It may be strange to think of the Forex market as some popularity contest, and to some extent, it is. Everyone is looking to see where the most action is to make the largest amount of money with the least risk.

Despite there existing hundreds of forex pairs, some are more popular than others; these are essentially the major pairs. Of course, market popularity is only one aspect of forex trading.

Yet, if you’re a beginner, in particular, major pairs are the easiest to get your feet wet in forex, owing to their colossal liquidity, stability, and tight spreads.

What is a major forex pair?

A major pair in forex is a market consisting of the USD dollar and any of the following seven currencies: AUD (Australian dollar), CAD (Canadian dollar), CHF (Swiss franc), EUR (euro), GBP (British pound sterling), JPY (Japanese yen), and NZD (New Zealand dollar).

These combine into a list of the following forex pairs (in alphabetical order):

- AUDUSD

- EURUSD

- GBPUSD

- NZDUSD

- USDCAD

- USDCHF

- USDJPY

The currencies in major pairs represent most of the countries in the G10 – Canada (CAD), Switzerland (CHF), Belgium, France, Germany, Italy (EUR), the United Kingdom (GBP), Japan (JPY), and the United States (USD) – along with New Zealand (NZD) and Australia (AUD).

These countries have some of the most valuable economies on the planet, and, hence, their currencies feature heavily in foreign exchange. While each nation within a major pair will have its own unique price drivers, these markets are often impacted by what’s happening in the United States.

Some literature classifies AUDUSD, NZDUSD, and USDCAD as ‘commodity pairs’ (because of Australia and New Zealand’s reliance on gold and Canada’s substantial oil exports).

However, these instruments will also be influenced massively by the US economy and, hence, are often grouped simply into major pairs. Regardless, such markets are characterized by inexhaustible liquidity or volume, low trading costs, and being relatively stable compared to other currency pairs.

Why trade major forex pairs at all?

We’ll now explore the main attractive elements of major pairs.

High liquidity

Liquidity refers to the ease at which you can enter and exit the forex market without any drastic change to the exchange rates. A financial instrument becomes highly liquid if many people are trading it, and this is what major pairs provide.

Liquidity fosters several benefits, such as lower trading costs, lower volatility (both of which we’ll cover in a bit more detail shortly), and smoother execution with sporadic cases of slippage.

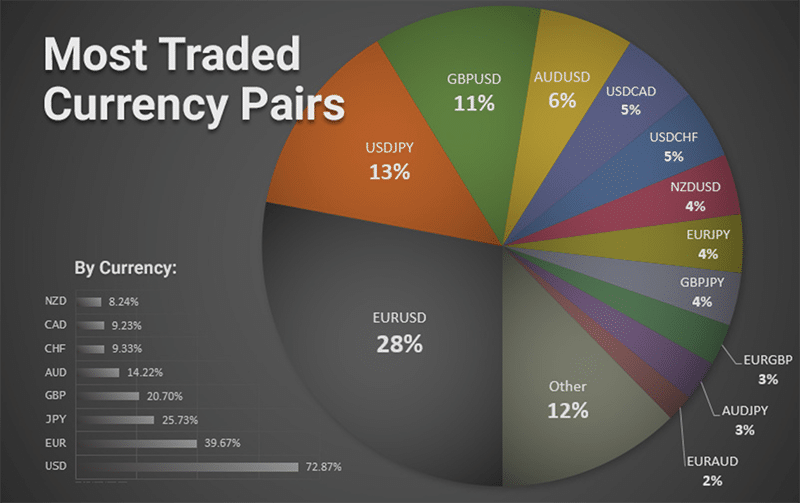

The chart below shows the most traded currency markets in 2022. Note that 80% of these are major pairs.

Tighter spreads

Tremendous liquidity lowers the trading costs in any market because as the number of traders grows, so does the competition among brokers to provide the cheapest fees. Nowadays, one shouldn’t be paying above two pips in a spread for a major pair for most of the trading day.

