- Cryptocurrency crash in play

- Cardano Solana and Ripple double-digit losses

- Dollar Strengthens to 20-day highs

There is no reprieve in sight as the cryptocurrency crash that started last week shows no signs of easing off. It’s been an abysmal week for cryptos as investors shun riskier assets amid growing concerns of global economic recession amid runaway inflation.

Cardano Ripple and Solana are some of the big coins that have been hammered, posting double-digit percentage losses. The violent swing downward has been fuelled by selling pressure across other markets as the risk-off mood remains the central theme in the capital markets.

Solana down 30%

Solana has shed more than 30% for the week after plunging below the critical $80 a coin level. SOLUSD did plunge to lows of $35 on Thursday but has since bounced back in what could be attributed to short-sellers taking profits.

While the coin has bounced above the $50 level, it faces an uphill task to find support above the psychological level. With technical indicators led by the Relative Strength Index turning bearish and affirming sell-off momentum, the coin faces the risk of edging lower after the minor bounce back.

Below the $50 level, SOLUSD could plunge to the $30 level seen as the next support level. On the flip side, the coin finding support above $50 could be the trigger behind a potential rally to the $70 area.

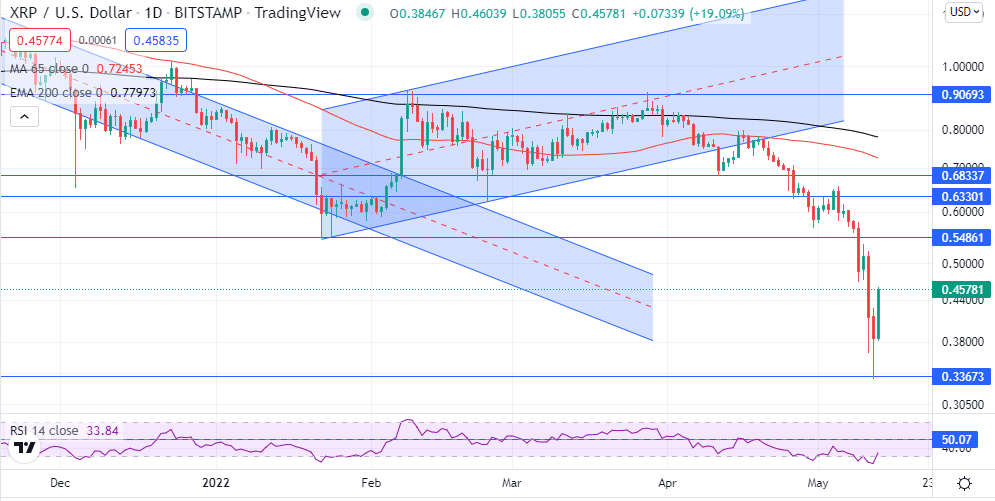

Ripple 20% sell-off

Ripple has also suffered a similar fate plunging by more than 20% this week. After failing to find support above the $0.54 level, which was the previous 2022 lows, the XRPUSD sell-off accelerated to 15-month lows of $0.35.

XRPUSD has since bounced back, retaking the $0.43 handle in what could be attributed to short sellers locking in profits. With the momentum still to the downside, the prospect of the coin edging lower despite the recent bounce back is still high. A drop below the $0.40 handle could trigger another leg lower in continuation of the long-term downtrend.

Cardano down 26%

Cardano has also turned bearish after failing to hold on to gains above the $0.74 a coin level. The coin is down by 26% for the week and looking increasingly bearish amid the ongoing sell-off in the broader market.

After registering a new 52-week low of $.039, ADAUSD has bounced back to the $0.53 handle, waiting to see if the bounce back will hold. With the Relative Strength Index turning bearish, the prospect of the coin ending lower after the ounce knack is still high.

Why Cardano Ripple and Solana are down

Faced with runaway inflation, investors are no longer looking to invest in the market, especially in riskier assets amid the economic uncertainty. Focus has since shifted to safe havens such as bonds and yield that tend to perform in times of uncertainty, thus the Cardano Ripple and XRP sell-off.

The raising of interest rates by the US Federal Reserve has also not helped cryptocurrencies course. The recent 50 basis hike and the prospect of another 50 basis hike in the next meeting continue to fuel dollar strength. The dollar strengthening to 20-year highs against the majors has been one of the biggest undoing and fuel behind the crypto crash.

Terra’s recent annihilation of the algorithmic stablecoin ecosystem also appears to have sent shockwaves in the crypto sector, fuelling the sell-off. Luna, the token that powers the Terra blockchain, imploded from $80 a coin to lows of $0.01. The sell-off has only gone to send jitters in the market.

Final thoughts

Solana Ripple and Cardano are some coins that have paid a hefty price on the broader sector turning bearish. Investors shunning riskier assets amid economic growth uncertainty and inflationary pressure means the coins could remain under pressure in the meantime.

Leave a Reply