Introduction

Statistics show that the forex market has the most significant liquidity of all financial markets. According to the 2019 Triennial Central Bank Survey by BIS, the forex market moved a daily average of $6.6 trillion in trades in April. Now, imagine that the EUR/USD pair dominates close to half of this liquidity. Crazy, huh?

The United States Dollar (USD) is globally the king of all currencies in terms of use in settling trade transactions. That is why you hear commodities and other items quoted in dollars. Otherwise called the greenback, the USD can be exchanged almost everywhere on the face of the earth. At a distance, the Euro follows the USD in terms of reserve holdings and trade transactions.

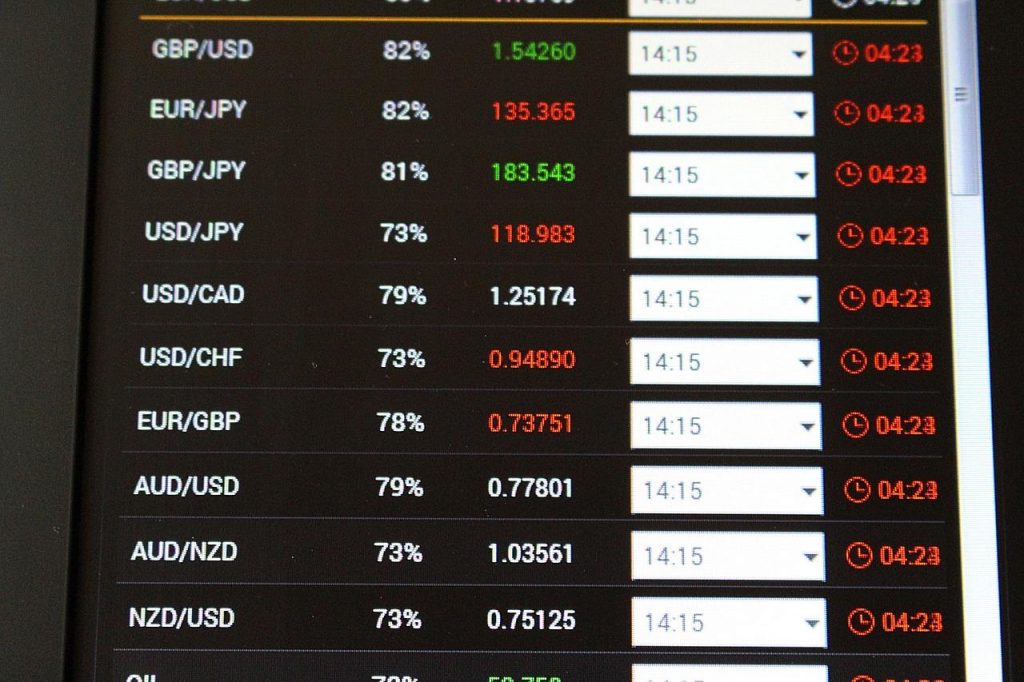

Traded as a pair, the EUR and the USD make up the most traded pair in the forex. The pair sits atop the list of major currency pairs, otherwise called Majors. Other Majors include AUD/USD, USD/JPY, GBP/USD, and more.

Traders like to assign nicknames to currency pairs. Besides being called the Eurodollar, the EUR/USD pair goes by the moniker “Fiber.” Although there are different versions of the origin of the nickname, there seems to be consensus around one narrative. Recall that the GBP/USD pair’s moniker is “Cable.” It arose from the fact that in the late 19th Century, a communication cable connected London and New York to share currency price data.

But the cable is a dated link that has been replaced by fiber optic telecommunications cables. Fiber enables faster communication. From this perspective, the EUR/USD pair is newer than the GBP/USD, and more liquid compared to the “Cable”. The upgrade, therefore, is similar to moving from the cable to the fiber.

What moves the fiber?

The currencies in the Fiber represent economic regions that account for much of the global GDP. Therefore, happenings in the US and the Eurozone economies move the currency pair. These factors include:

- Economic data from Eurozone and US

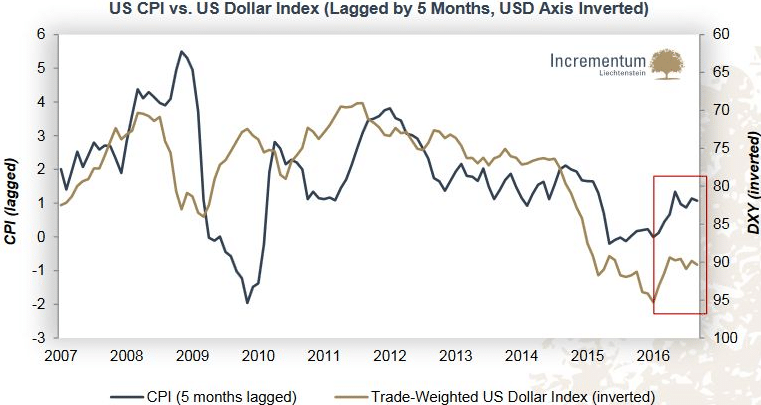

Economic data speaks volumes about the inherent strength of an economy. It actively supports the value of a currency in the forex market. For example, the consumer price index (CPI) indicates the level of domestic inflation. Controlling inflation is one of the cardinal tasks of the central bank.

If the US reports a high CPI, it means Americans are paying more for necessities like food and transport. In response, the US Fed moves to raise interest rates to reduce the volume of money circulating in the economy. The forex market interprets this phenomenon differently. If the US CPI data beats consensus expectations, the dollar will strengthen against the EUR in return. It is because of the belief that a strong economy makes USD a safer asset to hold.

