- The cryptocurrency market crash accelerates.

- Solana is down 30%.

- Network outages hurt Solana sentiments.

The broader cryptocurrency market has turned bearish. The crypto crash that started last week has gathered steam, with Bitcoin sliding below the $30,000 level and Ethereum plunging below the pivotal $2,000 level. In contrast, Solana remains the biggest casualty and seems to be under immense pressure if a 30% slide over the past week is anything to go by.

After rallying by more than 11,000% last year, Solana’s sentiments have turned from bad to worse this year. The coin is down by more than 70% year to date, having lost more than 80% in market value from its peak highs of $259 a coin registered late last year.

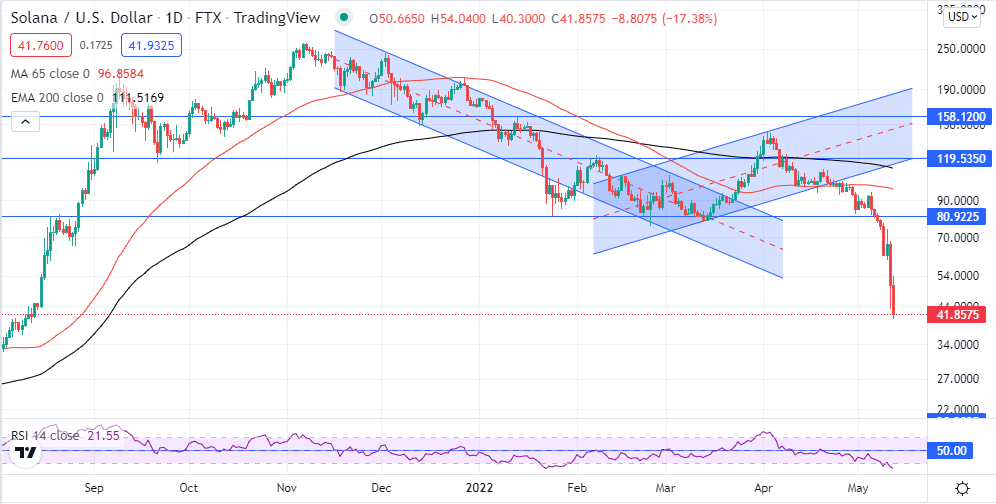

Solana technical analysis

A slide below the $100 level appears to have given shorts sellers a reason to push the coin lower amid the broader cryptocurrency market sell-off. A recent slide below the $50 mark should be worrisome as it raises serious concerns about Solana’s long-term prospects.

The deep pullback is staring at strong support near the $20 level below which SOLUSD could capitulate. With all the major indicators turning bearish, things are not looking good. Bulls face an uphill task to defend the $40 level.

A daily close below the $40 level could accelerate the SOLUSD drop to the $20 level. With the coin under immense short selling, pressure bulls will have to steer a rally above the $50 handle to avert the risk of SOLUSD tanking in continuation of the long-term downtrend.

Why is Solana Crashing

Network outages

Solana’s deep pullback is fuelled by a wider crash in the cryptocurrency market. Coins that exploded last year at the height of the crypto boom have paid a hefty price shedding a significant amount of market value in the process.

However, it is a series of outages on the Solana network that appears to be accelerating a sell-off of SOLUSD at a time when short-sellers are looking for any reason to sell. A string of outages has made investors view the coin with a lot of caution.

Last week, the Solana network was down as NFT minting bots that contribute 4 million transactions a second knocked validators out of consensus. The result was the crashing of the network for about seven hours. It has since emerged that the Solana blockchain, which has been touted for its scalability attributes, is feeling the full impact of a large number of transactions from NFT mining bots.

Solana has always been touted against Ethereum over the scalability edge that allows it to handle more than 50,000 transactions per second. It was one of the reasons the coin exploded last year, as investors saw it as a worthy alternative to Ethereum in the development of decentralized applications, given its high throughput.

In the recent past, Solana has accepted that high compute transactions have caused a reduction in network capacity. It’s also faced some instability issues with duplicate transactions leading to network congestions and outages.

Inflation woes

In addition to network outages, Solana has also suffered from investors shunning speculative assets in the aftermath of disappointing inflation figures in the US. High inflation levels are forcing investors to pull back investments in speculative assets in favor of safe havens such as bonds and treasuries.

Rate hikes and economic tightening measures are taken by the US central and is also forcing investors to pill back from trickier assets such as cryptocurrencies. Concerns that the FED won’t be able to tackle the runaway inflation without triggering recession are another factor fuelling the sell-off in the sector, all but pilling pressure on Solana.

Final thoughts

Solana looks set to remain under pressure in the medium amid the ongoing crypto crash. A drop below the $40 a coin level could result in SOLUSD plunging to lows of $20 a coin as the sell-off gathers steam.

Leave a Reply