- Cardano tanks below $1

- Risk-off mood weighing heavily on Cardano

- Cardano blockchain upgrade

It’s been a rough year for Cardano, going by the deep pull back from record highs of $3 a coin registered in September of last year. The coin has shed more than 70% in market value and is currently flirting with one-year lows with no reprieve in sight.

Cardano has underperformed the overall cryptocurrency market even on most coins coming under pressure in recent months. A plunge below the $1 a coin level is already fuelling concerns given the strength of the downward momentum.

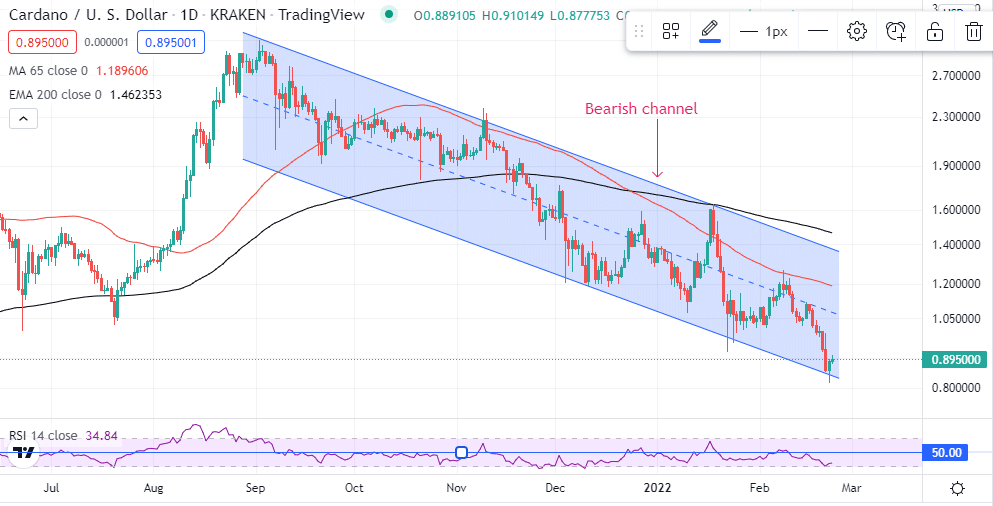

Cardano technical analysis

ADAUSD’s deep pullback has coincided with a deep pullback in the overall cryptocurrency market. A slump to the $0.89 level leaves the coin susceptible to further losses as it has broken through a crucial support level near the $1 level. That said, Cardano could tank to the $0.69 level seen as the next substantial support level.

With the Relative Strength Index below 50 on the daily chart, bearish bias remains in play, supporting the notion that short sellers are still in control. However, given that the coin is trading at the lower end of the descending channel, the prospects of it bouncing back before edging lower is high.

The 65 exponential moving averages have emerged as a crucial support level. A bounce back to the EMA has so far been followed with a strong sell-off in continuation of the long-term downtrend. Nevertheless, a bounce-back followed by a close above the 65EMA with the RSI reading also rising above the 50 level could affirm the suggestion that Cardano has reached a bottom and is poised to bounce back.

Cardano sell-off drivers

Cardano’s sentiments have been weighed heavily by the risk-off mood in the market. Traders and investors are increasingly scampering for safety in safe havens shunning riskier assets such as cryptocurrencies. Geopolitical tensions between Russia and Ukraine, which have also drawn the US the UK, among other powers, is fuelling a wave of caution in the investment world.

Concerned by the long-term impact of the escalating tensions, investors have had to hedge their portfolios, opting to settle for safe havens such as the US dollar and gold. Most investors have decided to sell off riskier assets for what they deem as safe investments amid the uncertainty on the global scene.

Regulators appearing to be going against major cryptocurrency companies in Canada are another development that is weighing on Cardano, the seventh-largest virtual currency. Regulators are pushing for the freezing of cryptocurrency accounts of people associated with the truck protests in Ottawa.

The regulatory crackdown has once again affirmed that cryptocurrency may not be immune despite its decentralized nature and anonymity.

Cardano blockchain development

Amid the wave of negative news and headwinds, Cardano is still a force to reckon with and likely to bounce back once the dust settles. The project’s engineers are working on a scaling solution that involves Hydra, which could prove to be a game-changer in the future.

The solution is expected to increase the amount of transactions that Cardano blockchain handles per second from the current 250. Current tests have shown that Hydra could allow Cardano to handle up to 1,000 transactions per second, something that could give it an edge in the highly competitive field.

The software engineers are also working on improving the volume of data that the Cardano blockchain can process in addition to the time it takes to complete transactions. There is also a push to improve the quantity of work that can be done simultaneously on the blockchain.

While Cardano has been battered in the market, the future can only be bright given the efforts being made to improve the blockchain and make it more effective in processing transactions.

Leave a Reply