No country in the world is self-sufficient. For this reason, governments engage in international trade to dispose of whatever is produced in abundance and acquire whatever an economy lacks. International trade between countries gives rise to a phenomenon commonly referred to as foreign exchange reserve.

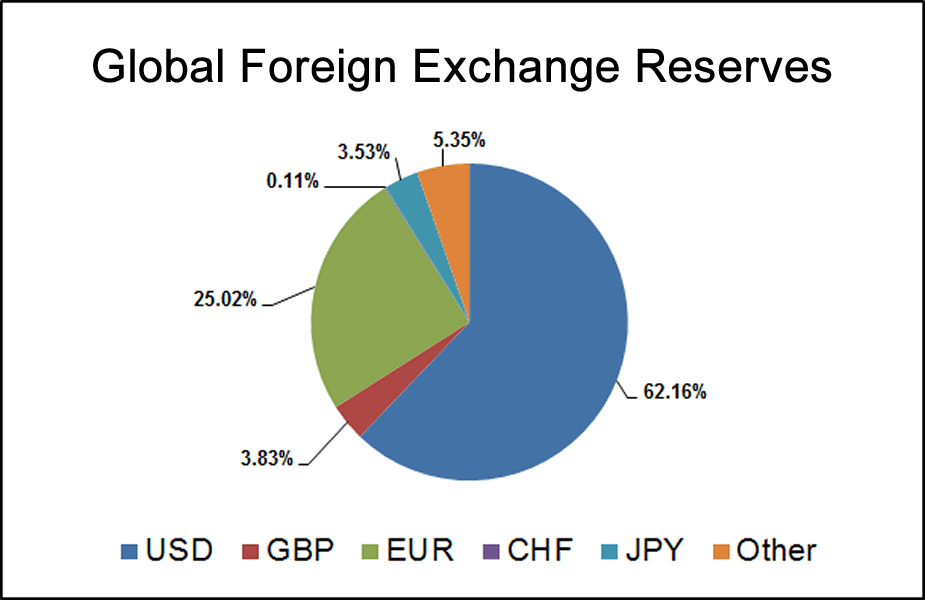

Foreign exchange reserves are assets or holdings held by a country in foreign currencies and foreign countries designed to serve various purposes. The investments are mostly denominated in foreign currency. In most cases, they are denominated in the US dollar, the de-facto global currency, or the euro, a popular currency for international transactions.

A perfect example of foreign exchange reserves in US government bonds held by the Bank of Canada. While denominated in US dollars and held by the Federal Reserve, they belong to Canada and can be used to serve various purposes when the need arises.

While holding US bonds is always sure to generate income, it is not always the case. In some cases, foreign exchange reserves consist of cash that does not generate any return. The cash is only kept to generate income in foreign currency.

Currencies role on foreign exchange

Transactions taking place on the international scene, involving countries, take place in the US dollar as the base currency. Even if the US is not involved in the transactions, the countries or exporters opt to use greenback to finalize transactions, given its stability compared to other currencies.

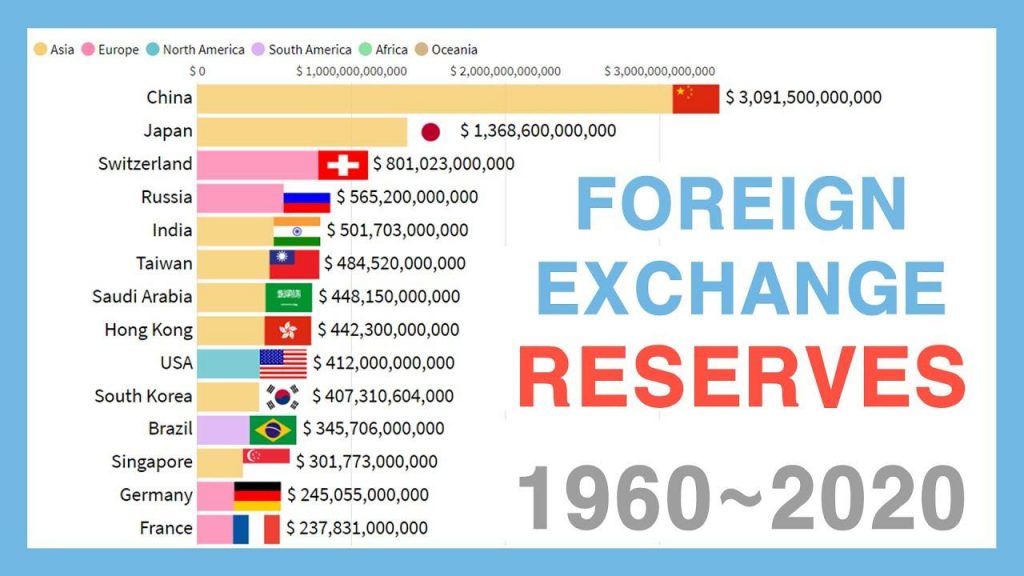

Similarly, a majority of foreign exchange reserves are held in the US dollar, at more than 60% as of 2010. Countries opt to hold most of their reserves in the US dollar to not worry about their payments fluctuating, as is always the case in dealing with other currencies.

