The Hong Kong dollar is one of the most traded currencies in the world and has its value pegged to the US dollar. In this article, we take a look at the factors that influence the exchange rate of the HKD/USD currency pair and the role of the Hong Kong Monetary Authority in keeping it pegged to the USD.

Table of Contents

HKD/USD and HKMA (Hong Kong Monetary Authority)

The Hong Kong Dollar is the national currency of Hong Kong. The HKD was pegged to the USD for the first time in 1972, with the exchange rate set at HK$5.65 to US$1. Since then, it has stayed linked to the USD with minor adjustments made by the Hong Kong Monetary Authority (HKMA).

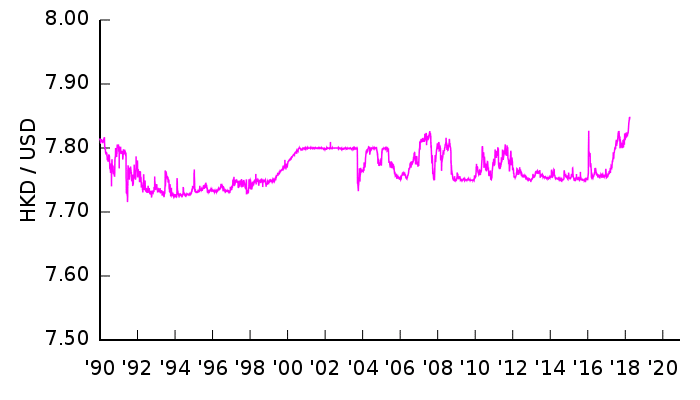

The HKD is pegged currently within the narrow range of 7.75 and 7.785 HKD for every USD. Whenever the HKD reaches these two bounds, it is corrected by the intervening HKMA and the currency is stabilized. Because of the pegging, it does not show any correlation with other currencies. Even then, it is the world’s 13th most traded currency.

Hong Kong economy: Understanding HKMA and Dollar pegging

After initially being linked to the dollar, when the HKD was still at HK$5.085, the government decided to float the currency starting in 1974. This monetary policy worked for a couple of years, and the price level only rose to 2.7% in 1975.

But, by 1980, it had soared to 15.5%. Amidst the fluctuating inflation and growth, the HK$ had risen, and to tackle the economic conditions; the HK government had to peg the US dollar within the narrow range that it finds itself in now.

The HKMA is responsible for maintaining the stability of its currency. It does this by ensuring that the new banknotes are issued only when note-issuing banks deposit a value equivalent to the USD.

What moves HKD/USD

Now, let us take a deeper look at what might influence the HK dollar against the USD, either directly or indirectly, and why traders should be aware of these factors.

1. The HKMA Peg

There are many benefits of fixing the currency of one country to another’s, especially when the former is small and the latter too important. The HKMA does so in order to ensure the competitiveness of the exported goods and services. For a small city-state like HK, it is easy to fix its currency to the USD since its chief source of revenue comes in that form.

The strategy of pegging the HKD to the USD helps Hong Kong stabilize its economy, which, as we have seen, may not be able to withstand the volatility. This HKMA does with its ‘Exchange Fund,’ whose main objective is to affect the HKD value.

The same fund is used to conserve the integrity and stability of Hong Kong’s financial and monetary systems by buying HKD in order to keep up parity with the USD. All this ensures that Hong Kong remains an international financial center.

In relation to its economy, the HKMA has one of the largest currency reserves in the world (about US$450 billion), which allows it to confine the HKD/USD rate within the defined range.

2. The Chinese angle

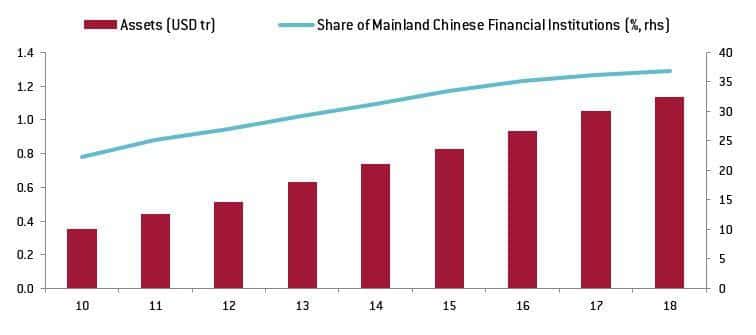

Hong Kong remains integral to China’s investments and financing. For the past decade, more than half of China’s inward and outward FDI was funneled through Hong Kong. Furthermore, since 2010 the number of Chinese institutions in Hong Kong has more than tripled with the financial system being increasingly dominated by Chinese banks.

This rising economic and financial dependence on Mainland China, along with the USD peg, has posed a dilemma to Hong Kong. Even though it has enough forex reserves to cover its monetary base two times over, the capital flows are very volatile due to the lack of capital control. However, despite tensions in the US-China relationship, demand for the HK dollar has risen on the back of multiple interventions by the HKMA.

Protests and civil unrest in Hong Kong could potentially lead to reduced access and liquidity and impact other financial centers as well. This is why the problem could become quite grave for traders who should be on the lookout for further developments.

3. GDP and Domestic Demand

The interest rates have been kept extremely low due to the fixed-rate system of currency. This ensures investment and expansion but has also fueled a boom in home prices in Hong Kong and has led to affordability problems.

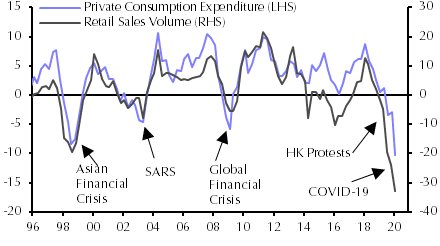

Hong Kong had enjoyed a slow but healthy GDP growth since the financial crisis up till 2019 when the civil unrest began. In order to keep up the value of the Hong Kong dollar, the HKMA has had to intervene multiple times. But, amidst record low domestic demand for the HKD, precipitated further by Covid-19, strictly maintaining the peg within the range is beginning to look doubtful.

There are a few indicators that traders should look out for when dealing with the HKD/USD currency pair:

- GDP

- Inflation

- Nominal Income

- Domestic demand

A worsening of the economic health will depreciate the HKD against the USD and force the HKMA to intervene frequently.

Suppose the city’s economic woes are further worsened due to the anti-government protests and the pandemic. In that case, the possibility of Hong Kong abandoning the peg to the US dollar should not be taken lightly. Given the increasing number of Chinese institutions in the city, Hong Kong’s relationship could further sour with the US and the dollar.

The Conclusion

The Hong Kong dollar and the US dollar currency pair have many unique factors that affect their exchange rate. The HKD’s reliance on its link with the US dollar has kept it from succumbing to its volatility and made Hong Kong’s goods and services highly competitive in the global market.

The Hong Kong Monetary Authority has thus far succeeded in maintaining the exchange rate of the HKD/USD currency pair, thanks to its vast foreign reserves. Indeed, the authority has enough Hong Kong dollars to cover for its whole monetary base.

However, lower domestic demand, deeper penetration of Chinese institutions in Hong Kong, civil unrest, and a shrinking economy due to the global pandemic have made it challenging to keep control of the capital and to maintain the peg. Nevertheless, the HKD/USD currency pair remains one of the most important pairs in the forex market.

Leave a Reply