Forex is an international financial market where currencies are exchanged. The Forex market is necessary for the normal functioning of the world economy and the exchange of capital between different countries. Trading involves central banks of different countries, companies conducting international business, commercial banks, and various traders. You can trade currencies, shares, and cryptocurrency.

Each Forex participant has its own goals and objectives:

- National banks intervene to stabilize their currencies;

- Importers and exporters come to Forex to exchange revenue;

- Commercial banks have their own business in this segment, which consists of setting currency quotes for the purchase and sale;

- Commercial banks have their own business in this segment;

- Speculators use Forex as a source of stable income.

Many people call the Forex exchange, but this is not entirely true. Unlike stock exchanges, Forex works around the clock because world banks are in different time zones. Besides, Forex is not tied to any particular place – it is a virtual market, and you can play on it from anywhere in the world: from Moscow, New York or from the Bali beach.

There are five key Forex exchange priorities:

- Trading with 50+ major world currencies;

- Twenty-four hours, five days a week;

- A wide range of trading tools;

- An impressive range of free and paid tutorials;

- Intuitive multilingual software platform interfaces.

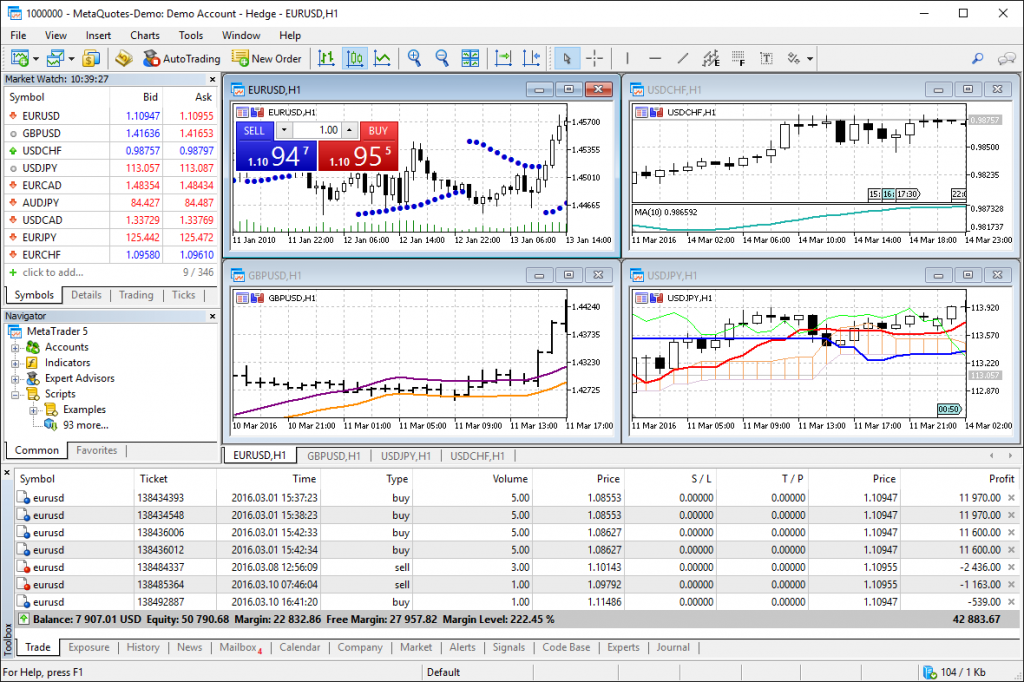

And there are demo accounts on Forex. Beginners can learn all the basic nuances here. Using up to 400:1 allows you to work with large lots without a significant starting capital. How to make money on the Forex exchange? Traders buy cheaper and sell more expensive. Assets are resold with profit because the price is continually changing.

How to start Forex Trading?

You need a computer, internet and a reliable forex broker. Access to trading is possible only through a brokerage company. If you seriously intend to make the game in the foreign exchange market a source of income, invest time, and effort in your education. Read specialized literature, attend seminars of specialists in trading in the international currency market – all this will give you an advantage over those who decide to play on the stock exchange without knowing all the intricacies.

Traders use fundamental and technical analysis. Fundamental analysis is taking into account all economic and political factors that can affect exchange rates (inflation, unemployment, interest rates of central banks, etc.). Technical analysis is the monitoring of quotation charts with a forecast of the course behavior shortly.

The Definition of Orders

A standard order is a type of contract that provides the right to buy or sell a certain amount of an asset at a certain price by a predetermined time. Thus, when trading standard orders, the trader has the opportunity to choose not only the asset itself and its quantity but also the time and price. The term of an order may include one day, a week, several months, or even a year. To trade you need a certain amount of money. Newbies usually start at 200-300 dollars. This is the minimum amount to enter the market. After a long study of the basics, you can move on to larger amounts.

To become the owner of the order, the buyer must pay the seller a certain amount, called the premium. Thus, if a trader buys an order, he pays a premium, and if he sells, he receives it. The amount of the premium is determined by several factors, including the current price of the asset. However, since order contracts are executed by a future date, the time factor is also of great importance. The date your order is exercised is called the expiration date, and the price of the asset the buyer can exercise is the strike price. The premium for long-term orders is higher than for short-term ones – here you can draw an analogy with insurance premiums.

The Basics of Forex Trading

When you call or put, the potential profit is not limited is made everything right. And if the market moves in an unfavorable direction, the potential losses of the trader are not limited by anything – the same as on the spot-market. Stop losses are used to limit the trader’s losses. You can also call or put when the price located outside of the profit zone. It which will minimize potential losses.

The risk is always limited by the amount of the premium. When selling an order, a trader acts in a role similar to that of an insurance agent. It ensures the position of another market participant, which is a great way to make money. A trader receives a premium, and if the market moves according to his scenario, this amount becomes his profit. If the trader did not guess, the result is not much different from the losing trade on the spot market.

Only having mastered the theory, one can begin to practice – try to apply technical and fundamental analysis, make transactions on a demo account, and only after that open a real account. It is best to do this under the guidance of an experienced trader who at first will adjust your actions, warn against errors and provide psychological support in case of failure. You always need to adhere to a money management strategy and control losses. otherwise, you can destroy your deposit in a matter of hours.

A newcomer to the Forex market is like a man lost in the forest. Attempts to find the right path at random are unlikely to succeed: in this way you can walk in circles in perpetuity. But the compass will accurately lead you to where you need to. Strategy is a compass: a guideline that tells you in which direction to move. This is a strict plan of action that a trader must follow relentlessly. Trading with such a clear guide is easier: no need to be nervous and think feverishly when to open or close a deal. It is enough to track the signals and act according to the rules.

Leave a Reply