Fed’s action during the early days of the coronavirus pandemic stemmed a rout in markets and kept financial costs low, according to Reuters. Fed restored trust in fragile moments, proving its critics wrong of role in preventing financial crisis.

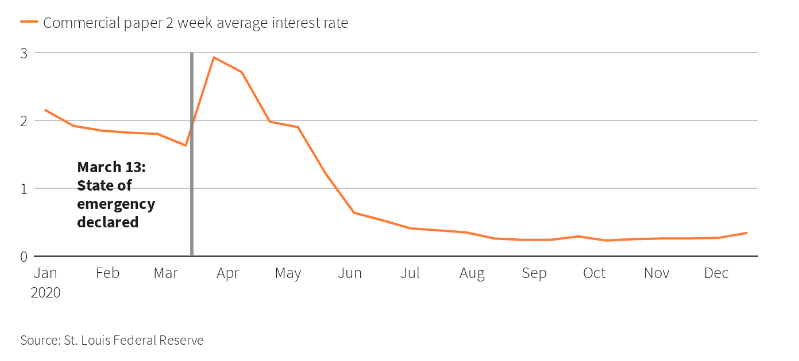

- When the coronavirus crisis intensified in March, Fed’s initial moves propped up trading in Treasury bonds, short-term corporate loans, and other essential financial instruments.

- Fed has been lauded for its fast response to the coronavirus crisis, with analysts calling it a “happy outcome” as markets limp to their feet again from the pandemic impacts

- Analysts believe it took less than anticipated to help the economy, with the Fed’s balance sheet expected to top $10 trillion by the end of 2020, better than feared, up from $4.2 trillion in mid-March.

- Fed’s lending programs, which ends on December 31, also attracted modest interest, much less than expected

- Analysts also point out that the crisis forced greater cooperation between the Fed and Treasury, which could help them work to keep government borrowing costs low.

- The Fed’s response was a stark contrast to the 2007-2009 financial crisis when it took roughly four years to scale up three successive programs of “quantitative easing.”

U.S. stocks are currently gaining. SPY is up 0.18%, QQQ: NASDAQ is up 0.36%

Leave a Reply