GBP/USD Introduction

The GBP/USD currency pair is as old as the forex market itself. For a long time, the pair has offered profit opportunities for millions of traders all over the world, especially in the US and the UK. The pair remains a popular choice for traders worldwide second only to the EUR/USD.

Before the advent of sophisticated telecommunications technologies, traders on both sides of the Atlantic relied on price quotes transmitted via an under ocean cable. Broadly, the prices shared along the cable related to the British Pound (GBP) and the US dollar (USD). Traders got so used to this mode of communication that they began to refer to the exchange between the GBP and the USD as a cable exchange. With time, the term “Cable” became slang for the GBP/USD pair.

Much of the pair’s volatility depends on economic activity and news releases in Britain/EU and the US. For this reason, the London and New York sessions see the highest liquidity for this pair. In the last five years, the pair has been tightly beholden to the Brexit drama. Proceedings of the drama have held a more significant sway on the pair’s direction than economic events in the period.

What moves the cable?

Other than Brexit, many other factors cause fluctuation of the GBP/USD. This section covers a number of them.

The Bank of England

Under the leadership of Andrew Bailey, the BoE exerts immense influence on the strength of the pound. First, the BoE set the monetary policy for the UK economy. The key rates aim to keep inflation grounded below 2%. The bank rate, which is now at 0.1%, determines the cost of credit hence the liquidity levels in the UK economy. If inflation is stable, the pound strengthens against major rivals like the USD, which upends the GBP/USD pair.

Secondly, the BOE releases quarterly inflation reports. Inflation indicates the economy’s inherent strength by showing how much goods and services cost in the period. If the inflation numbers in the report meet expectations, forex traders see this is a positive thing. They will want to buy more of the Pound.

Besides, comments by Andrew Bailey, or any of the Bank’s senior executives, influence the GBP’s exchange rate. Investors search the comments for possible policy directions or a hint of future inflation numbers.

UK financials

Financial data of the UK economy affects confidence and sentiment on the pound immensely. Traders draw three types of conclusions about the future of the GBP from such data. They conclude that the pound could weaken, strengthen, or remain unchanged. Public debt figures, for instance, speak of the government’s ability to spend on economic growth. If public debt is enormous, then the government will spend more on debt settlement than economic development in the future. Consequently, one can reliably conclude that the pound sterling might weaken against the greenback in the future.

The trade balance is another critical indicator of the economy’s inherent strength. A positive trade balance shows that the economy is exporting more than it is importing. In this case, the demand for the pound to buy UK products and services is high. The net result of a positive trade balance is a strong pound, which means the value of the GBP/USD tends upwards.

Economic data from the EU, UK, and US

Economic activity on both sides of the Atlantic is critical to the fluctuations of the cable. Investors read the economic data with their eyes on the future. After all, forex trading is all about anticipating future exchange rates. GDP figures in both countries provide crucial insights about where the dollar will be in the future.

The US dollar index (USDX) is an essential indicator of the strength of the dollar. Remember that an economy’s strength often reflects the currency strength. If therefore, the US economy’s labor market GDP declines, then the USDX is likely to decline.

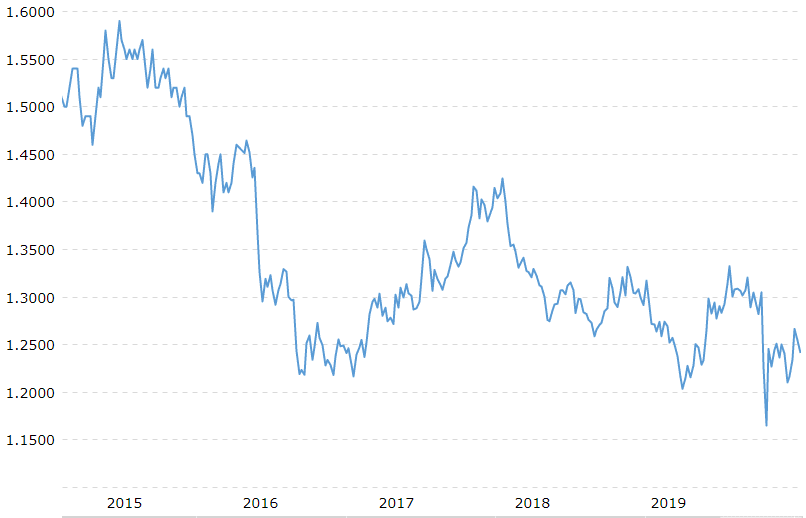

Interestingly, the USDX is more like a predictor of the GBP/USD exchange rate. In Figure 2 and Figure 3 below, one can easily make a relationship between the trend lines. The dollar index was at its highest in the last five years in late 2016 and early 2017. Conversely, the GBP/USD exchange rate was quite low in that period. One can pick out a similar relationship in early 2020.

Admittedly, economic data from the Eurozone is likely to influence the GBP/USD but not much. This influence will continue to diminish when the UK completely decouples from the Union.

Brexit

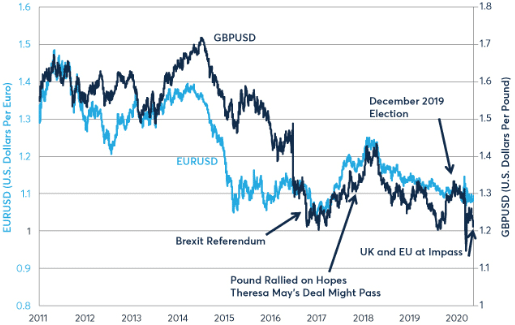

Britain’s decision to exit the EU is among the significant geopolitical occurrences in the last decade, whose effect on the GBP/USD has been tremendous. Before the UK parliament passed the law allowing the Brexit referendum to proceed, the GBP/USD was at 1.5900. One year later, and before the actual plebiscite, the pair had shed 9.7% off its value. In June 2016, Britons voted to exit the EU. That became another reason why the GBP/USD pair declined another 15.2% in six months (as shown in Figure 1).

The UK is a significant economy whose strength depends on trade with its neighbors. When it was part of the EU, the UK had access to the largest single market for its products and services. Therefore, investors were worried that decoupling from the EU would hugely undermine the strength. A consensus began to emerge concerning which traders seemed to agree that the GBP would be much inferior to the dollar in the future.

Figure 1 shows just how much sway Brexit has held on the value of the pound since 2015. The phenomenon has been a significant determinant of the direction of sentiment on the GBP in the market. Notice the instances when positive reports about Brexit led to a slight, sometimes major, bumps in the GBP/USD exchange rate in the chart.

Brexit has claimed two Prime Ministers since the first scene. The election of Boris Johnson, another consequence of the drama, added to the pound’s strain. Traders seemed to price in Boris’s controversial nature as a politician, especially when it comes to the possibility of a no-deal Brexit. Boris had promised to deliver Brexit, whether there was a deal or not. That is why the pound seemed destined for historical lows when the EU and the UK hit an impasse (as shown in Figure 1).

Conclusion

The cable is the market’s oldest pair in the currency markets. Interestingly, the pair’s popularity in the era of cable communications across the Atlantic earned it the moniker “Cable.” In the last five years, GBP/USD has fluctuated primarily based on the direction of the Brexit drama. Nonetheless, traders still consider crucial financials in the UK and the US when making trades.

The actions of the Bank of England also affect the strength of the GBP, and hence the value of the GBP/USD. For instance, the GBP weakens when the Bank’s inflation reports signify weakening economic activity. Events in the US and the EU, including economic data and political stability, affect the cable’s value.

Leave a Reply