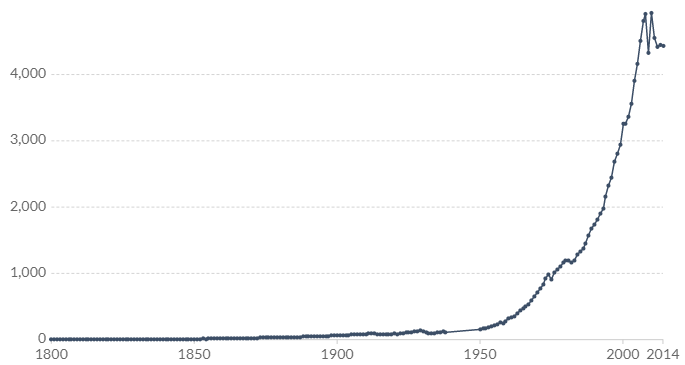

Global trade might not be at its highest peak today, but it remains a critical aspect of the global economy. According to analysis, global trade has grown exponentially over the past century, largely on the back of increased economic integration through globalization. National economies are now part of a global economic system, which has contributed to the creation of wealth on an unprecedented scale.

Another impact of the deep integration of national economies is the amplification of the impact of currency fluctuations on national economies. Economic growth in the current scenario has become largely dependent on currency rates and the kind of impact that currency fluctuations have on the economy’s production and consumption capacity.

Currency fluctuations explained

Each national economy has a domestic currency that facilitates internal trade, but beside that, the countries trade with each other. For example, US companies buy oil from Canada, while Chinese businesspeople buy soybeans from the US. China also sells a wide variety of goods to countries in Africa and Europe, and even the USA.

For cross-border trade to happen, one party will have to buy the currency of another country. Consider an electronics store in the US that buys stock from China. Initially, the store owner has $10,000, but the funds are unusable in China unless converted into Chinese yuan (CNY).

At the time of converting, the USD/CNY exchange rate was 6.50, which means the entrepreneur will end up with CNY 65,000. Say, for certain reasons, the exchange rate shoots to 7.50 from 6.50 the minute the entrepreneur steps to the forex bureau’s counter. After conversion, the entrepreneur will have 75,000 in his hands, which is 10,000 more yuan.

In short, currency fluctuation refers to the changes in the exchange rate of a currency pair. As we have seen, the fluctuations affect the purchasing power of currencies. Such fluctuations are only possible in a scenario where there is a floating exchange rate between the currencies in question.

Factors that cause currency fluctuations

Currency fluctuations happen because the exchange rate of the currency pair is unfixed, which means it is floating. A floating exchange rate regime is one that depends on the forex market’s equilibrium between supply and demand forces. Contrariwise, fixed exchange regimes entirely depend on government agencies to change them.

Therefore, any factor that has an influence – however small – on a currency pair’s exchange rate causes currency fluctuations. These include the following three factors below.

Interest rates

Interest rates are a potent tool by which central banks regulate economic growth. A strong economy tends to experience higher inflation rates because of the high-velocity money supply. Left alone, the economy might overheat, meaning it might enter a period of hyperinflation. It is the central bank’s responsibility to ensure hyperinflation does not happen, and it achieves the mandate by raising interest rates.

Higher interest rates reduce the velocity of money flow. Under this scenario, loans become expensive, but also savings earn higher returns. If foreign investors spot such an opportunity, they will rush in with their funds, hence leading to increased demand for the domestic currency. The net effect of this movement of funds is a stronger domestic currency against rivals.

Economic strength

The strength of the underlying economy exerts a great influence on the value of the currency. A strong economy attracts many investors because of safety reasons. Investors want to put their money in assets whose value will remain strong for a long time, and this is what strong economies offer.

The currency from an economy that performs better often appreciates against currencies from weaker economies.

Inflation

Inflation has an immense effect on exchange rates, although indirectly. We have already seen how inflation rates influence changes in interest rates, which then impact exchange rates.

However, inflation can also have a direct impact on exchange rates. Consider two countries that are close trading partners, say Canada and the US. Say the US Fed decides to devalue the greenback to spur the domestic economic activity. As a result, imports from Canada become expensive all of a sudden.

On the flip side, imports from the US to Canada become very cheap. If the USD’s devaluation happens to throw the US economy into a high inflation scenario, the inflation is highly likely to be exported to Canada.

Impacts of currency fluctuations on the economy

Let us now consider the same factors from a different point and find out what their impact on the economy will be.

Impact on the import and export trade

Cross-border trade often takes the biggest hit when exchange rates between currencies gyrate, back to our US-Canada example. When the US devalues the USD against the CAD, the weaker greenback makes US-made goods cheaper. All of a sudden, Canadians find imports from the US cheaper than similar products manufactured locally.

On the other hand, Canada’s exports to the US become expensive, which implies reduced revenues for Canadian companies. Ultimately, the US’s trade deficit with Canada will reduce, while Canada’s will increase.

Impact on economic growth

Most of the developed countries have built strong export industries because global trade fuels rapid economic expansion. If the currency fluctuations result in a positive balance of trade for a country (a shrinkage in trade deficit), the country’s economy is likely to experience a massive expansion.

Unfortunately, import-intensive economies experience large trade deficits that undermine any opportunities for economic growth.

Impact on consumers

Currency fluctuations impact consumers in two ways. If the fluctuation leads to a stronger domestic currency, the purchasing power of consumers’ funds will increase. They might find buying foreign goods cheaper, which leads to increased spending.

On the flip side, a weaker currency erodes the purchasing power of the consumers’ disposable income. In this scenario, consumers will pay more to acquire items whose value has not changed. Ultimately, a weaker currency undermines consumers’ welfare – in an import-oriented economy.

Conclusion

As long as international trade continues to take place, currency fluctuations will continue to be part of the financial markets. Forex traders focus on the fluctuations to improve their trading strategies, and to gain an edge against the market.

Leave a Reply