Nowadays, almost anyone with the internet and a smartphone has access to low-cost trading platforms. However, not everyone has the time it takes to trade professionally. That is why in recent years, social trading has become popular.

Who would not like to share experiences, comment, and consult other expert traders? Well, with social trading, we can learn about the strategies and tips that other people that dedicated more time to trading can share with us.

In this article, we will talk about how social trading can help you to improve your trading. We will mention some advantages and disadvantages and how to start interacting online with professionals.

What does social trading mean?

Social trading is a relatively new concept that refers to a new investment model connecting a community with experts. Professionals share strategies, and beginners can follow them to learn. In other words, it is an online community where knowledge is shared so everyone can learn from it. This new model combines the fundamentals of social networks with trading. After all, it works similarly to Facebook or Twitter, for example.

Due to its simplicity and familiarity, social trading has been gaining popularity exponentially.

What are the advantages of social trading?

Undoubtedly, social trading has some advantages. It is one of the most common options for beginners who decide to invest their money in the financial markets.

The main advantage is its user-friendliness. Thanks to monitoring the activity of the traders you select, you can base your investments on the actions of great specialists. Thus, there is no need to analyze the market independently; you just have to trust the trader you have chosen and follow their actions.

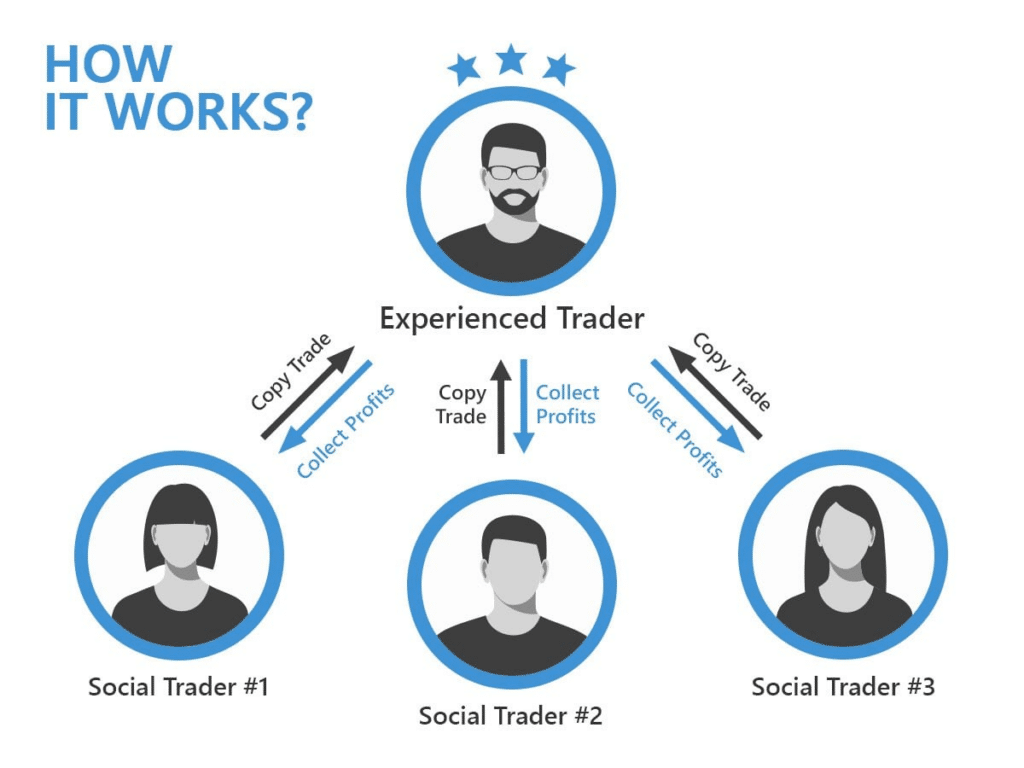

Thanks to copy trading, you don’t have to create a strategy to operate in the market. Instead, find a trader who has a style that you like. Thus, it does not matter if we do not have deep knowledge. If the person we copy profits, we will also earn.

On the other hand, it offers the possibility of putting different traders in contact with each other. Thus, the network of contacts increases, and not only that but also the acquired knowledge and strategies. After all, it is a platform that helps professional growth in this sense.

Following the illustration above, social trading allows traders to analyze the market more impartially since it is done jointly and not individually. It has been proven that when traders work together, it is much easier to discuss and analyze market activity and make better decisions.

Finally, social trading means that the financial market is no longer a space dedicated exclusively to expert investors and international banks. Instead, it becomes accessible to all those interested in investing.

How to get started in social trading?

Getting started in social trading is very easy. We will need to create an account with a broker who will provide us with all the necessary information about the traders available for copying. Note that the traders whose strategies we copy receive a percentage of the trades’ profits that they execute with our capital.

To participate, you must have a minimum amount of money to invest; this amount may vary according to the broker’s requirements. Based on the amount you decide to invest, the expert trader may use part or all of your capital to execute their operations.

Below is a summary of the steps to follow to get started.

- Choose the online broker that best meets your needs and expectations.

- Open an account with the broker in question.

- Provide documents such as ID, passport or driver’s license, and recent utility bills showing your address.

- Make the initial deposit with the amount of money you are going to start investing.

- Complete the social trading broker profile. Similar to when you create a user in a social network.

- Get your hands on the broker’s rankings, where they show you the most followed traders with the best moves and strategies.

- When you start following one of these traders, you will see their trades and how they perform. If you want to copy their trades, you have to choose the amount of money you provide to them. Then, transactions will be applied to your account.

- You can stop following or copying any investor at any time. You can also follow and copy several at the same time and thus diversify the risk.

Disadvantages of social trading

For example, what if you follow a bad trader? Unfortunately, you will end up losing money. So make sure you follow a trader who is worth your time.

Another major drawback of social trading is the difficulty of selecting the right platform. There are many online brokers, which makes a choice more difficult. There are even platforms that have scammers behind them.

For beginners, social trading networks that reward only profits can encourage them to take very high risks. Better are those networks that reward for both the profits earned and the low-risk investment approach, thus, raising awareness of the risk involved in investing.

Conclusion

Finally, we must answer whether social trading helps us generate profitability on our savings? Well, sometimes, yes, but not always. First, it must be made clear that social trading is not infallible, and it is simply a trading technique with its pros and cons.

If you think you can open an account on one of these social trading platforms and collect profits at the end of the month, you will most likely not get the expected results. Many things may not work out as well as expected. For example, whether a trader is “successful” is measured over the long term.

Ensure you keep realistic expectations about what it is and what you can achieve through social trading.

Leave a Reply