- AVAX coin up 60%

- Terra stablecoin capability impact

- AVAX blockchain increased use

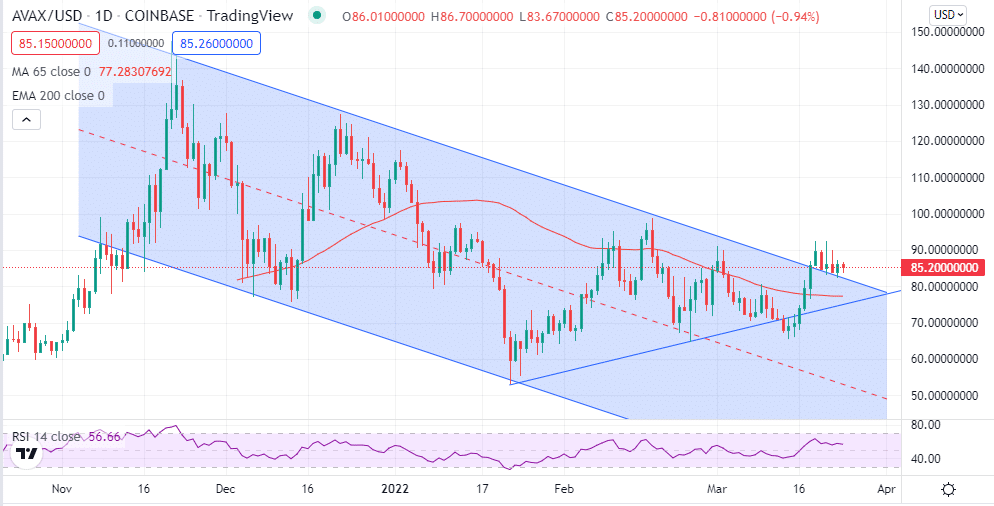

Bounce back is the central theme in the cryptocurrency market. High risk-reward opportunities are increasingly cropping up as highly battered tokens bounce back amid improving sentiments. AVAX is one of the coins eliciting strong interest after breaking out of a descending channel.

AVAX technical analysis

The coin has made big gains in recent weeks amid improving risk sentiment in the burgeoning sector. The digital coin is already up by more than 60% from lows of $53 coin registered at the start of the year. The bounce-back has coincided with an uptick in trading volume affirming renewed investor interest.

While the broader cryptocurrency market is still in a bear market, the same cannot be said about AVAXUSD. The Relative Strength Index indicator has already risen above the 50 handle to 57, signaling a buildup in buying pressure. The pair rising and finding support above the $80 handle is another pointer that affirms buyers are in control.

Standing in the way of bulls steering a rally to the $100 barrier is the $92 level, which happens to be the immediate short-term resistance level. AVAXUSD has retreated three times from this level, which could be attributed to traders and investors taking profits after the recent higher run.

A rally followed by a daily close above the $92 handle should pave the way for AVAXUSD to make a run for the $100 psychological level. On the flip side, the $82 area is the short-term support level above which AVAX remains bullish and is likely to continue edging higher. A daily close below the level could trigger renewed sell-offs that could see the coin plunging back to the $66 area.

AVAX bounce back prospects

AVAX is one of the coins well-positioned to soar in a full-blown rebound of the cryptocurrency market. The coin has so far turned out to be one of the biggest gainers among the top cryptocurrencies, affirming strengthening sentiments in the market.

One of the factors driving Avalanche coin price higher is the unveiling of a new capability that allows Avalanche users to stake Terra stablecoin. The ability to stake in the Anchor Protocol marks an important milestone on Avalanche blockchain evolution. The integration underscores the increasing use of the underlying blockchain in decentralized finance.

Avalanche Blockchain’s competitive edge in decentralized finance stems from the Blockchain’s fast speeds, finality, and ability to price transactions in real-time. The blockchain boasts a throughput of up to 4,500 transactions per second and a finalization time of fewer than two seconds.

In addition, transaction fees on the Avalanche blockchain are some of the lowest, an attractive feature that continues to attract more people to the network.

The platform also supports open and programmable smart contracts, a feat that has allowed it to attract more developers. The fact that the Avalanche is compatible with Ethereum smart contracts has allowed the lending protocol Aave stablecoin and Curve exchange to be deployed in the blockchain.

Increased use of the Avalanche blockchain in smart contracts and powering decentralized finance is the catalyst fuelling strong demand for the AVAX coin. The net effect has been a significant price increase in the recent past.

Final thoughts

The recent 60% plus rally underscores AVAX’s bounce-back credentials. The organization behind the Avalanche project reiterating plans to disrupt traditional finance while improving DeFi is one factor that should continue to support AVAX price gains. As more people resort to using the Avalanche blockchain to power decentralized applications and DeFi products, demand for AVAX coins should increase, which could further appreciate its value.

Leave a Reply