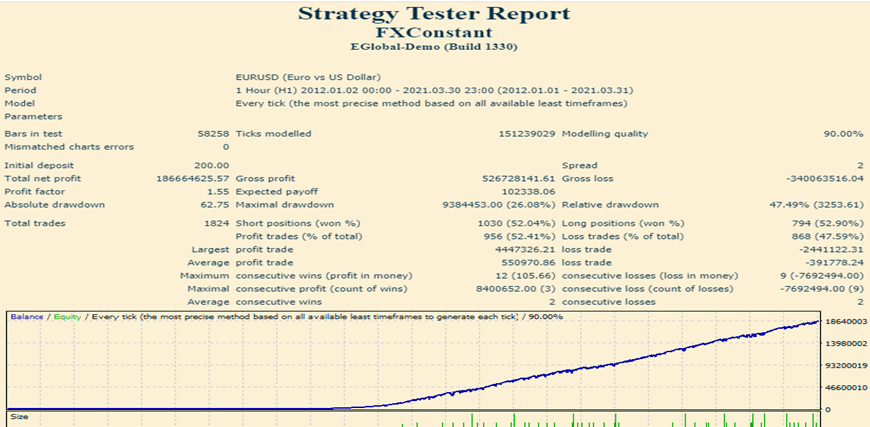

FXCONSTANT Strategy Tests

Backtesting results are available for this FX EA with the testing done since 2012. One of the test reports is seen in the screenshot here:

Modeling quality of 90% is used for the tests, which is not sufficient for identifying crucial aspects of the strategy like the spread, slippage, etc. We consider a modeling quality of 99.9% offers a better insight into the trading approach.

From the testing done on the EURUSD pair using the H1 timeframe, the ATS has amassed a profit of 186664625.57 for an initial deposit of $200. The profit factor is 1.55 and the maximum drawdown is 26.08%. While the profits are appreciable, we are concerned about the drawdown value.

Real Live Account Trading Results

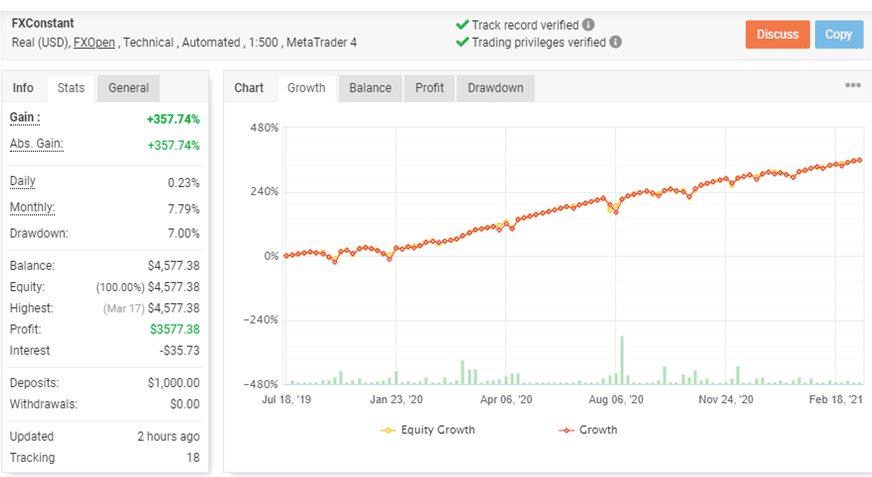

A real USD account using the leverage of 1:500 on the MT4 platform verified on the myfxbook site is provided by the vendor. On a closer look, it is not a live account with the account closing on March 16, 2021.

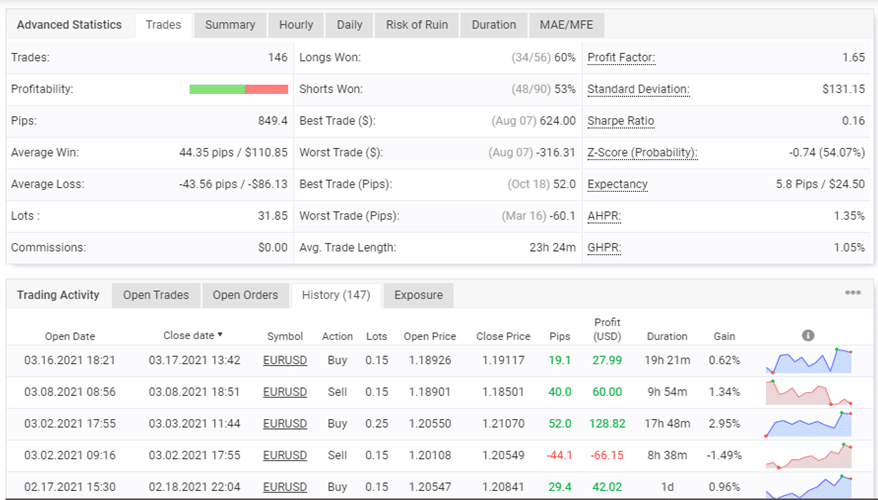

From the trading stats, the absolute and the total gain values are similar at 357.74%. A low drawdown value of 7% is seen with a daily profit of 0.23% and a monthly profit of 7.79%. The average win was seen at 44.35 pips and the average loss at 43.56 pips. From July 2019 up to March 2021, there have been 146 trades done. The lot sizes vary from 0.15 up to 0.42 and more. The profit factor value is 1.65.

Pricing

This FX EA is available for $295 now. The cost includes a single license regardless of the type of account you choose and unlimited chances of changing accounts. This trading software is compatible with the MT4 and MT5 platforms.

For instructions on setting up the software, the vendor provides a detailed guide along with 24/7 support. A refund option is provided wherein you have 30 days to get your money back if you are not satisfied with the FX robot.

Customer Reviews

There are no user reviews for this FX robot on trusted third-party sites such as Forexpeacearmy, Trustpilot, etc. We prefer these sites as they provide an unbiased insight into the FX instrument. Reviews reveal important details such as how the system is performing and whether the strategy used is working or not. We can also find about the customer support provided and whether the vendor provides the refund in case of dissatisfied customers. Without the reviews, we are unable to gain sufficient details on this ATS.

FX CONSTANT appears to be an FX EA with reasonable performance potential at the outset. But a closer look at the system reveals several shortcomings.

The trading account, although verified by the trusted myfxbook site, has stopped trading in March. We find the closure, despite the profit and drawdown being at acceptable levels, puzzling. Furthermore, when you consider the backtesting, the drawdown is high at 26%, but the real account results show a low drawdown value of 7%.

The absence of vendor transparency is another factor that does not favor this FX robot. While the refund option is appealing, the expensive price and lack of user reviews override it.

Leave a Reply