Understanding the AUD/USD Pair

Why AUD is a commodity currency

A commodity currency is that whose value rises and falls in tandem with demand for specific commodities. Another way of looking at this is that the domestic economy of a commodity currency heavily depends on the export of commodities. As the demand for specific commodities increases, more buyers acquire the currency to facilitate transactions. In the process, the value of the currency grows.

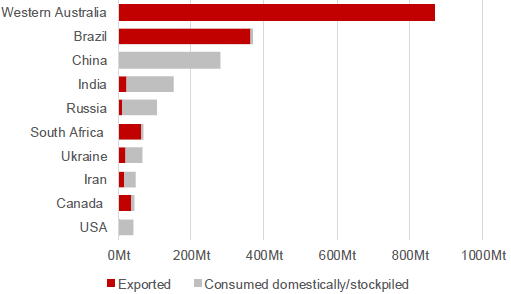

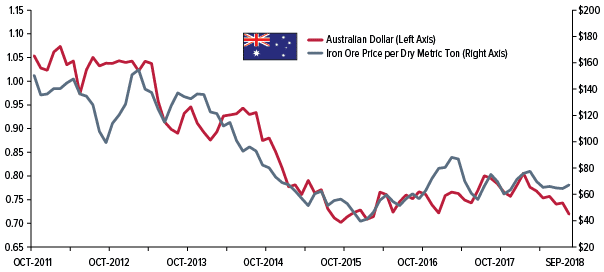

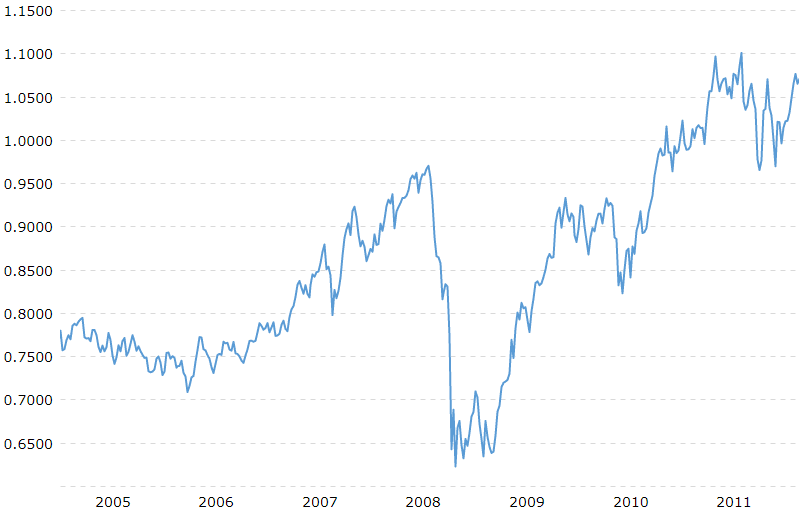

Consider this; Australia is the world’s largest producer of iron ore at 38% of global output in 2017 (Figure 1). Interestingly enough, Australia exports almost the entire production mainly to China. When the demand for iron ore falls, the value of the AUD tends to decrease. In a sense, the AUD seems coupled to the ebb and flow of the demand for iron ore, as shown in Figure 2. For this reason, the AUD qualifies as a commodity currency.

Overview of the Australian economy

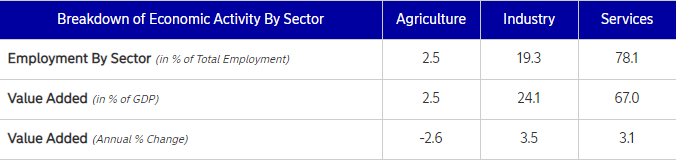

Compared to other economies in the Global North, Australia was late to industrialization. Nonetheless, the economy has a sizable industrial sector, with about 19.3% of the country’s workforce. This sector accounts for 24.1% of Australia’s GDP. The food industry accounts for the largest share of Australia’s manufacturing industry, where it employs approximately 40% of the workers. Other significant industries include metal processing and metal goods, machinery and equipment, and chemical and petrochemical industries.

The agriculture sector is also a significant employer in Australia. Nonetheless, it contributes the least to the country’s GDP at 2.5%. Australia competes on a global level as an exporter of cotton, meat, and wheat. However, Australia’s economic strength lies in the services sector. The sector employs 78.1% of Australia’s workers, and it comprises 67% of the country’s GDP. The business and financial services sector in Australia has grown to compete in the upper half of the OECD economies.

Australia is the biggest beneficiary of the commodity boom that started in the early 1990s. It has a lot to do with the fact that Australia’s economy is deeply integrated into the global economy. Consequently, a slight shift in demand for certain goods and services has excellent implications for Australia’s economy. Notably, Australia’s terms of trade improved drastically between 2005 and 2011 due to the high demand for certain commodities that were unmatched by available supply.

After the Great Recession, however, the terms of trade deteriorated as demand for commodities such as iron ore plummeted. China, the largest importer of iron ore from Australia, experienced a sharp reduction in economic activity. Subsequently, the AUD had a poor run against the USD, especially between 2011 and 2014.

What moves AUD/USD?

