NZD/USD Introduction

A forex trader is, essentially, one whose understanding of the forex market is above par. It includes good knowledge of individual currencies that make up currency pairs. Such information is critical when creating winning forex trading strategies.

From the foregoing, the New Zealand dollar (NZD) is a significant currency – which is to say it one among the most actively traded currencies in the forex market. The US dollar (USD) ranks even higher than the NZD. To put this in context, 88% of all transactions in the forex market in 2019 involved the USD.

From the foregoing, the NZD/USD currency pair is on the side of majors. A major forex pair includes two major currencies. In forex traders’-speak, the NZD/USD is known as the kiwi, although the name sometimes refers to the New Zealand dollar alone.

The NZD/USD pair has unique qualities in that its value fluctuates in correlation with changes in prices of dairy products, which are New Zealand’s major export products. For this reason, the currency pair is classified under the term commodity pair. But this is not saying that this particular commodity is the only factor that moves the forex pair.

Carry trade in NZD

Experienced traders have numerous forex trading strategies at their disposal to earn from the market. One of these is carrying trade. Carry trade entails complex maneuvers where a trader sells one currency at a low-interest rate and buys another whose interest rate is higher. The intention is to benefit from the interest rate differential, otherwise called the forex swap.

But how does a carry trade work? Say you buy the NZD/USD forex pair. Technically, this means you are buying the NZ dollar while simultaneously selling the greenback. But remember, each of these currencies has an interest rate. As of February 2020, the NZD’s interest rate was 1% and 1.75% for the USD. Here, you find that the interest rate differential was (1.75% – 1%) = +0.75%.

If you bought the NZD/USD pair, therefore, you will end up with a positive carry trade worth of 0.75%. It is your profit when you exit the position.

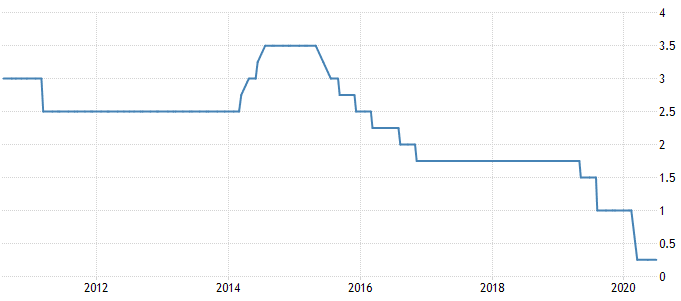

Why is the carry trade important for the NZD? For a long time – before the onset of the COVID-19 pandemic – the interest rate set by the Reserve Bank of New Zealand (RBNZ) has been lower than that set by the US Federal Reserve (Fed). RBNZ’s rate was higher than Fed’s in 2018 and 2019 alone in the recent past. It means traders earned a positive carry trade when buying the NZD/USD pair for much of the past five years except 2018 and 2019.

What moves NZD/USD?

Market risk appetite

Risk appetite in forex refers to the willingness of traders to take on positions where they face the possibility of losing huge amounts of money if things fail to work out. If they do, then the traders can earn colossal profits. Indicators of higher market risk appetite include traders exploiting bigger leverages. In other words, risk appetite is low when traders exit positions in assets that promise more significant profits in favor of low yield assets.

