Correlation explained

A Correlation refers to a statistical relationship, which shows the independence of two variables. During the years 2007 to 2008, traders started to realize the importance of correlations between forex and other asset classes. They realized that it was important to watch other markets as well. Presently, traders use correlations extensively to forecast and explain price movements.

Successful traders often use a trading methodology known as lead/lag, Intermarket, Crossmarket or Crossasset analysis. Here, traders use correlation to take a look at the current price movement in one asset and guess what another asset’s price would perform in the future. They use the correlation between the two assets along with a historical or theoretical relationship to perform this.

Found One? 4 Questions To Ask Yourself:

You may encounter correlations in financial markets. But before jumping into conclusions, you need to ask yourself four important questions.

- Is there any econometric or logical sense in the correlation?

This is one of the most important questions to ask even if the r2= 99.9%. There has to be some underlying logic behind the correlation. For correlations without any logic, you can either search for a reasonable explanation to justify it or discard it.

You can encounter something known as a spurious correlation. It refers to correlations where people infer a direct cause-effect relationship between two random variables. Between the variables, there isn’t any logical or actual connection.

- How likely is the correlation to continue into the future?

Correlations can be unstable and you have to make a logical assessment of whether they will continue into the future or not. This usually comes as traders develop experience. Some correlations such as interest rates vs currencies are reliable and have existed pretty much since financial markets began. On the other hand, correlations such as that between CAD and natural gas are mostly useless and might work a couple of times out of luck.

- In this particular sample, are there periods of both rising and falling prices?

If a correlation has simply two prices going straight up and down together, it is highly likely that it’s spurious. Find a bunch of price charts that have been steadily rallying within a given time period. Then, overlay the price charts with each other to imply some kind of relationship. If you find that the prices are going up and down together, it’s highly likely that’s you haven’t found two smooth trends happening simultaneously by mere coincidence and it’s a spurious one.

- Is there any third variable that’s influencing the movement in the two-variable you’ve chosen?

It’s a well-reiterated fact that correlation doesn’t imply causation. However, it can definitely provide a clue.

By using correlations, you can at least confirm that you’re searching in the right direction. There have been many instances where a third variable is influencing two financial variables which are not the cause of each other’s variability.

A famous example of this kind correlation is the relationship between the increase in ice cream sales and human drowning deaths. It’s obvious that there isn’t any correlation between the two events. The relationship exists because of cold weather when both ice cream sales and the rates of drowning increase. In this case, the third variable is temperature, which is influencing both events. But even though this may be spurious, it is a stable and persistent correlation and is therefore not useless. For instance, you can easily infer that drowning deaths are going up by finding out whether ice-cream sales have recently gone up, without knowing anything about the temperature.

Whether the causality between two variables is real, determinable, or direct, is not that important. So long as a correlation exists and persists, it is useful. For instance, the US and Canadian interest rates have a strong correlation between them. It is driven primarily by changes in the US economic outlook, which acts as the third variable. The reason for this is the enormous influence the US economy has on not only determining US interest rates but Canadian output as well. The relationship is a logical one since Canada’s export economy hugely depends on the growth of the US economy. For example, traders can trade using this logic by betting high on Canadian dollars when there is a big move up in US interest rates.

Spurious Correlations

A spurious correlation is one in which people infer direct causation between two variables in the absence of any real or logical connection between the two.

Examples of Spurious correlations

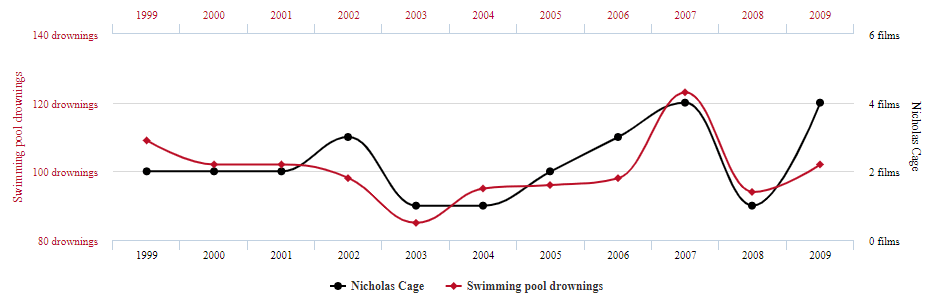

- Correlation between the number of people who drowned by falling into a pool with Nicholas Cage Starred films.

Correlation: 66.6%

r= 0.666004

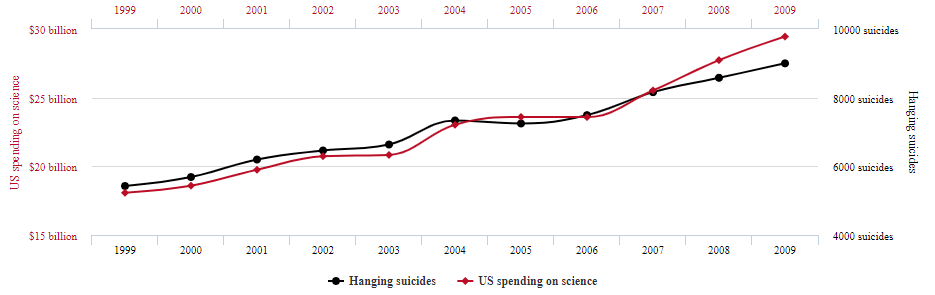

- Correlation between US spending on science, space and technology, and instances of suicide by strangulation, hanging, and suffocation.

Correlation: 99.79%

r=0.99789126

The Bottom Line

Currently, there is a multitude of algorithms that trade correlations with Forex in real-time. Additionally, there is a phalanx of hedge funds analyzing currencies using quantitative analysis models.

Leave a Reply