The purchasing managers’ index (PMI) is another critical economic indicator that affects the strength of a currency. Released monthly, the data indicates the direction of the economy. A low PMI, usually below 50, tells investors that the economy is contracting. If the Eurozone released such numbers, therefore, the EUR would slide against the USD. When PMI data fails to meet expectations, sentiment in the market about the currency sours and investors offload their positions. Others begin to short the EUR. The net result is a declining EUR/USD pair.

- Federal reserve/European Central Bank

Each of the currencies in the EUR/USD pair is affected differently by their central banks. The net effect is the pair’s movement either up or down. The Federal Reserve adjusts the interest rates in the US economy to control inflation. Usually, this happens in response to economic data such as CPI.

Say the CPI comes out weak. It means the economy is unable to meet the inflation targets put in place by the Fed. The appropriate response is for the Fed to increase the money supply, which stimulates aggregate consumption. In short, more Americans will have more disposable income to satisfy demand. The Fed’s actions impact the sentiment of traders in the forex market, where more of them favor the dollar.

Besides monetary policy, central banks move currency pairs through speeches by critical personalities. Members of the monetary policy committee of central banks give speeches regularly. Say, for instance, Christine Lagarde, head of ECB, meets Eurozone commercial bank CEOs. In her remarks, she hints at the ECB lowering policy rates to tackle a recession at hand.

Similarly, comments by Jerome Powell of the US Fed could have an immense influence on the market sentiment on the dollar. Oftentimes, the comments of the Fed Chairman give crucial hints concerning monetary policy direction. This is even more critical in a period of turmoil in the economy. Listening for the message in the comments helps traders to formulate accurate strategies when trading the EUR/USD pair.

When the interest rate of EUR falls below that of the USD, the EUR will weaken because of the International Fisher Effect. Consequently, the weight of the EUR/USD shifts to the USD side, and the pair’s value falls.

- Political stability

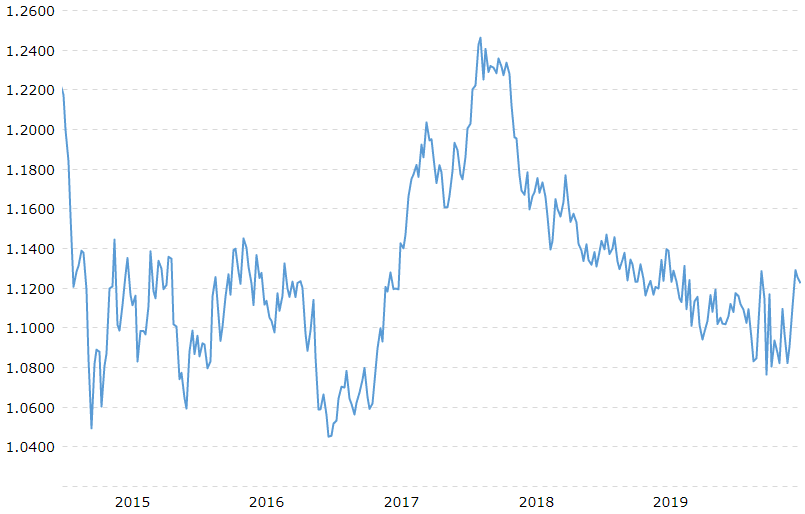

The politics of a country and its economy are intricately intertwined, such that a shift in one sphere produces a significant shift in the other. For example, the value of the EUR against the USD declined significantly after Brexit started. Britain was one of the EU’s biggest economies, so its exit threatened a Euro flight.

Before the Brexit debacle began, one EUR fetched 1.1451 USD, on April 5, 2016. The Brexit referendum happened in June 2016, and less than six months later, the EUR had collapsed 8.7% to $1.0456.

Across the Atlantic, political temperatures heated up when Donald Trump was elected in 2016. Almost immediately, the new President launched a trade war with China. The net effect of the political upheavals at home and abroad with a key trading partner affected the greenback. From December 2016 to January 2018, the EUR/USD pair gained 19.3% to 1.2463.

Traders price political stability in their trading positions. In a choppy political environment, investors flee from risks and search for currencies that offer more security. When the Brexit drama began to unfold, investors thought the USD safer and sold EUR in its favor. The opposite happened with the onset of Trump’s reign.

- Trading session

Differences in time zones imply that trading sessions in say, Asia, and Europe never coincide. Trading in each session takes around six hours, which is always during the daytime. Therefore, a Eurozone trading session might find Asian traders asleep.

Trading sessions are crucial because this also the time that releases of critical data happen. In this regard, the EUR/USD pair is more liquid during New York and London sessions. However, the London session is the most significant because it intersects with the Asian and US sessions.

The Asian (Tokyo) session begins at midnight and ends at 0600 hrs. GMT. In London, the trading session starts from 0700hrs to 1600hrs GMT. Lastly, the New York session spans from 1200hrs to 2000hrs GMT. Therefore, the best hours to trade span from 0700hrs GMT to 2000hrs GMT. During this time, EUR/USD liquidity is at peak levels.

Conclusion

The forex market is a sophisticated space that, if mastered, is fulfilling. To do so, one must begin by understanding the ins and outs of favorite currency pairs. The EUR/USD is the best pair to trade because of high liquidity. Nicknamed the “Fiber,” the pair comprises two of the world’s most traded currencies.

The behavior of the fiber depends on the individual fluctuations of the constituent currencies. Factors such as economic data cause gyrations in the exchange rate of currencies in the pair. In sum, political stability, trading sessions, and actions of central banks cause exchange rate differences between currencies in a pair.

Leave a Reply