EURUSD is the cheapest (one of the reasons it’s so prevalent to trade), where you can get spreads lower than one. The benefit of lower spreads is of particular significance to scalpers or short-term traders where every pip does matter.

These individuals tend to focus only on a handful of markets, and all of these are almost exclusively the majors.

Stability

Stability refers to the somewhat predictable economies these markets represent and their relatively low volatility. The former point is debatable as no one pair is necessarily easier to trade than another.

However, most analysts would agree that predictability in the context of major pairs refers to the historical economic patterns they exhibit over time. In terms of volatility, this is technically good and bad, depending on the individual trader.

Lower volatility is advantageous as the price movements are less ‘choppy.’ On the flipside, this quality doesn’t produce so-called ‘big moves,’ which can potentially yield a trader more profits in a shorter span.

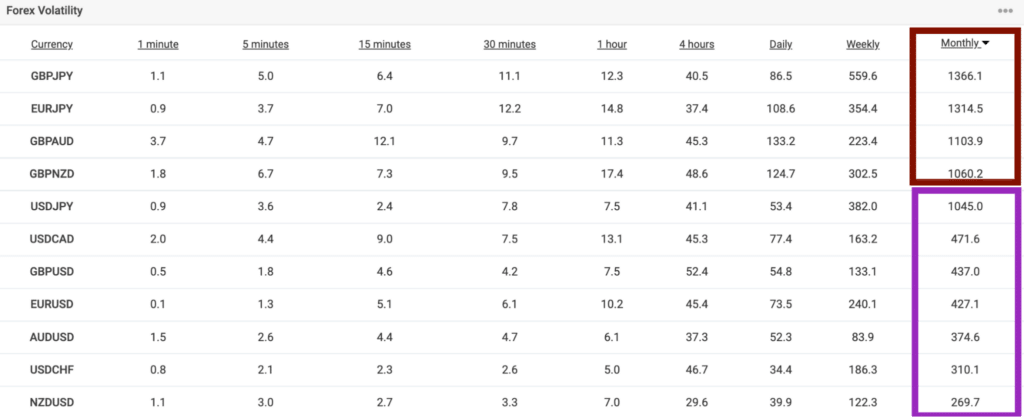

For a better illustration, the image compares the monthly pip volatility of all the major pairs against four minor pairs on Myfxbook.

Some downsides of trading major forex pairs

Fortunately, major pairs don’t have many downsides, although they are worth mentioning. These markets are heavily tied to the US dollar, meaning they don’t provide much diversification.

Whether you’re trading the euro or the British pound, you’re essentially taking a pro-USD or anti-USD stance. This is why minor or cross pairs will feature in the watchlist of an average forex trader.

However, some strategies, mainly those based on the short term (e.g., scalping), perform fine by relying on all or most majors. Yet, for the rest, you should feel free to explore the ‘forex ocean’ and look for opportunities away from the greenback.

The second disadvantage is the lower volatility. However, as briefly mentioned, this isn’t necessarily a bad thing. GBPUSD, USDCAD, and USDJPY are the most volatile major pairs, with their pip range rivaling their minor counterparts.

Therefore, if you were looking for a bit more volatility with some stability, these could be your markets of focus. Lastly, major pairs don’t have any attractive swap rates for long-term traders.

This is because the central banks behind their currencies have low, zero, or even negative interest rates. Therefore, the differentials are less massive than minor and exotic pairs.

Still, this quality is also positive as you can hold positions for months on end, incurring very tiny swap rates.

Curtain thoughts

The purpose of this article is to help you understand what makes major pairs the most traded.

While such securities are beginner-friendly, traders gain further insights into other economies, which naturally inclines them to trade currencies that may not be part of the majors.

These days, the average trader follows about 29 markets in total (7 majors; 22 minors), a more than enough selection to find regular opportunities. Yet, you may choose only to follow the major pairs or ditch them altogether, depending on your strategy.

Leave a Reply