- Cardano’s bounce back gathers steam.

- Cardano up 50% from 2022 lows.

- Increased adoption and updates affirm long-term prospects.

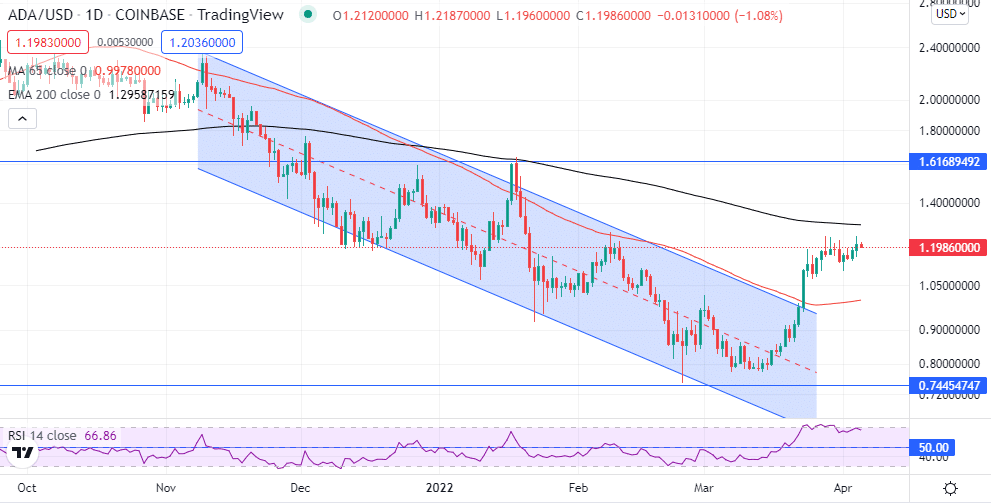

Cardano has taken a significant beating over the past few months, going by the 77% correction from all-time highs to lows of $0.75 in February. The deep pullback might as well have presented an attractive buy opportunity going by the strength of the recent bounce back. A 50% plus bounce back in March affirmed renewed buying pressure as investors jostle for opportunities.

ADAUSD technical analysis

Cardano has turned bullish going by recent price action activity. The Relative Strength Index rising to highs of 67 affirms buyers are in control following the recent break out of a descending channel. A close above the 200-day moving average would reaffirm the emerging uptrend as a rally to all-time highs gathers stream.

Standing in the way of bulls steering further upside action on ADAUSD is the $1.24 level that has emerged as a short-term resistance level. A breakthrough in the resistance level should pave the way for bulls to make a run for the $1.60 mark, the next substantial resistance level. A breakthrough at the $1.60 level should pave the way for another leg higher to the $2 psychological level.

On the flip side, the $1.13 mark is the immediate short-term support level above which ADAUSD bulls remain in control. A break below the support could trigger renewed sell-off that could see Cardano pulling back to the $1.07 area, the next substantial support level.

Coinbase Cardano support

Cardano finding support above the $1 level affirms the emerging uptrend supported by a series of solid underlying fundamentals. Coinbase adding support for the staking of ADA tokens is one factor that continues to strengthen the tokens sentiments in the market.

Coinbase making it easy for people to stake ADA tokens marks an important milestone. The move is likely to entice people to stake Cardano token in anticipation of a 3.75% annual percentage yield. The prospects of earning rewards could fuel increased adoption of ADA, likely to offer support to price appreciation.

Cardano updates

Another factor fuelling the ADAUSD rally has to do with reports that the card is in the process of rolling out massive updates. The updates are expected to enhance Cardano Blockchain’s scalability. In return, the network should compete better against other competing lightning-fast networks.

The updates should strengthen Cardano’s blockchain edge in processing transactions. The blockchain currently processes 250 transactions per second, better than 14 seconds per second for the Ethereum blockchain. In addition, the updates will make it a preferred platform for developing smart contracts and decentralized applications.

In addition, Cardano’s recent rally has been supported by an uptick in demand for riskier assets in the capital markets. Investors are increasingly turning to sell off assets that have turned out to be attractive on the risk-reward front.

Final thoughts

Cardano has grown to become an excellent pick for investors on the back of an impressive track record of updates that have strengthened its blockchain. The high number of transactions that the blockchain can process has continued to fuel increased adoption.

Therefore it does not come as a surprise that the crypto has started bottoming out. A 50% plus rally over the past month affirms strengthened investor confidence about the coin’s long-term prospects. While Cardano is still down by about 60% from all-time highs, it looks like an attractive prospect on the risk-reward front.

Leave a Reply