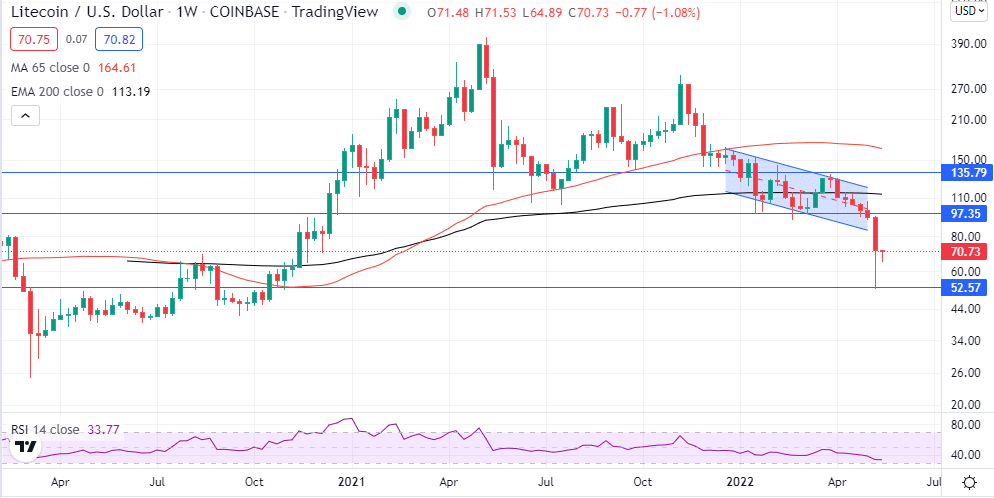

- Litecoin bounce back stalls

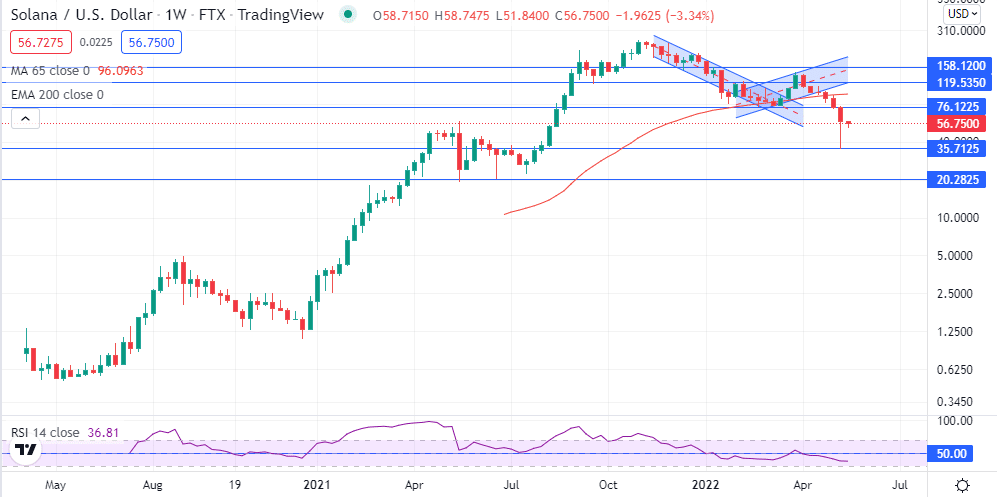

- Solana is under pressure after bouncing back

- Crypto mainstream adoption stalls

Cryptocurrencies are in consolidation mode after a recent bounce back. However, major coins are struggling for direction as the upward momentum shows signs of exhaustion. A stalled bounce back is already looming, with short sellers on the brink of fuelling another leg lower.

Litecoin and Solana are some of the coins struggling to hold on to gains after the recent slump to monthly lows. The slump came as a deep sell-off in the stock market spread into digital assets. Concerns about inflationary pressures and the global economy’s health have sent investors scampering for safety in safe havens shunning riskier assets such as virtual currencies.

LTCUSD bounce back

Litecoin is one of the coins under immense pressure after the recent slump to seven-month lows of $52 a coin. While LTCUSD has bounced back, retaking the $70 handle, it remains engulfed in a strong bearish momentum. With the Relative Strength Index implying bearish momentum, the likelihood of the coin edging lower after the recent bounce back is still high.

Similarly, LTCUSD is trading below the 200-day moving average, affirming short sellers in firm control. LTCUSD needs to rally and find support above the $80 handle to avert the prospect of further losses after the recent bounce back. A sell-off followed by a daily close below the $70 handle will only accelerate the drop to seven-month lows near the $50 handle.

SOLUSD hits strong resistance

Solana is another coin trying to bounce back after the recent slump to nine-month lows. While SOLUSD has bottomed out of the $35 handle, it is struggling to power through the $60 handle. Bulls need to steer a rally past the short-term $60 resistance level to affirm the bounce-back push.

On the flip side, a deep pullback followed by a daily close below the $50 handle will accelerate the drop to recent lows of $35. With all the major indicators led by the RSI and 200SMA affirming bearish momentum, the prospect of the coin tanking is high.

Why are Solana and Litecoin under pressure?

The Federal Reserve raising interest rates by half a percentage point is one factor that is fuelling the sell-off in the cryptocurrency market. The rate hikes have stocked fears amid concern that it could trigger a slowdown in economic growth given the expected increase in borrowing costs. The jitters have sent stock markets into a nosedive, with the sell-off spilling over into the cryptocurrency market.

Cryptocurrencies have been trading in tandem with the stock market. Consequently, Litecoin and Solana have tanked whenever the stock markets have come under pressure. The sell-off looks set to continue as investors shun riskier assets such as stocks and cryptocurrencies in favor of bonds and treasuries that benefit from a high-interest rate environment.

Additionally, reports indicating mainstream crypto adoption is lagging is another factor that is weighing heavily on crypto sentiments in the market. Last year, Litecoin and Solana raced to all-time highs as numerous events underscored the growing crypto importance in the mainstream financial services, all but fuelling adoption.

Investors invested heavily in cryptocurrencies as more businesses started accepting virtual currencies as payment for goods and services. El Salvador accepting Bitcoin as a legal tender was one factor that sent cryptos higher. Fast forward, it’s been quieter with fewer milestones to report on the growing crypto use cases. Concerns that mainstream adoption is taking longer is one factor that has weighed heavily on sentiments about crypto investments.

Final thoughts

Litecoin and Solana are still under immense pressure and likely to edge lower despite the recent bounce back. The crypto crash dust is set to settle to attract more buyers into the market.

Leave a Reply