In all financial markets, investors go to great lengths in order to properly time their trades so that they’re buying low and selling high. Regardless of the asset being traded, this is no easy feat, especially for those dipping their toes into the trade. Even more so, the crypto market is marked by numerous violent price swings and is arguably the most volatile market in existence. Therefore, timing the market in this industry can make or break your trading career. So how do beginners and experts alike solve this age-old problem? Enter dollar cost averaging.

About the DCA strategy

You have no doubt heard several stories of individuals who bought several Bitcoins for pennies when the coin was first introduced, who are now worth millions, if not billions of dollars. Unfortunately, the chances of getting the coin at a throwaway price and converting your investment into millions in a few years have drastically reduced. However, you can still obtain a sizeable profit if you invest wisely.

Ideally, if you can time the lowest market trough, you can use the entirety of your available investment to purchase a coin like Bitcoin and enjoy significant profits over time. However, what if, right after your investment, the market dips even further? What if instead of buying the trough, you’re actually buying a rally’s peak?

To prevent this, you can opt to take the total amount you wish to invest and divide it into small increments. You can then invest these smaller amounts at regular intervals, regardless of the position of the market at the time. This constitutes the dollar-cost averaging (DCA) strategy. This strategy significantly reduces the risk of mistiming the market.

How it works

First off, DCA is inherently a long-term trading strategy. The cryptocurrency market is a highly speculative industry, and nobody knows if these digital assets will actually increase in value over time. Therefore, you should do extensive research before settling on any coin. The coin you choose should have significant long-term potential.

Take, for instance, the case of a trader who has $10,000 to invest in crypto. He decides to invest in Bitcoin, the most common asset in the market. Rather than use the whole amount to purchase BTC at once, he splits it into $100 increments, which he uses to buy the coin every Friday at noon. The hope is they will end up with more BTC than if he had bought it all at once.

Perks of DCA

For one, this strategy eliminates the emotional turmoil that comes with attempting to time the markets. Usually, traders who attempt to time their trades are afraid of investing during bear markets, only for prices to plummet further. On the other hand, they’re afraid to miss out on a rally, which drives them to trade out of FOMO.

Secondly, DCA has been known to avoid major losses. Even if prices trend further down right after you place your trade, you will not be risking your entire amount. Therefore, this strategy can be helpful to risk-averse investors as it subjects one to much lower risk in this highly volatile market.

Drawbacks of DCA

Typically, in investing, the more you risk, the more you stand to make in profits. Though DCA significantly mitigates risk, it generally yields fewer profits over time than if the same amount was invested as a lump sum when the market was down. However, timing the market is no easy feat, even for seasoned investors.

Usually, crypto trading platforms will charge a fee for each transaction, whether it be a purchase or sale of crypto. Since DCA involves a large number of trades, this means that the applicable fees will accumulate. However, being a long-term strategy, the gains obtained over several years will more often than not offset these transaction costs.

What is the ideal trading frequency for DCA?

Usually, before you can begin utilizing the DCA strategy, you have a dollar amount in mind and a duration over which to invest. For instance, you could have $12,000, which you intend to invest in BTC within the space of a year. You could choose to invest $250 every week or, alternatively, $1,000 every month. Since each of your transactions will be charged a trading fee, it would be cheaper to utilize the monthly purchases. Therefore, to optimize your DCA strategy, the best practice would be to make your transactions less frequent.

DCA automation

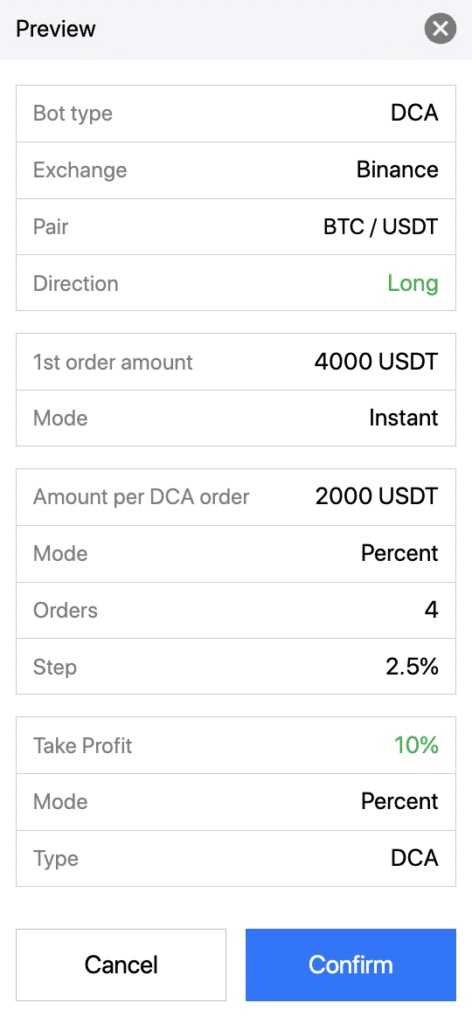

DCA is a very straightforward strategy, considering it does not involve much in terms of technical analysis. For that reason, it lends itself well to automation, and there are several DCA bots in existence. However, for best results, it’s always advisable to create your own bot, which is custom-made to your individual needs. The issue with this is that most bots require complex coding to create, which hinders investors with no programming knowledge.

The good news is, on Bitsgap, you can create your own DCA bot with just a few clicks of your mouse. The whole process takes a few minutes to complete, and you will not have to write even a single line of code. This bot can help you find opportune entries using indicators and create a grid for each trading cycle to get you better entry prices. You can also instruct it to reduce trade sizes whenever you need to recover from a large loss. It also incorporates risk management in case of any unforeseen black swan events.

Conclusion

Timing the market is a vital part of investing, regardless of the market you’re trading. This is more so for crypto, which is characterized by higher volatility than most other financial markets. To reduce the risk of mistiming the market, one could opt to make periodic purchases at regular intervals. This is called the dollar-cost averaging strategy.

Leave a Reply