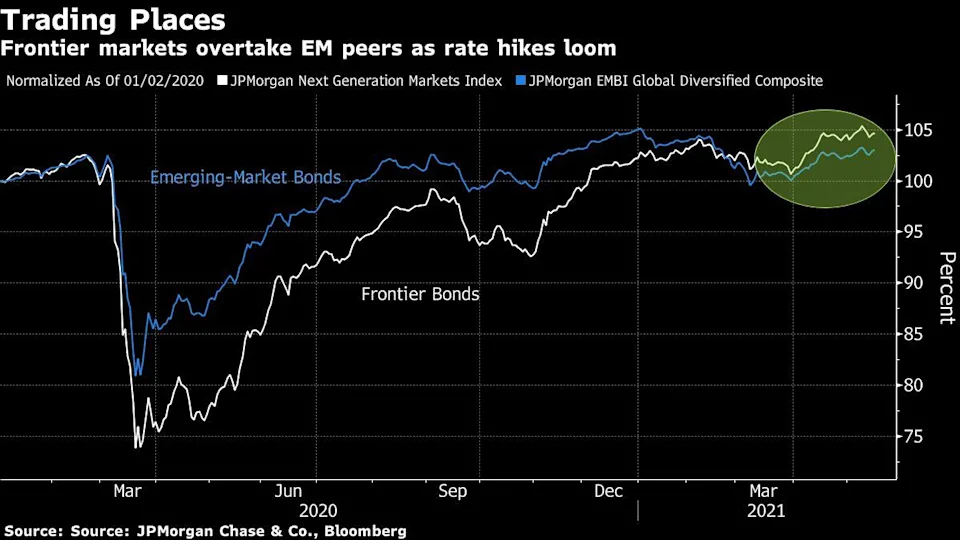

The world’s least-developed nations have posted higher bond returns this year than emerging market economies as more buyers are coming into the smaller countries, Finance.Yahoo reported.

- Frontier debts have posted 2.6% in bond returns this year, versus the 2% decline in emerging market debt.

- Frontier debts recorded a similar performance in 2020, while debt in emerging countries climbed 5.3%.

- More buyers are going into smaller economies as securities tend to have a shorter duration and are less swayed by potential interest rate increases.

- Sovereign bonds in frontier markets average six years, versus 7.9 years for emerging markets.

- An analyst said investors are taking into consideration the rise in interest rates as economies recover from the COVID-19 pandemic.

- The analyst believes players are parking their funds in investments with higher yields and less interest-rate duration, such as frontier bonds which could return at least 9% in the next year.

- Smaller nations tend to offer higher yields as they are perceived to have a higher chance of default.

Leave a Reply