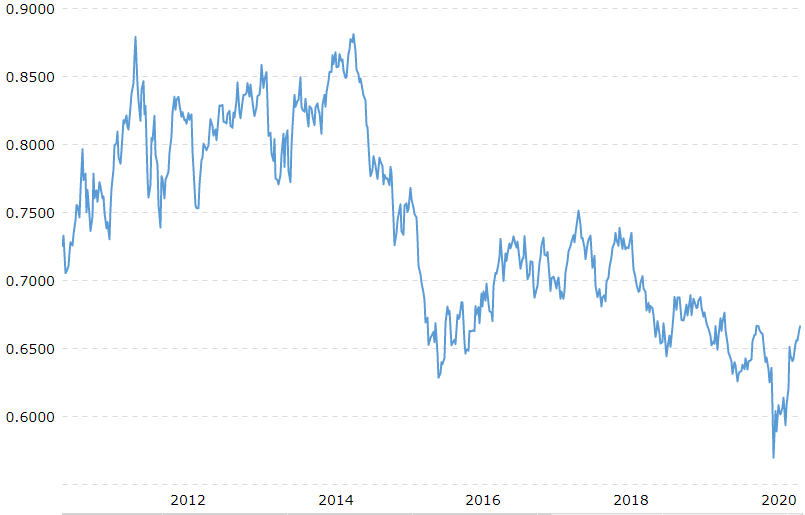

In the case of the NZD/USD pair, the NZD is a higher risk asset because of how much it loses ground when the global economy is in recession. Contrariwise, traders tend to flock to the greenback in times of trouble because it slides less. When market risk appetite is high, the value of NZD/USD climbs upwards because many traders want to take advantage of the high-yield possibilities of the NZD. The opposite happens when trouble befalls the global economy.

Central Bank of New Zealand

The RBNZ is NZ’s Central Bank. Among other tasks, it helps regulate inflation rates within the country’s economy by controlling the liquidity trap. To do so, the RBNZ alters the interest rate depending on the prevailing situation. High inflation implies too much liquidity in the economy. And what does the RBNZ do in response? It increases the interest rate such that less money flows through the ‘veins’ of the country’s economy.

A contractionary monetary policy in New Zealand makes the NZD attractive to traders in the market. It is even better when the US Fed cuts interest rates. It means traders can buy the NZD and sell the USD and then benefit from positive carry trade. As more traders buy the NZD, its value against the USD climbs up, and so does the value of the NZD/USD forex pair.

Over the past 10 years, the RBNZ has been cutting interest rates aggressively (Figure 1). Although the US Fed has been doing the same, the interest rate differential between the NZD and the USD has been thinning fast.Accordingly, the NZD/USD exchange rate’s trajectory has been trending downwards, as shown in Figure2 below.

Economic data, survey, and debt

New Zealand – like every other country – releases economic data and surveys regularly. This data includes information about the country’s economic performance, the balance of payments, and debts. All these data have a direct/indirect effect on the value of the NZD through influencing the market sentiment.

An excellent example of crucial economic data is the Consumer Price Index (CPI). The CPI gives traders an idea about the inflation situation in the country in question. Notably, New Zealand considers 11 item groups as part of the CPI, including food prices, housing, recreation, health, communication, education, and more.

Whenever New Zealand announces a high CPI, it tells traders that inflation is trending upwards, and the market begins to anticipate a rate hike. In one sense, higher inflation says to traders that the economy is unhealthy hence making the NZD unfavorable. But traders with higher risk appetite can exploit the currency to earn from a possible positive carry trade – especially if the rival currency’s (USD) interest rate is likely to decline.

The Debt-to-GDP ratio is also a significant data point for traders. Traders like to track this ratio, particularly to anticipate the direction of the country’s economy. A higher debt-to-GDP ratio indicates several things. One of them is that government expenditure is high. It implies that the economy of NZ will be stronger in the future. A long-term oriented trader will take advantage of such information to go long on NZD/USD.

Conclusion

A lot of mechanics go into the fluctuation of the NZD/USD pair. Unique factors and some common factors influence the direction that each of the currencies takes. This currency pair is among the most traded in the market because each of the underlying economies plays a significant role in international trade.

Of the pair, the NZD is the most volatile because of the disproportionate influence that agricultural commodities have on it. Fluctuations in the prices of dairy products significantly move the value of the NZD because this is one of New Zealand’s primary foreign exchange earners.

Additionally, the activities of the RBNZ when discharging its monetary policy responsibilities cause the NZD’s exchange rate to gyrate. The NZD will fall against rivals such as the USD when the RBNZ cuts rates to stimulate inflation. But this depends on the rates that the US Fed sets. In short, the NZD/USD exchange is a function of many factors, each with a certain weight. Smart traders should seek to unbundle the weight that each factor carries to create more profitable forex trading strategies.

Leave a Reply