Introduction

In the foreign exchange market, categories of currency pairs exist where categorization is based on demand and liquidity of the pair. Majors include all pairs associated with the US Dollar. Because close to 90% of the forex transactions involve the greenback, all associated currency pairs are massively liquid and in high demand.

Contrariwise, forex pairs that include a primary currency and a developing economy currency make up the exotics. Exotics or exotic currency pairs are not common because of low liquidity. Because of this, the spreads are sometimes ungodly. An excellent example of an exotic currency pair is USD/INR (US dollar vs. Indian Rupee). Another way of looking at this is this way; an exotic pair contains one major currency and one exotic currency. In USD/INR, USD is the major currency, and the INR is the exotic currency.

Another defining quality of exotics is high volatility. As earlier noted, exotic currencies come from developing economies. An economy like India does not have stable institutions that can guide it through significant crises. Because of this, the possibility of a major devaluation of the exotic currency is high. Over the past year, for example, INR has declined significantly against the greenback. Consequently, the USD/INR pair has gained 9% in the period.

Indian economy: Is India the new China?

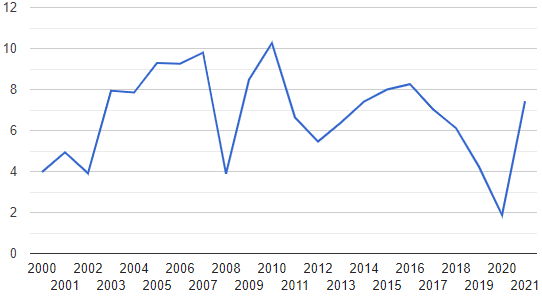

Serious forex traders appreciate the relationship between a strong economy and the strength of its currency. It is no less accurate for the India Rupee. Over the past four years, India has ceded colossal growth potential due to domestic and global factors. In the last recession (2007/08), India was among the few countries whose economy recovered fast. The trend line of India’s GDP growth rate shows a V-shaped recovery, which indicates an economy with great potential for phenomenal growth.

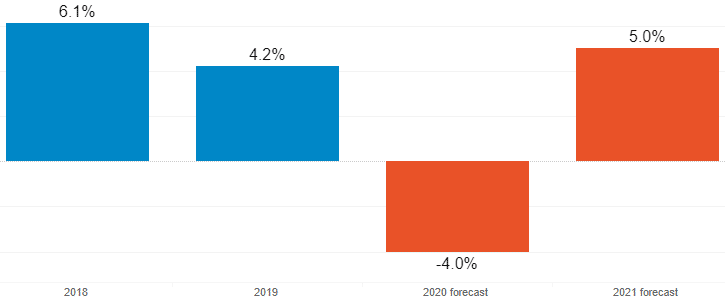

Since 2016, India has consistently reported lower GDP growth figures year-on-year until it reached a ten-year low of 4.23% in 2019. The incidence of the COVID-19 pandemic has led toIMF expecting India’s GDP to contract by 4.5% in 2020. Even then, this estimate could be an underestimation considering that the pandemic is still unfolding.

Additionally, the IMF is confident that India’s GDP will expand by 6% in FY2022. Past the pandemic, India has the potential to match China’s phenomenal growth in the early 21st Century. The country’s authorities are making the right steps to address issues such as corruption that impede the full utilization of its growth potential. According to the 2017 Global Competitiveness Report, India’s war on corruption is working. If the country persists in this trajectory, the recovery from the COVID-19 pandemic could mirror or even best China’s phenomenal growth in the early 2000s.

What moves USD/INR?

In India, just as it is in many other jurisdictions, corporate entities and exporters wish to protect their profits at all costs. It means they would look for all means to hedge against interest rate differentials in the currency that would hurt the profits. For starters, the majority, if not all, of Indian corporates that deal with foreign currency do so with US dollars. However, the USD/INR exchange rate is ever-changing. If they held all their profits in INR, a depreciating INR would eat into their profits. In mitigation, the corporates buy foreign exchange forwards to hedge against the interest rate differential risk.

Forward market hedging affects the spot rate of INR. If the corporates buy plenty of dollars, market sentiment for the INR deteriorates. Consequently, a mass sell-off of the INR ensues, which undermines the value of the Rupee. In the end, the USD/INR pair inches up.

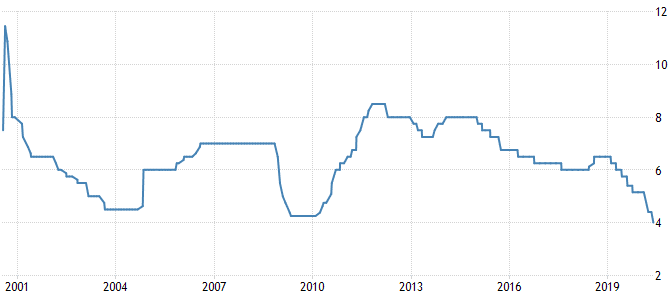

The interest rate in India

The Reserve Bank of India (RBI) adjusts policy rates regularly to control inflation and unemployment. In finance phraseology, this is what experts refer to as monetary policy. A contractionary monetary policy entails raising policy rates. Primarily, such a move aims to reduce the amount of money in circulation, hence lower inflation. Besides, higher policy rates/interest rates make a country’s bonds attractive to foreign investors. If the foreigners snap up the bonds in US dollars, the INR will strengthen against the greenback. Reason? The influx of USD against INR lowers USD’s demand, leading to a lower exchange rate.

Interest rates in India have an interesting relationship with the USD/INR exchange rate. Notice that Figure 1 and Figure 3 are almost a mirror image of each other. In periods when the interest rates are low, the USD/INR exchange rate is up. For instance, since 2000, the general trend of policy rates set by the RBI has been declining. Contrariwise, the general trend of the USD/INR exchange rate since 2000 is upward-looking. Every time RBI adjusts the policy rate down, demand for Indian government bonds declines. The net effect is a decline in foreign currency (USD) inflows.

GDP growth expectations

The market prices in various indicators when deciding whether to buy or sell a currency pair. In an exotic pair such as USD/INR, investors would be much more interested in India’s economy than the US. It is because the US has a robust economy supported by a globally accepted currency. One of the indicators closely monitored by investors is India’s GDP growth (both actual and expected).

In 2019, India recorded a GDP growth rate of 4.2%, which was about 1.9% contraction from 2018, according to Asian Development Bank figures. Because of COVID-19, ADB expects India’s GDP to contract by 4.0% in 2020. Generally, India’s GDP would have contracted three years in a row at the end of 2020. Given this fact, more investors seem to be betting against the INR, as shown in Figure 1.

When India’s GDP growth rate was comfortable, i.e., in 2019, the INR was strong. As shown in Figure 1, USD/INR was below 70 in July 2019. In summary, strong GDP growth rates strengthen the INR against other currencies.

Conclusion

The forex market categorizes currency pairs based on liquidity and demand. While majors have tighter spreads and massive liquidity, sometimes they lack the kind of volatility that could generate more significant returns. For this reason, exotics such as the USD/INR are attractive. Though illiquid relative to majors, USD/INR is highly volatile. If one creates a good strategy for this pair, then one could generate huge profits. Heightened volatility in the USD/INR emanates from the fact that India is still developing and the economy lacks strength to weather storms in the global financial sector.

Leave a Reply