The AUD/USD currency pair is among the most liquid in the forex market. It has a lot to do with AUD’s exposure to global trade as well as the USD’s stature in global commerce. Various factors that influence the direction of the AUD/USD pair include:

Chinese data

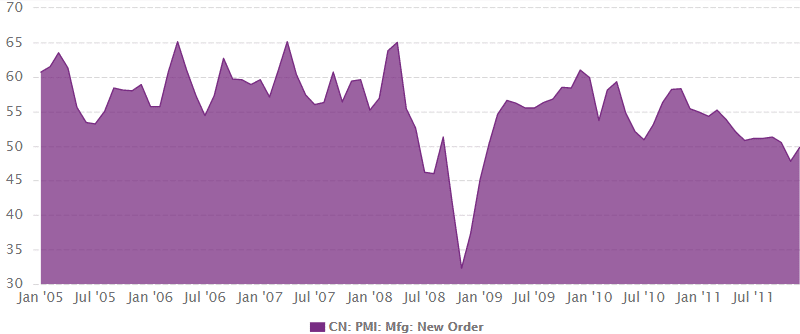

As noted earlier, China is Australia’s largest export market for commodities such as iron ore. From 2005, demand for iron ore in China experienced an upsurge that began to level off in late 2011. In the same period, the PMI coming out of China was constantly above 50. It was only in late 2008 and early 2009 that manufacturing contracted in China.

In the same period that PMI remained above 50, Australia’s trade terms were favorable. Demand for iron ore and other commodities from Australia were high, so was the demand for the AUD. In January 2005, the AUD/USD exchange rate was 0.7691. About six years later, in July 2011, the exchange rate had grown from 43.14% to 1.1009, the highest rate on record.

From the foregoing, Chinese data has a profound effect on the value of the AUD/USD pair. For instance, positive China PMI data generates a positive sentiment in the market, after which the demand for the AUD notches up.

Commodity prices

Commodities make up a significant part of Australia’s exports. For this reason, the country’s industrial sector lags in the services sectors. Of all the iron ore produced in Australia in 2017 (as shown in Figure 1), more than 95% of it was exported. Considering that such commodities account for a significant part of Australia’s balance of payments, a change in price positively affects the value of the AUD/USD.

In Figure 2, the AUD tracks the performance of iron ore in global markets. The value of the currency is at its best when iron ore prices are at the highest. Subsequently, traders need more of the USD to buy one unit of AUD. Eventually, the value of the AUD/USD climbs higher.

US Federal Reserve and the Royal Bank of Australia

Like the RBA, the US Fed sets the policy rates that determine the money supply in the economy. Contractionary policy rates tighten liquidity in the market. The result of this is that demand begins to outweigh the supply of the currency, which leads to higher exchange rates. Expansionary policy rates have the opposite effect.

Say, for example, the US Fed cuts interest rates by 50 basis points. It discourages saving in that savers will earn 0.5% less interest on their money deposited in commercial banks. More people, therefore, might choose consumption over saving. Consequently, the amount of the USD against the AUD in the forex market increases. The increased supply of USD against constant demand leads to the greenback to depreciate against the AUD. Consequently, the value of the AUD/USD notches up. The same is true when the RBA cuts or raises interest rates.

Australian data

Besides the RBA’s monetary policy decisions, other news events concerning the Australian economy affect the behavior of the AUD/USD pair. Housing data is a crucial indicator that reflects a country’s inherent economic strength. Forex traders use the housing data to decide between shorting a currency pair or going long.

Positive housing data implies growth in the economy whose natural consequence is heightened liquidity. But the RBA may want to control this growth to prevent inflation rates from skyrocketing out of control. To this end, the RBA increases interest rates (contractionary policy rates) that flush out the excess liquidity from the economy. Higher interest rates attract investors, which results in increased demand for the AUD.

On the contrary, negative housing data tells the RBA that liquidity in the economy is low. As a remedy, the RBA may cut interest rates to increase the money supply. However, low-interest rates are unattractive to investors, which leads to a lower demand for the AUD. Consequently, the strength of the AUD against the USD and other currencies deteriorates.

US data

Data was coming from the US to influence the behavior of the US dollar. The US Consumer price index (CPI), for example, tells the market how much Americans are paying for basics such as food, transport, and energy. In a sense, the CPI is indicative of inflation (both real and perceived) within an economy.

A high CPI tells stakeholders that inflationary pressures within the economy are high. In this case, the US Fed steps in by raising the benchmark rates to tighten liquidity. High-interest rates attract investors to the greenback. The strengthening dollar upsets the balance of the AUD/USD pair, whose value begins to fall.

US GDP is also critical to the greenback’s strength. GDP data indicates the vibrancy of economic activity, which informs the USD’s sentiment in the market. Positive GDP data implies that US assets are less risky, which offers safety for investors. As a result, more investors buy the USD and, consequently, it begins to appreciate against rivals such as the AUD.

Conclusion

The AUD/USD pair is volatile because the two currencies are deeply integrated into the global economy. For the AUD, changes in commodity prices significantly influence the direction of its exchange rate. In the last decade, the AUD closely tracked the prices of iron ore in the international markets. It is because Australia is the largest producer and exporter of the commodity in the world.

Each of the currencies in the AUD/USD pair behaves differently based on unique factors. The performance of the currencies in the forex depends on the strength of their domestic economies. If the US reports positive housing data, for example, investors troop to the greenback to cash in on the profit potential.

Leave a Reply