The euro, another stable currency, also follows closely on the number of reserves held on it. The Japanese yen is another popular currency that most reserves are pegged with, given its stability as a major currency.

How do they work?

Whenever countries export goods, it’s common for them to be paid in foreign currencies, mostly the dollar, given its global reserve status. Once they are paid, they deposit the same in local banks, which transfers the currency to the central bank.

In most cases, central banks use foreign currencies to buy sovereign debt or meet other financial obligations. Central banks are known to increase their holdings in the dollar and euro-denominated assets, given the stability they come with.

Central banks use foreign exchange reserves in various ways.

Currency stabilization

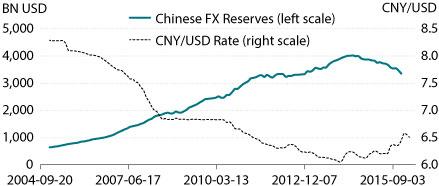

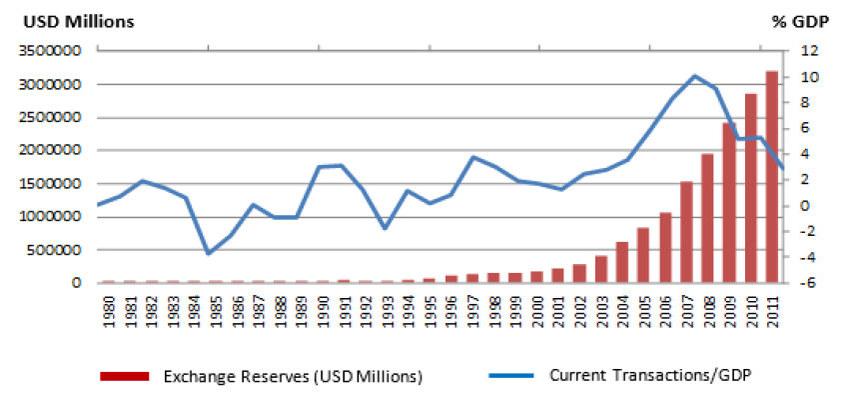

Most countries rely on their reserves in a foreign land to stabilize their native currencies. Over the years, China has leveraged its reserves to stabilize the Yuan conversely fuels its export-dependent economy.

China does so by ensuring most of its assets on the global scene are held in US dollars. Having more reserves in dollars can raise the value of the greenback relative to the yuan. In this case, the net effect is a depreciation in yuan value, which in return makes its exports cheap. This is a play that is leveraged by most countries, including Japan.

Japan’s situation is unique as it relies on a floating exchange rate to lower the value of its native currency. In most cases, the Bank of Japan would buy the US Treasuries, thereby increasing its foreign reserves. By doing so, the yen value tends to drop conversely, making the country cheap and competitive.

Maintain liquidity

In times of crisis such as a recession or economic downturn, foreign reserves come in handy in helping countries meet their financial obligations on the international scene. For instance, the reserves can be used to pay off foreign debt or pay for much-needed imports.

In times of political instability such as coups, investors are known to withdraw their deposits, which results in a severe shortage of foreign currency in the economy. If that were to happen, a central bank would turn to foreign exchange reserves to stabilize the local currency, often under pressure.

Central banks often use their reserves in a foreign land to buy local currencies, therefore curtail inflation from edging higher in economic crises. By steadying the economy, a central bank can encourage foreign investors to invest in the economy.

Vote of confidence

Foreign exchange reserves often act as a vote of confidence to the economy. Foreign investors are known to weigh investment decisions based on the number of foreign reserves that a country has given their usefulness in crisis times.

Similarly, they act as a safety net that an economy can rely on in crisis times, assuring foreign investors that things won’t get out of hand. Such assets come in handy in meeting external obligations such as international payment, including sovereign bonds.

Fund developments

Reserves also provide the much-needed financing for funding development projects. Whenever such holdings increase in value, countries can utilize them to fund development projects such as infrastructure.

China has over the years used its foreign exchange reserves to recapitalize financial institutions back at home.

Boost returns

In addition to holding cash, central banks also diversify holdings in foreign exchange reserves. By holding appreciating assets such as gold, central banks can boost returns of their holdings without compromising returns. It is such returns that are often used to enhance economic development back at home.

Bottom line

Foreign exchange reserves are important holdings or assets held outside a country that can be in various forms such as government securities, Treasury bills, or even banknotes. Such assets act as nations’ savings that can appreciate and finance various operations in case of emergencies such as the devaluation of native currencies.

Leave a Reply