Candlestick cheat sheets are powerful tools to improve your trading skills and to be more efficient when identifying candlestick patterns in the Forex market.

I am pretty sure you always wanted to know how to trade forex with candlesticks, but how many figures or candles do you have to memorize? As experience comes with time, memory too. You are going to know all candlestick patterns, but this cheat sheet will help you to use the figures wisely.

Welcome to the forex candlestick patterns world with this cheat sheet. Shall we begin?

Candlestick patterns are separated into two groups, simple designs that stand for single candle formation that provide much information by itself, signaling a technical event.

Also, complex candlestick patterns that are made by two or more candles that usually include simple patterns to suggest a better approach of candlestick analysis.

Whether you want to go buy or sell, check this page always before opening your trades, so you are sure that your analysis is based on certain information. Sometimes, there are Doji or Hammer candles people don’t know how to identity; well, the forex candlestick patterns cheat sheet is here.

Simple Candlestick Patterns Cheat Sheet

Candlesticks patterns made by only one candle are simple formation, including the following: | Big positive candle: Bullish pattern. A green or white candle that usually has a long body with a big difference between the opening and closing prices. Price opens and closes near to lows and highs respectively. |

| Big negative candle: Bearish pattern. Usually, a red or black candle that is the opposite of a big positive candle with an unusually long body with opening and closing prices near to highs and lows. |

| Doji: Indecision pattern. A candle formed when the body is unusually small with closing and opening prices virtually the same. Doji candles have some variations. |

| Doji: Indecision pattern. A candle formed when the body is unusually small with closing and opening prices virtually the same. Doji candles have some variations. |

| Dragonfly Doji: Reversal pattern or confirmation of bullish trend. A candle with opening and closing prices virtually the same but at near to the high of the candle and it has a long shadow below. When showing up at bottoms, it is considered a reversal signal. |

| Dragonfly Doji: Reversal pattern or confirmation of bullish trend. A candle with opening and closing prices virtually the same but at near to the high of the candle and it has a long shadow below. When showing up at bottoms, it is considered a reversal signal. |

| Hanging Man: Bearish pattern during an uptrend. A positive or negative candle with small body near to the high with virtually no upper shadow. It also has a long lower tail, which is two or three times the size of the body. |

| Hammer Bullish pattern during a downtrend. A positive or negative candle with a small body near to the high with virtually no shadow above the body but a long tail below. |

| Inverted negative hammer: Bottom reversal pattern. A negative candle with the body at the bottom of the figure and a long upper shadow. |

| Long Lower Shadow: Bullish signal when near to support levels. A negative or positive candle formed with a lower shadow that is two thirds or more of the total of the range of the candlestick. The body is on the upper side of the candle. |

| Long Upper Shadow: Bearish signal. Candle with an upper shadow that is two thirds or more of the size of the candlestick. It is a bearish signal when it is near resistance levels. |

| Marubozu: Continuation pattern. A candle with no shadow when opening and closing prices are the highs and lows. |

| Shooting Star: Bearish pattern in an uptrend. A positive or negative candle that has a small body at the bottom of the candlestick. It has no lower tail but a long upper shadow. |

| Spinning Top: Neutral pattern. Candle with a small body. Shadows can vary. |

Advanced Candlestick Patterns

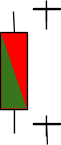

Now, let's talk about complex candlestick patterns for advanced technical analysis. Usually, advanced patterns are built from two or more candle sticks that represent bullish or bearish signals. Let's see the most popular. | Bearish Harami: Bearish pattern in an uptrend. A green candle followed by a smaller red candle which is developed inside the top and low prices of the previous candle. |

| Bearish Harami Cross: Reversal signal when at top or trend. A sizeable positive candle followed by a Doji. |

| Bullish Harami: Bullish pattern in a downtrend. A red candle which is followed by a green inside candle. That means that the second candle develops itself inside the previous candle's lows and top prices. |

| Bullish Harami Cross: A reversal pattern when it is at the bottom of a downtrend. An unusual large negative candle followed by a Doji. |

| Bearish 3-Method Formation: Bearish continuation pattern. Two long negative candles separated by three small positive candle sticks. The three positive bodies are inside the range of the first negative candle. |

| Bullish 3-Method Formation: Bullish continuation pattern. Two large positive candles with three small negative candle sticks between them. The three negative bodies are inside the range of the first positive candle. |

| Dark Cloud Cover: Bearish reversal signal in an uptrend. A long positive candle followed by a negative candle stick that opens above the high and closes well into the body of the previous candle. |

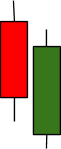

| Bearish Engulfing: Major reversal signal when at top. A green candle followed by a red candle which is significantly larger than its previous. The first candle should be entirely inside the second one. |

| Bullish Engulfing: Major reversal signal when at the bottom. A red candle followed by a bigger green candle when the red is developed inside the greens top and low prices. |

| Evening star: Reversal signal when at top. A big positive candle followed by a small body candlestick that opens with a gap above the previous one. The final candle is a negative candle that finishes well into the body of the first candle. |

| Evening Doji Star: Reversal signals when at top. Three candles when the first is a big positive candle followed by a Doji that opens with a gap above the previous candle. Then, the third candle is negative that closes well into the first candle body. It is a more powerful reversal signal than the Evening Star. |

| Morning Star: Major reversal signal when at the bottom. A sizeable negative candle followed by a small body candle that develops itself below the previous candle body. The third stick is a positive one that closes well into the negative first candle. |

| Morning Doji Star: Major reversal signal when at bottom, more potent than the Morning Star. Three candles, the first is a significant negative candle followed by a Doji that occurs below the body of the first. Then, the final candle closes well into the body of the first. |

| Three Black Crows: Top reversal signal when it at highs. Three negative candles in a row with consecutively lower closes near to their respective lows. |

| Three White Soldiers: Bottom reversal signals when at lows. Three positive candles with consecutive higher closes when closing prices are near to their tops. |

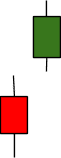

| Tweezer Bottoms: Minor reversal signal. Two or more candlesticks with the same bottoms. The size of candles can vary, and they may be consecutive or may not be, positive or negative. |

| Tweezer Tops: Minor reversal signal. Two or more candles with matching highs. Candles may not be consecutive, mix direction, and sizes can vary. |

| Doji Star: Reversal signal. Large candle followed by a Doji candle that opens with a gap below or above the previous candlestick. It needs confirmation in the next period. |

| Piercing Line: Reversal signal when at the bottom. Negative candle followed by a positive candlestick that opens below the low of the previous one and closes in the second half of the body of the first candle. |

| Rising Window: Support for the selling pressure. Two positive candles when the second opens with a gap above the previous closing price. |

Leave a Reply